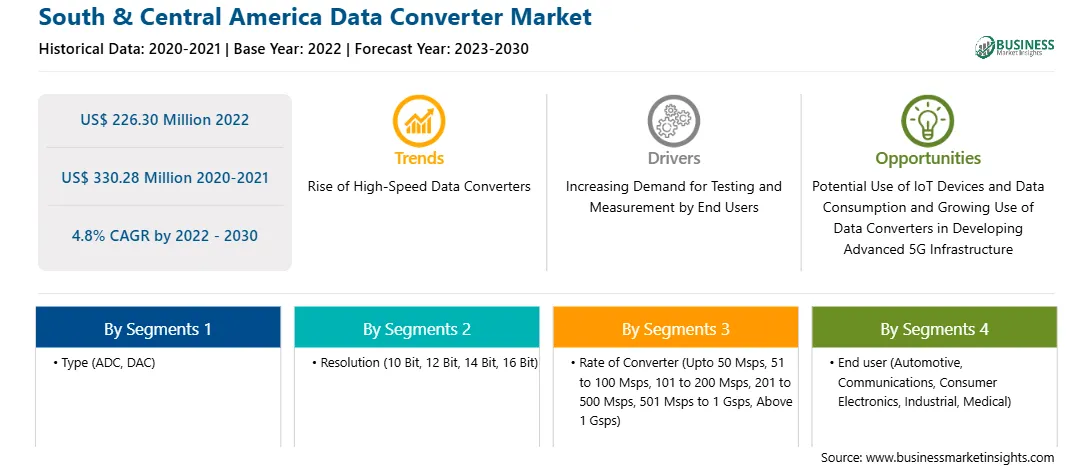

The South & Central America data converter market was valued at US$ 226.30 million in 2022 and is expected to reach US$ 330.28 million by 2030; it is estimated to register a CAGR of 4.8% from 2022 to 2030.

The constantly growing demand for data converters has forced the market players to raise investments in the development of new and innovative product offerings. A few of the major product developments are mentioned below:

• In November 2023, Renesas Electronics announced the launch of a new 32-bit microcontroller in its RX family, this time bringing with it a high-precision analog front-end (AFE) providing 24-bit resolution at up to eight times the speed of its predecessor. The stand-out feature of RX23E-B is its analog front-end (AFE), a 24-bit delta-sigma ADC, which delivers a claimed sampling rate of 125,000 samples/second (125kS/s), an eightfold improvement on the company's earlier RX23E-B, according to Renesas, with a 31.25kS/s variant available offering a reduced power draw.

• In February 2023, Agile Analog, an analog IP innovator, extended its range of data conversion IP with introduction of the first customizable, process-agnostic, 12-bit ADC.

• In February 2024, Asahi Kasei Microdevices Corporation (AKM) developed the AK5707, a low-power monaural 16-bit ADC equipped with the acoustic activity analyzer (AAA), a specific sound detection function. Operating at only 34µA, the AAA outputs an interrupt signal to activate the built-in ADC or external SoC when it detects an anticipated sound with adjustable parameter settings.

• In December 2021, Texas Instruments Inc. launched the smallest 24-bit wideband ADC that aids in signal measurement with industry-leading precision with wider bandwidths. The launched ADS127L11 helps in achieving ultra-precise data acquisition in a 50% smaller package, significantly optimizing power resolution, consumption, and measurement bandwidth for a broad range of industrial systems. The product can be utilized in various applications such as test and measurement equipment and portable medical devices with improved battery life requirements.

• In May 2022, Analog Devices, Inc. unveiled a new portfolio of next-generation 16-to-24-bit, ultrahigh-precision successive approximation register (SAR) ADCs. The new AD4630-24 SAR ADC offers high accuracy and performance with a broad common mode input range.

• In October 2021, Omni Design Technologies, Inc. introduced silicon-validated 12-bit 6 GSPS ADC and 12-bit 7 GSPS DAC on Taiwan Semiconductor Manufacturing Company Limited (TSMC) 16nm technology. The new 12-bit 6 GSPS ADC can operate with the sampling rates of 1–8 GSPS with linearly scaling power consumption, further providing high input bandwidth, excellent SFDR and NSD performance, and background calibration with a notch-less spectrum. In addition, the 12-bit 7 GSPS DAC supports a wide range of applications, including versions with 14/12/10 bits of resolution and 8/4/2 GHz update rates. These versions have superior SFDR, IMD3, and NSD characteristics.

Innovations in data converters, followed by high investments from manufacturers to develop their product portfolios and innovate products as per changing requirements from customers, boost the South & Central America data converter market growth.

The South America (SAM) data converter market is segmented into Brazil, Argentina, and the Rest of South America. Countries in the region have been steady adopters of technologies. Among all countries in South America, Brazil is estimated to be the most significant contributor to the revenue of the South America data converter market during the forecast period. The market growth can be attributed to the growing telecommunication industry in the country. According to the report by BNamericas, the Brazilian telecom market surpassed 338 million subscriptions in fixed and mobile telephony, fixed broadband, and pay TV in November 2021. In addition, Brazil's federal government is planning to commission a 5G wireless network in the country, which is expected to support the growth of the South & Central America data converter market in South America.

The ever-increasing demand for electronic devices such as smartphones, tablets, smart TVs, gaming devices, AR/VR devices, and smart speakers is propelling the consumer electronics industry. Data converters are deployed in the most advanced electronics and applications. Thus, all these factors are fueling the growth of the South & Central America data converter market.

Strategic insights for the South & Central America Data Converter provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Data Converter refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Data Converter Strategic Insights

South & Central America Data Converter Report Scope

Report Attribute

Details

Market size in 2022

US$ 226.30 Million

Market Size by 2030

US$ 330.28 Million

Global CAGR (2022 - 2030)

4.8%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Resolution

By Rate of Converter

By End user

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Data Converter Regional Insights

The South & Central America data converter market is categorized into type, resolution, rate of converter, end user, and country.

Based on type, the South & Central America data converter market is bifurcated ADC and DAC. The ADC segment held a larger market share in 2022.

By resolution, the South & Central America data converter market is segmented into 10 bit, 12 bit, 14 bit, 16 bit, and others. The others segment held the largest market share in 2022. The 10 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The 12 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The 14 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The 16 bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps. The others bit segment is further sub segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1Gsps, and Above 1Gsps.

Based on rate of converter, the South & Central America data converter market is segmented into Upto 50 Msps, 51 to 100 Msps, 101 to 200 Msps, 201 to 500 Msps, 501 Msps to 1 Gsps, and Above 1 Gsps. The 501 Msps to 1 Gsps segment held the largest market share in 2022.

In terms of end user, the South & Central America data converter market is segmented into automotive, communications, consumer electronics, industrial, medical, and others. The consumer electronics segment held the largest market share in 2022.

By country, the South & Central America data converter market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America data converter market share in 2022.

Analog Devices Inc, Asahi Kasei Microdevices Corp, Microchip Technology Inc, Renesas Electronics Corp, ROHM Co Ltd, STMicroelectronics NV, Teledyne Technologies Inc, and Texas Instruments Inc are some of the leading companies operating in the South & Central America data converter market.

The South & Central America Data Converter Market is valued at US$ 226.30 Million in 2022, it is projected to reach US$ 330.28 Million by 2030.

As per our report South & Central America Data Converter Market, the market size is valued at US$ 226.30 Million in 2022, projecting it to reach US$ 330.28 Million by 2030. This translates to a CAGR of approximately 4.8% during the forecast period.

The South & Central America Data Converter Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Data Converter Market report:

The South & Central America Data Converter Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Data Converter Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Data Converter Market value chain can benefit from the information contained in a comprehensive market report.