South and Central America Dual Clutch Transmission Market

No. of Pages: 110 | Report Code: TIPRE00025852 | Category: Automotive and Transportation

No. of Pages: 110 | Report Code: TIPRE00025852 | Category: Automotive and Transportation

A transmission system is considered as one of the most essential parts of any automobile, which is developing from manual to the automated mechanism for boosting the fuel economy and power requirements of the vehicles. The major advantages of dual clutch transmission (DCTs) include lower power loss, faster transmission, and greater fuel economy, compared to other transmission types available in the market. The former technology is limited to be used in sports cars, race cars, and subsequently in passenger vehicles. The technology is subjected to robust research by established automakers to develop DCT systems such as DSG in Volkswagen and PDK from Porsche.

Strategic insights for the South and Central America Dual Clutch Transmission provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

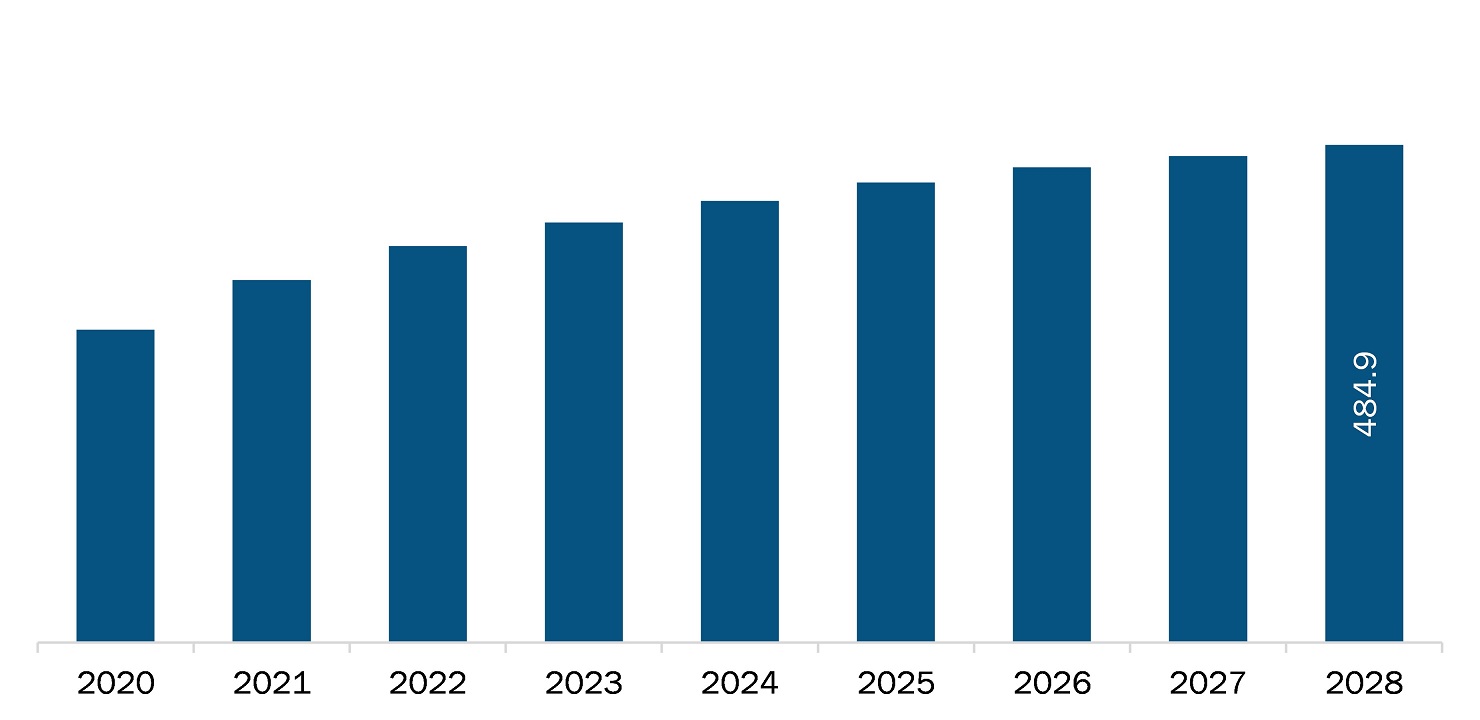

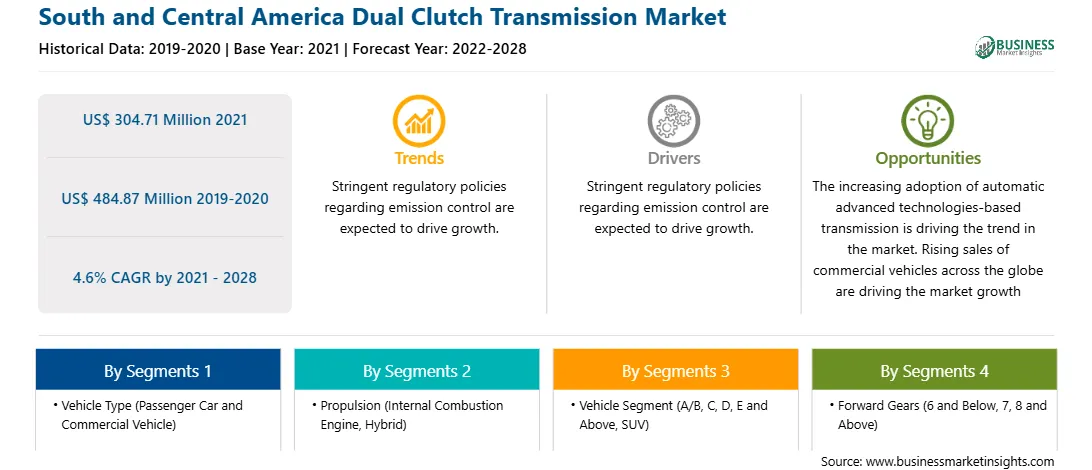

| Market size in 2021 | US$ 304.71 Million |

| Market Size by 2028 | US$ 484.87 Million |

| Global CAGR (2021 - 2028) | 4.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South and Central America Dual Clutch Transmission refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South and Central America dual clutch transmission market is expected to reach US$ 484.87 million by 2028 from an estimated value of US$ 304.71 million in 2021; it is likely to grow at a CAGR of 4.6% from 2021 to 2028. Growing sales of SUVs worldwide and increasing concerns about fuel economy and CO2 emission are driving the market. However, the increasing adoption of electric vehicles and their high costs may hamper the growth of the South and Central America dual clutch transmission market during the forecast period.

The demand for dual clutch transmission is increasing at a prime rate for SUVs. The rising demand for SUVs globally is boosting the growth of the dual clutch transmission market. The popularity of SUVs continues to grow in almost every market in the world. As the global marketplace declines following trade tensions and a slowdown in the Chinese market, car manufacturers look for new ways to expand their market. The shifting interest of customers from sedans or hatchbacks to SUVs started around seven years ago and is still growing strong. The increasing preference of consumers for SUVs is forcing vehicle manufacturers to focus on integrating advanced dual clutch transmission in vehicles. This corresponds with a drop in consumer spending capabilities. General Motors (GM) kept the lead but squandered market share to Toyota, Nissan, Ford, and Honda. FCA, the second-largest SUV manufacturer, overtook shares, owing to the new Jeep Wrangler and Compass. VW Group, Hyundai-Kia, Mazda, Subaru, and BMW Group were among the other major SUV market shareholders. Furthermore, advanced techniques such as dual clutch transmission systems are used by automotive OEMs to minimize fuel consumption and CO2 emissions while preserving performance. Hence, the increasing concern about fuel economy and CO2 emission will propel market growth.

Brazil recorded the highest number of COVID-19 cases in South and Central America, followed by Ecuador, Chile, Peru, and Argentina. The governments in South America (SAM) have taken an array of actions to protect their citizens and contain COVID-19’s spread. It is anticipated that South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe, and the US, which are important trade partners. Containment measures in several countries of South America have impacted the manufacturing industry, including automotive manufacturing. Major automotive manufacturers have also temporarily closed their production process in the region, owing to cost control measures because of the pandemic.

Based on vehicle type, the South and Central America dual clutch transmission market is segmented into passenger cars and commercial vehicle. The passenger car segment led the dual clutch transmission market in 2021, and the same segment is expected to account for a larger share of the market by 2021–2028.

In terms of propulsion, the South and Central America dual clutch transmission market is classified into internal combustion engine (ICE) and hybrid. In 2021, the ICE segment held a larger share of the market; however, the hybrid segment is expected to grow at a faster rate in the coming years.

Based on vehicle segment, the South and Central America dual clutch transmission market is classified into A/B, C, D, E and above, and SUV. The SUV segment led the largest share of the dual clutch transmission market in 2021, and the same segment is expected to account for the largest market share by 2021–2028.

Based on forward gear, the South and Central America dual clutch transmission market is classified into 6 and below, 7, and 8 and above. The 7 segment led the dual clutch transmission market with the highest market share in 2021, and the same segment is expected to account for the largest share of the market during the forecast period.

The primary and secondary sources associated with this report on the South and Central America dual clutch transmission market include the International Organization of Motor Vehicle Manufacturers (OICA), the Environmental Protection Agency (EPA), and the Nationwide Highway Traffic Safety Administration (NHTSA).

The South and Central America Dual Clutch Transmission Market is valued at US$ 304.71 Million in 2021, it is projected to reach US$ 484.87 Million by 2028.

As per our report South and Central America Dual Clutch Transmission Market, the market size is valued at US$ 304.71 Million in 2021, projecting it to reach US$ 484.87 Million by 2028. This translates to a CAGR of approximately 4.6% during the forecast period.

The South and Central America Dual Clutch Transmission Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Dual Clutch Transmission Market report:

The South and Central America Dual Clutch Transmission Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Dual Clutch Transmission Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Dual Clutch Transmission Market value chain can benefit from the information contained in a comprehensive market report.