South & Central America Construction Accounting Software Market

No. of Pages: 70 | Report Code: BMIRE00029104 | Category: Technology, Media and Telecommunications

No. of Pages: 70 | Report Code: BMIRE00029104 | Category: Technology, Media and Telecommunications

The construction industry has begun to undergo technological transformation. Companies are implementing technologies to reduce costs and improve safety, efficiency, and quality of construction activities. As construction companies increasingly emphasize accounting decisions to determine the ROI and future of respective businesses, the demand for construction accounting software is rising. Analyzing the financials using accounting software before starting a business allows emerging entrepreneurs to carry out unique business ideas and rapidly and efficiently reflect their vision. A business plan software analysis also enables new business owners to understand the fundraising strategies and expansion policies. Additionally, the software-based accounting plans help the end-user foresee potential problems and obstacles. Thus, many companies are offering construction accounting software due to the rising awareness among new entrepreneurs, which is expected to offer lucrative business opportunities for market players in the coming years.

South & Central America includes countries such as Brazil and Argentina. The region has witnessed more than 17,000 construction projects, which depicts the region's growing construction industry. According to the Association of Equipment Manufacturers (AEM), the construction industry witnessed modest growth in past year. Brazil holds the most extensive construction market share in the region, and the country’s government continuously invests a substantial amount in developing its commercial and industrial infrastructures. Moreover, Colombia and Argentina are expected to witness faster growth in construction, which is mainly attributed to the public-private partnership (PPP) projects.

In the context of the construction industry, the government had stated plans to initiate ~7,000 construction projects with an investment of US$ 40 billion (BRL 131 billion) by the end of 2018. Moreover, several publicly funded infrastructure projects such as “My House, My Life” and the National Education Plan 2014–2024 program will boost the construction industry's growth. Such government initiatives will help stimulate the development of the construction industry in the region. Moreover, the region promotes economic growth via increased public spending and increasing infrastructure bottlenecks to assist private sector development; this focus is further expected to contribute to the construction industry's business growth. The more the construction projects, the higher will be the penetration of construction accounting software.

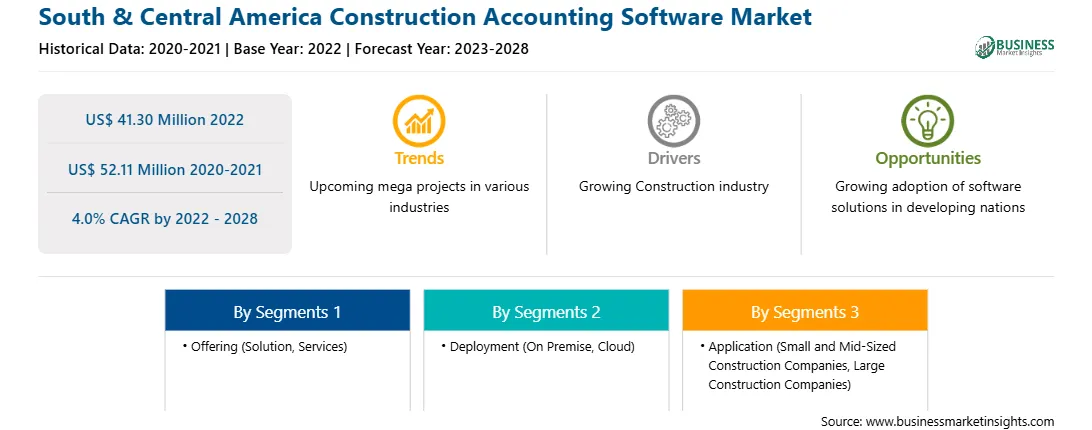

The South & Central America construction accounting software market is segmented based on offering, deployment, application, and country. Based on offering, the South & Central America construction accounting software market is bifurcated into solution and services. The solution segment held a larger market share in 2022.

Based on deployment, the South & Central America construction accounting software market is bifurcated into on-premises and cloud. The cloud segment held a larger market share in 2022.

Based on application, the South & Central America construction accounting software market is bifurcated into small and mid-sized construction companies and large construction companies. The large construction companies segment held a larger market share in 2022.

Based on country, the South & Central America construction accounting software market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America construction accounting software market in 2022.

Intuit Inc, Xero Ltd, Trimble Inc., and Procore Technologies are some of the leading players operating in the South & Central America construction accounting software market.

Strategic insights for the South & Central America Construction Accounting Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 41.30 Million |

| Market Size by 2028 | US$ 52.11 Million |

| Global CAGR (2022 - 2028) | 4.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Construction Accounting Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America Construction Accounting Software Market is valued at US$ 41.30 Million in 2022, it is projected to reach US$ 52.11 Million by 2028.

As per our report South & Central America Construction Accounting Software Market, the market size is valued at US$ 41.30 Million in 2022, projecting it to reach US$ 52.11 Million by 2028. This translates to a CAGR of approximately 4.0% during the forecast period.

The South & Central America Construction Accounting Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Construction Accounting Software Market report:

The South & Central America Construction Accounting Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Construction Accounting Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Construction Accounting Software Market value chain can benefit from the information contained in a comprehensive market report.