South & Central America Cooling Water Treatment Chemicals Market

No. of Pages: 93 | Report Code: BMIRE00030567 | Category: Chemicals and Materials

No. of Pages: 93 | Report Code: BMIRE00030567 | Category: Chemicals and Materials

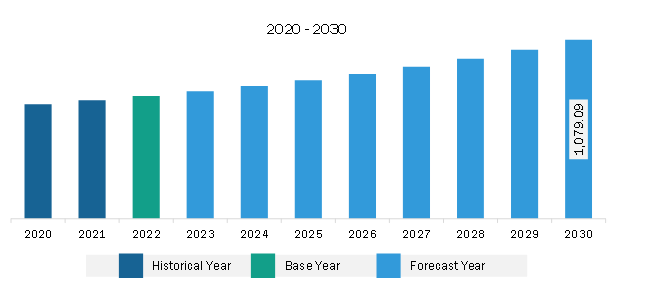

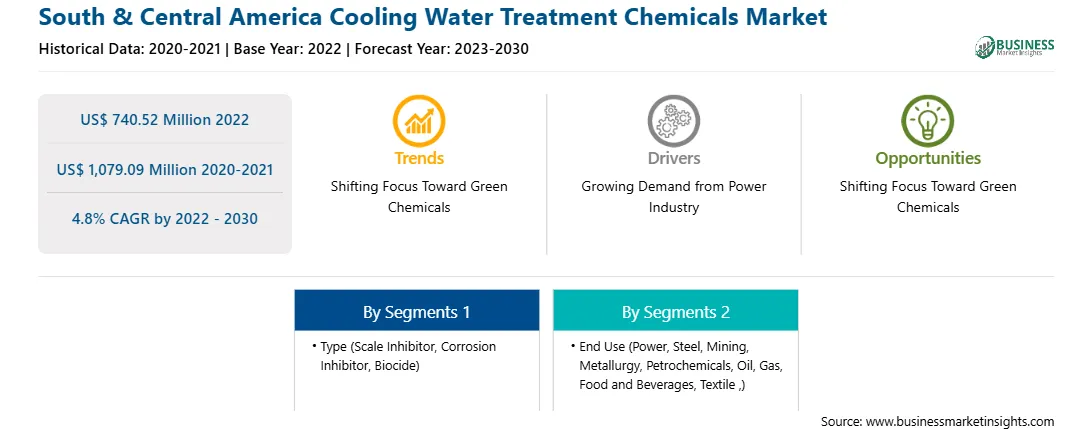

The South & Central America cooling water treatment chemicals market was valued at US$ 740.52 million in 2022 and is expected to reach US$ 1,079.09 million by 2030; it is estimated to register a CAGR of 4.8% from 2022 to 2030.

The power, oil & gas, chemicals, petrochemicals, and mining industries produce enormous volumes of wastewater. Generally, these wastewaters are released through a plant outfall into a surface water body, a dissipation lake, or a deep well injected. Environmental concerns due to such releases have catalyzed advancements in zero liquid discharge (ZLD) processes. ZLD is a treatment process in which all wastewater is purged and reused, thereby leaving zero release toward the end of the treatment cycle. This wastewater treatment technique incorporates ultrafiltration, switch assimilation, vanishing/crystallization, and fragmentary electrode ionization. It focuses on the economic reduction of wastewater volumes, along with producing clean water that is suitable for reuse.

ZLD systems generally comprise brackish water concentrators and crystallizers that use thermal evaporation to transform the saline solution into highly refined water. Apart from evaporator/crystallizer systems, ZLD systems may be enabled by promising advancements such as electrodialysis/electrodialysis reversal (ED/EDR), forward osmosis (FO), and membrane distillation (MD). These components are utilized in various combinations to bring down the expense and raise the productivity of the ZLD framework. In addition to the abovementioned techniques, other procedures associated with ZLD include softening, reverse osmosis, drying, and clarification. These procedures require different water treatment chemicals to enhance the productivity of the entire process. The growing concerns among populations about the effects of environmental releases of industrial waste, and stringent guidelines by administrations on water protection and wastewater management have added to the popularity of zero liquid discharge among different businesses, eventually boosting the cooling water treatment chemicals market growth.

The cooling water treatment chemicals market in South & Central America is segmented into Brazil, Argentina, and the Rest of South and Central America. Technological and industrial developments in the region support the economic growth of countries such as Brazil and Argentina. The changing economic conditions in South and Central America, development of new manufacturing facilities, and government measures for encouraging industrial production are the major factors providing huge developing potential for the cooling water treatment chemicals market players in South and Central America. Power, steel, mining and metallurgy, petrochemicals, oil & gas, food & beverages, and textile industries are among the major consumers of cooling water treatment chemicals in this region. Many international businesses find it simple to enter into the Brazilian manufacturing market owing to robust government and financial support. Thus, the ongoing development of the manufacturing sector and government support for increasing industrial production are expected to favor the cooling water treatment chemicals market growth in South & Central America in the coming years.

Strategic insights for the South & Central America Cooling Water Treatment Chemicals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Cooling Water Treatment Chemicals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Cooling Water Treatment Chemicals Strategic Insights

South & Central America Cooling Water Treatment Chemicals Report Scope

Report Attribute

Details

Market size in 2022

US$ 740.52 Million

Market Size by 2030

US$ 1,079.09 Million

Global CAGR (2022 - 2030)

4.8%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By End Use

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Cooling Water Treatment Chemicals Regional Insights

The South & Central America cooling water treatment chemicals market is categorized into type, end use, and country.

Based on type, the South & Central America cooling water treatment chemicals market is segmented into scale inhibitor, corrosion inhibitor, biocide, and others. The scale inhibitor segment held the largest market share in 2022.

In terms of end use, the South & Central America cooling water treatment chemicals market is segmented into power; steel, mining, and metallurgy; petrochemicals, oil, and gas; food and beverages; textile; and others. The power segment held the largest market share in 2022.

By country, the South & Central America cooling water treatment chemicals market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America cooling water treatment chemicals market share in 2022.

Albemarle Corp, Buckman Laboratories lnternational Inc, ChemTreat Inc, DuBois Chemicals Inc, Ecolab Inc, Kemira Oyj, Kurita Water Industries Ltd, and Veolia Water Solutions & Technologies SA are some of the leading companies operating in the South & Central America cooling water treatment chemicals market.

The South & Central America Cooling Water Treatment Chemicals Market is valued at US$ 740.52 Million in 2022, it is projected to reach US$ 1,079.09 Million by 2030.

As per our report South & Central America Cooling Water Treatment Chemicals Market, the market size is valued at US$ 740.52 Million in 2022, projecting it to reach US$ 1,079.09 Million by 2030. This translates to a CAGR of approximately 4.8% during the forecast period.

The South & Central America Cooling Water Treatment Chemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Cooling Water Treatment Chemicals Market report:

The South & Central America Cooling Water Treatment Chemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Cooling Water Treatment Chemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Cooling Water Treatment Chemicals Market value chain can benefit from the information contained in a comprehensive market report.