Colonoscopes are used for the removal of foreign bodies, excision of tumors or colorectal polyps (polypectomy), and control of hemorrhage. Routine colonoscopy is important in diagnosing intestinal cancer, the second leading cause of cancer deaths in the United States. These endoscopic procedures reduce the need for invasive surgical diagnostic and therapeutic procedures.

Strategic insights for the South and Central America Colonoscopes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 136.89 Million |

| Market Size by 2028 | US$ 169.50 Million |

| Global CAGR (2021 - 2028) | 3.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South and Central America Colonoscopes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

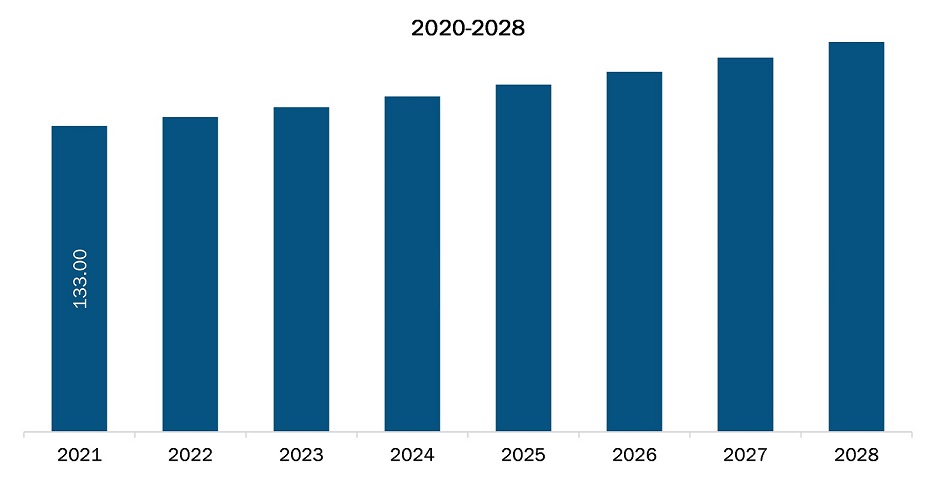

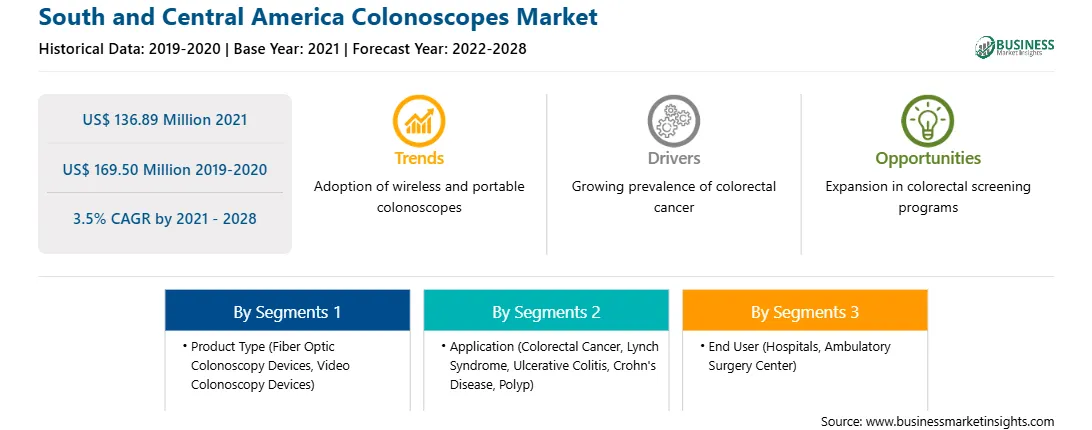

The South and Central America colonoscopes market is expected to reach US$ 169.50 million by 2028 from US$ 136.89 million in 2021; it is estimated to grow at a CAGR of 3.5% from 2021 to 2028. A few factors such as the increasing prevalence of colorectal cancer, growing research activities to extend its applications in therapeutic areas, technological advancements in colonoscopy devices, and development of robotic colonoscopes are driving the growth of the market. However, the availability of alternative diagnostic tests for rectal diseases hampers the market growth.

Colorectal cancer is a malignant tumor that develops in the tissues of colon or rectum. Colon and rectal cancer are often grouped due to common features of both conditions. According to an article published online by science direct, in 2016, colorectal cancer is one the 5 the leading cancer diagnosis in Central and South America and males have 1–2 times higher colorectal cancer rates than females. Furthermore, it is the second leading cause of cancer death in the country, among men and women combined, while it stands as the third leading cause of cancer death when men and women are considered separately. Such a high prevalence makes it the second most frequently occurring cancer, after breast cancer, and the second leading cause of death, after lung cancer. In ideal situations, where the cancer is diagnosed in early stages, doctors can remove the tumor via surgical procedures. A colonoscopy is an important screening test for colorectal cancer, and it has become a part of routine cancer screening. The annual count of adults getting screened for cancer surged by 3.3 million in the US during 2014–2016, which is considered a prime factor associated with a 30% decrease in colon cancer mortality rate in people older than 50 in the past decade. In its updated screening guidelines released in 2018, the American Cancer Society quoted colonoscopies as the gold standard for detecting cancers and precancerous polyps in the colon. Also, to significantly reduce the adenoma “miss rate” of standard forward-viewing colonoscopy, manufacturers across globe are continuously striving to improve the current colonoscopy techniques, by exploring more advanced optics and wider-angle visualization tools along with a user-friendly, intuitive endoscopic platform interface. The introduction of such technologies is fuelling the colonoscope market growth.

The COVID-19 pandemic has severely impacted medical care in South and Central America. Market participants and end users are losing their businesses due to the temporary closure of companies in different countries. In this situation, there was the discontinuation of diagnosis and other related treatments. However, the COVID-19 outbreak has had a negative impact on the flow of medical care in the area. The COVID-19 pandemic has shifted the accepted and routine treatment of elective cases in hospital administration. This postponement resulted in a delay in the treatment of all non-COVID-19 patients, including cancer patients. The pandemic can lead to further potential innovations in cancer screening. Colon cancer screening programs (CRC) have been forcibly suspended since the pandemic began. A hospital system in distress needs a systematic approach to ensure timely cancer care. Screening delays beyond 4–6 months would significantly increase advanced CRC cases and mortality if they lasted longer than 12 months.

The South and Central America colonoscopes market, by product type, is bifurcated into fiber optic colonoscopy devices and video colonoscopy devices. The fiber optic colonoscopy devices segment held a larger share of the market in 2021, and the same segment is anticipated to register a higher CAGR in the market during the forecast period.

The South and Central America colonoscopes market, based on application, is segmented into colorectal cancer, lynch syndrome, ulcerative colitis, crohn’s disease, and polyp. In 2021, the colorectal cancer segment held the largest share of the market. Also, the market for the same segment is expected to grow at the fastest rate in the coming years.

The South and Central America colonoscopes market, based on end user, is segmented into hospitals, ambulatory surgery center, and others. In 2021, the hospitals segment held the largest share of the market. Further, the market for the same segment is expected to grow at the fastest rate in the coming years.

A few of the primary and secondary sources referred to while preparing the report on the South and Central America colonoscopes market are The Brazilian Association of Intestinal Cancer Prevention, Pan American Health Organization (PAHO), and the American Cancer Society.

The South and Central America Colonoscopes Market is valued at US$ 136.89 Million in 2021, it is projected to reach US$ 169.50 Million by 2028.

As per our report South and Central America Colonoscopes Market, the market size is valued at US$ 136.89 Million in 2021, projecting it to reach US$ 169.50 Million by 2028. This translates to a CAGR of approximately 3.5% during the forecast period.

The South and Central America Colonoscopes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Colonoscopes Market report:

The South and Central America Colonoscopes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Colonoscopes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Colonoscopes Market value chain can benefit from the information contained in a comprehensive market report.