South & Central America DNS Security Software Market

No. of Pages: 66 | Report Code: BMIRE00030092 | Category: Technology, Media and Telecommunications

No. of Pages: 66 | Report Code: BMIRE00030092 | Category: Technology, Media and Telecommunications

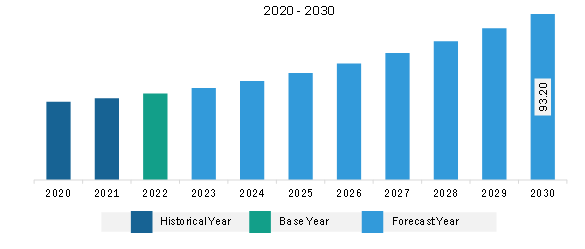

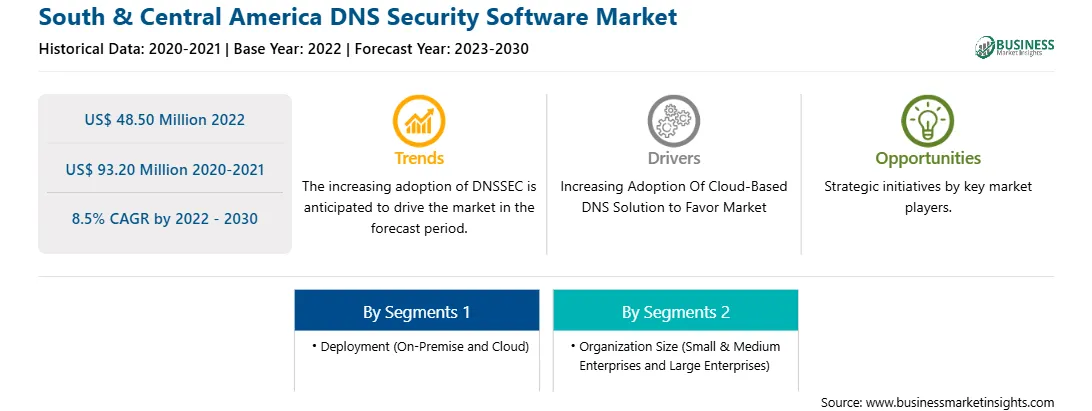

The South & Central America DNS security software market is expected to grow from US$ 48.50 million in 2022 to US$ 93.20 million by 2030. It is estimated to grow at a CAGR of 8.5% from 2022 to 2030.

Like many internet protocols, DNS systems were not designed keeping security in mind, and they contain several design limitations. These limitations, combined with technological advancements, have made it easier for online attackers to hijack a DNS lookup for malicious activities, which involve redirecting users to fraudulent websites that can distribute malware or collect personal information. Domain Name System Security Extensions (DNSSEC) is a security protocol created to fix this problem. DNSSEC is a set of extensions to DNS that adds a layer of security by digitally signing DNS data. DNSSEC provides a higher level of security by ensuring authenticity and integrity of DNS data. As cyber threats like DNS spoofing and cache poisoning become more sophisticated, organizations are turning to DNSSEC as a crucial defense mechanism. Moreover, DNSSEC implements a hierarchical digital signing policy across all layers of DNS. For instance, in the case of google.com lookup, a root DNS server would sign a key for the.COM name server and it would then sign a key for google.com's authoritative name server. Many industries and government entities have imposed regulations that require the implementation of DNSSEC for security and compliance reasons. This includes sectors such as finance, healthcare, and government. DNS security software that offers DNSSEC support helps organizations meet these compliance requirements. The increasing adoption of DNSSEC is anticipated to be a significant trend in the DNS security software market because it addresses critical DNS-related security concerns, aligns with regulatory requirements, and enhances trust and authenticity in the digital landscape. DNS security software providers that offer DNSSEC support are well-positioned to fulfill the evolving security needs of organizations and individuals in an increasingly interconnected world. Therefore, the DNSSEC is likely to emerge as a significant future trend in the DNS security software market in the coming years.

The South and Central America DNS security software market is segmented into Argentina, Brazil, and the rest of the South and Central America region. The increasing cyber-attacks in Brazil are helping to boost the adoption of the DNS security software market in South and Central America. In August 2022, according to the threat intelligence lab, FortiGuard Labs report, Brazil suffered US$ 31.5 billion in attempted cyber-attacks from January to June 2022. a 94% increase compared to 2021. Brazil is the second most targeted country in Latin America. In total, the Latin America and Caribbean region has suffered 137 billion attempted cyber-attacks. Furthermore, according to FortiGuard Labs, the number of ransomware signatures has nearly doubled in six months. In the first half of 2022, a total of 10,666 ransomware signatures were found in Latin America, with only 5,400 seen in the last half of 2021. Such an increase in cyber-attacks and ransomware attacks is helping to boost the adoption of DNS security software technologies in the South and Central America region. The Rest of SAM includes countries such as Chile, Peru, and Columbia. Chile recorded a record number of distributed denial of service (DDoS) attacks in 2020. Cyber attackers have expanded their target profile beyond the suspect industries as the mass shift to remote working and online gaming has opened up new opportunities. According to the NETSCOUT threat intelligence report in August 2021, in Chile, the frequency of cyber-attacks on various industries has been increasing. According to the NETSCOUT threat intelligence report, the top ten industries are affected by the cyber-attacks are wireless telecommunication carriers, telecommunication resellers, electronic computer manufacturing, other telecommunication industries, data processing hosting related services, internet publishing broadcasting services, wired telecommunication carriers, religious organizations, software publishers, cable and other subscription programming. The increase in cyber-attacks across various industries in Chile is boosting the adoption of DNS security software services. Similarly, in Columbia, the adoption of DNS security software services is increasing to prevent damage from DDoS attacks. For instance, in May 2022, Columbia Wireless, a high-speed ISP delivering connectivity throughout Columbia experienced a DDoS attack that saturated its upstream provider links and effectively brought down the network service for all customers for about one hour. Due to the attack, Columbia Wireless lost approximately 25% of its business customers due to this attack.

Strategic insights for the South & Central America DNS Security Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 48.50 Million |

| Market Size by 2030 | US$ 93.20 Million |

| Global CAGR (2022 - 2030) | 8.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America DNS Security Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America DNS security software market is segmented into deployment, organization size, and country.

Based on deployment, the South & Central America DNS security software market is bifurcated into on-premise and cloud. The cloud segment held a larger share of the South & Central America DNS security software market in 2022.

In terms of organization size, the South & Central America DNS security software market is bifurcated small & medium enterprises and large enterprises. The large enterprises segment held a larger share of the South & Central America DNS security software market in 2022.

Based on country, the South & Central America DNS security software market is segmented into Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America DNS security software market in 2022.

Akamai Technologies; Comodo Security Solutions, Inc; Efficient IP; Open Text Corporation; ScoutDNS, LLC; and Cisco Systems Inc are some of the leading companies operating in the South & Central America DNS security software market.

1. Akamai Technologies

2. Comodo Security Solutions, Inc

3. Efficient IP

4. Open Text Corporation

5. ScoutDNS, LLC

6. Cisco Systems Inc

The South & Central America DNS Security Software Market is valued at US$ 48.50 Million in 2022, it is projected to reach US$ 93.20 Million by 2030.

As per our report South & Central America DNS Security Software Market, the market size is valued at US$ 48.50 Million in 2022, projecting it to reach US$ 93.20 Million by 2030. This translates to a CAGR of approximately 8.5% during the forecast period.

The South & Central America DNS Security Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America DNS Security Software Market report:

The South & Central America DNS Security Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America DNS Security Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America DNS Security Software Market value chain can benefit from the information contained in a comprehensive market report.