South & Central America Electronic Toll Collection System Market

No. of Pages: 75 | Report Code: BMIRE00030117 | Category: Electronics and Semiconductor

No. of Pages: 75 | Report Code: BMIRE00030117 | Category: Electronics and Semiconductor

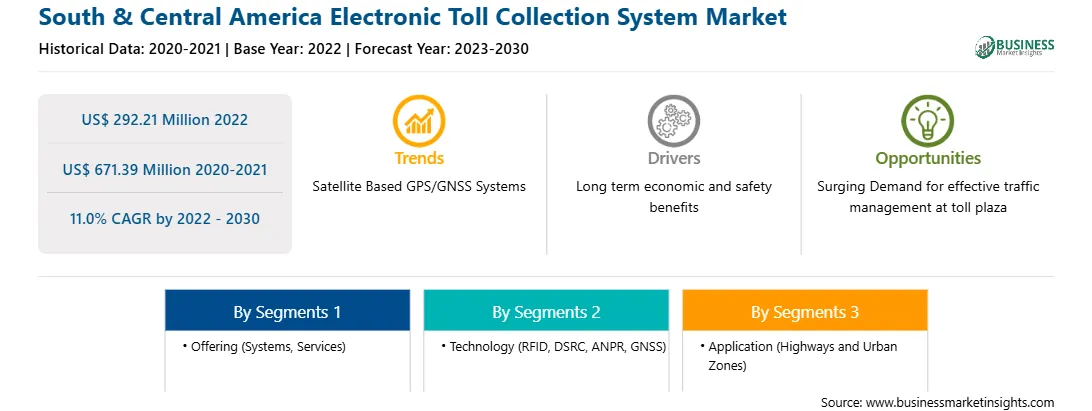

The South & Central America electronic toll collection system market was valued at US$ 292.21 million in 2022 and is expected to reach US$ 671.39 million by 2030; it is estimated to grow at a CAGR of 11.0% from 2022 to 2030.

The state of road infrastructure plays an essential role in the economy's growth as it connects important small cities, towns, and metropolitan cities for freight transportation by road. Moreover, the continuous maintenance, expansion, and improvement of expressways, highways, bridges, and tunnels ensure the continuous, uninterrupted movement of goods, which contribute toward the respective country's GDP. However, the administrators face the challenge of maintaining road infrastructure growth along with the number of registered vehicles. As a result, the central or state government agency deploys various tolls for fees and levy tax across strategic locations on roadways for financing new infrastructure, controlling traffic, maintenance, and management of congestion of vehicles.

Rapid urbanization has driven the demand for a robust network of roads connecting cities and towns across the countries globally. Subsequently, this has boosted the investment toward the development of highways, bridges, and expressways for improved freight transportation by road. As a result, this is increasing the demand for efficient toll collection systems in the region's economies owing to the surge in the number of registered vehicles. For instance, in 2021, the Talca-Chillán stretch of Route 5, a 195-kilometer toll highway, will be upgraded and operated under a build-concession contract granted by Chile to China Railway Construction Corporation (CRCC). Along with improving access to other roads, landscaping, lighting, and drainage, CRCC plans to gradually replace the 18 current cash toll plazas with 13 scanning gantries that read license plates to process payments electronically.

Therefore, numerous contracts contributing to the demand for effective traffic management at toll plazas are anticipated to create lucrative business opportunities for ETC manufacturers and providers in the coming years.

The government of South & Central America is investing in many highway projects. Some of these include investment in new tolled highways around Buenos Aires in Argentina; financing for toll road operator Rodovia das Colinas (Sao Paulo state); plans for the construction of a toll bridge over the Maipo River in the Metropolitan Region (Chile); plans for the Norte Grande Highway and the Melipilla Connection in Chile. Many urban areas in South & Central America face severe traffic congestion issues. ETC systems help alleviate congestion by reducing vehicles' time at toll booths, leading to smoother traffic flow. Many companies are providing electronic toll collection systems in South & Central America. For example, ALEATICA company provides remote toll collection and free flow toll collection systems in South & Central America. Several South & Central America countries, such as Peru and Chile, have implemented or expanded their ETC systems recently. As the region continues to address traffic and infrastructure challenges, the demand for electronic toll collection is expected to increase further, contributing to improved transportation efficiency and revenue generation.

Strategic insights for the South & Central America Electronic Toll Collection System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 292.21 Million |

| Market Size by 2030 | US$ 671.39 Million |

| Global CAGR (2022 - 2030) | 11.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Electronic Toll Collection System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America electronic toll collection system market is segmented based on offering, technology, application, and country. Based on offering, the South & Central America electronic toll collection system market is bifurcated into systems and services. The systems segment held a larger market share in 2022.

In terms of technology, the South & Central America electronic toll collection system market is segmented into RFID, DSRC, ANPR, GNSS, and others. The RFID segment held the largest market share in 2022.

By application, the South & Central America electronic toll collection system market is bifurcated into highways and urban zones. The highways segment held a larger market share in 2022.

Based on country, the South & Central America electronic toll collection system market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America electronic toll collection system market share in 2022.

Conduent Inc, Kapsch TrafficCom AG, Thales SA, Magnetic Autocontrol GmbH, Sociedad Iberica de Construcciones Electricas SA, Mitsubishi Heavy Industries Ltd., and Q-Free ASA are some of the leading companies operating in the South & Central America electronic toll collection system market.

1. Conduent Inc

2. Kapsch TrafficCom AG

3. Thales SA

4. Magnetic Autocontrol GmbH

5. Sociedad Iberica de Construcciones Electricas SA

6. Mitsubishi Heavy Industries Ltd.

7. Q-Free ASA.

The South & Central America Electronic Toll Collection System Market is valued at US$ 292.21 Million in 2022, it is projected to reach US$ 671.39 Million by 2030.

As per our report South & Central America Electronic Toll Collection System Market, the market size is valued at US$ 292.21 Million in 2022, projecting it to reach US$ 671.39 Million by 2030. This translates to a CAGR of approximately 11.0% during the forecast period.

The South & Central America Electronic Toll Collection System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Electronic Toll Collection System Market report:

The South & Central America Electronic Toll Collection System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Electronic Toll Collection System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Electronic Toll Collection System Market value chain can benefit from the information contained in a comprehensive market report.