Marine organisms such as fish, jellyfish, sponges, and other invertebrates harbor a significant source of collagen peptides. They are highly advantageous over other sources, as they are metabolically compatible, lack religious constraints, and are free of animal pathogens. Marine-sourced collagen peptide is majorly used for skincare product manufacturing. It is a versatile compound capable of healing skin injuries of varying severity and delaying the natural human aging process. Moreover, marine-sourced collagen peptides can be used as a biomaterial owing to its water solubility and metabolic compatibility. Thus, the demand for marine-sourced collagen peptide is increasing with its rising utilization for different industrial applications.

Furthermore, marine-sourced collagen peptides do not foster transmissible diseases. Land animals possess many transmissible diseases, making them less favorable for industry use. For example, cattle, although a large source of collagen, pose risks for BSE and TSE. These progressive neurological disorders affect cattle and can result in life-threatening human infections. In addition, a few religious constraints on using bovines for the pharmaceutical and cosmetic industries are up for debate. These factors make marine sources of collagen peptides a much easier, safer, and more promising alternative. Thus, with increasing demand, manufacturers are launching different products. For instance, in January 2021, Darling Ingredients introduced Peptan, a marine collagen peptide under its Rousselot brand. This product helps the company to enter the dietary supplements market. Thus, the growing demand for marine-sourced collagen is expected to open new opportunities in the collagen peptides market during the forecast period.

The collagen peptides market in South & Central America is subsegmental into Brazil, Argentina, and the Rest of South & Central America. Growing population, and constant improvement in processing industries positively affected the growth of the economy of Brazil and Argentina largely. The shift in consumer lifestyle and dietary patterns is a critical factor boosting the growth of the collagen peptides market in South & Central America, especially in Brazil. Moreover, Brazilian consumers' desire for nutritional value added-beauty products which influences industry participants to boost their investments in the launch of collagen peptides for meeting the raw material demands from a wide range of industries, including dietary supplements and cosmetics. For instance, on August 10, 2022, JBS—the Brazilian global leader in protein-based products manufacturer—launched Genu-in Life and invested US$ 78.10 million in a new plant (production of collagen peptide and gelatin). Genu-in Life has been launched to strengthen cartilage, tendons, muscles, and bones and enhance skin beauty.

Consumers in Brazil suffer mobility-related health issues such as osteoporosis and bone and joint health impairment. Furthermore, rheumatoid arthritis is increasingly contributing to the annual mortality rate of the country. According to the World Health Organization (WHO) data published in 2020, rheumatoid arthritis-related deaths in Brazil reached 596 or 0.05% of total deaths. As a result, the demand for collagen peptides peptide-based supplements is predicted to grow significantly in countries in South & Central America during the forecast period.

Strategic insights for the South & Central America Collagen Peptides provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Collagen Peptides refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Collagen Peptides Strategic Insights

South & Central America Collagen Peptides Report Scope

Report Attribute

Details

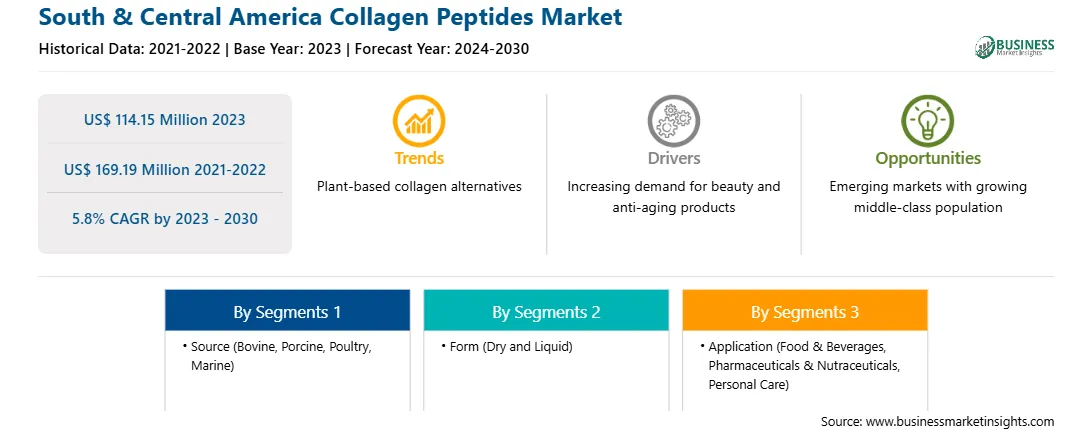

Market size in 2023

US$ 114.15 Million

Market Size by 2030

US$ 169.19 Million

Global CAGR (2023 - 2030)

5.8%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Source

By Form

By Application

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Collagen Peptides Regional Insights

South & Central America Collagen Peptides Market Segmentation

The South & Central America collagen peptides market is segmented into source, form, application, and country.

Based on source, the South & Central America collagen peptides market is segmented into bovine, porcine, poultry, marine, and others. The bovine segment registered the largest South & Central America collagen peptides market share in 2023.

Based on form, the market is segmented into dry and liquid. The dry segment held a larger South & Central America collagen peptides market share in 2023.

Based on application, the South & Central America collagen peptide market is segmented into food & beverages, pharmaceuticals & nutraceuticals, personal care, and others. The pharmaceuticals & nutraceuticals segment held the largest South & Central America collagen peptide market share in 2023.

Based on country, the South & Central America collagen peptide market is segmented into the Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the South & Central America collagen peptide market share in 2023.

Darling Ingredients Inc, GELITA AG, Lapi Gelatine SpA, Rousselot BV, and Tessenderlo Group NV are some of the leading companies operating in the collagen peptide market in the region.

The South & Central America Collagen Peptides Market is valued at US$ 114.15 Million in 2023, it is projected to reach US$ 169.19 Million by 2030.

As per our report South & Central America Collagen Peptides Market, the market size is valued at US$ 114.15 Million in 2023, projecting it to reach US$ 169.19 Million by 2030. This translates to a CAGR of approximately 5.8% during the forecast period.

The South & Central America Collagen Peptides Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Collagen Peptides Market report:

The South & Central America Collagen Peptides Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Collagen Peptides Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Collagen Peptides Market value chain can benefit from the information contained in a comprehensive market report.