Polyvinyl chloride (PVC) is one of the most widely used synthetic polymers globally and finds applications in various sectors, including construction, automotive, electrical, packaging, and healthcare. The production of PVC involves the polymerization of vinyl chloride monomers, and chlorine is a key raw material in this chemical process. The construction and infrastructure development activities are increasing substantially. PVC pipes, fittings, and profiles are extensively used in construction due to their durability, cost-effectiveness, and versatility. As urbanization continues to accelerate in many parts of the world, the demand for PVC-based construction materials rises in tandem, leading to a higher need for chlorine to meet the polymerization requirements. According to the European Council of Vinyl Manufacturers, PVC is the third-most-produced plastic in the world, after polyethylene and polypropylene. Approximately 70% of all PVC produced in Europe is used for flooring, windows, pipes, roofing membranes, and other building products. PVC's lightweight nature, ease of processing, and cost-efficiency have made it a preferred choice for manufacturing automotive parts such as dashboards, door panels, and wiring covers. Therefore, the growth of the automotive sector propels the demand for PVC, which bolsters the requirement for chlorine as a raw material in PVC production.

PVC films and sheets are widely used in packaging applications, particularly for food and pharmaceutical products. With the increasing demand for packaging goods and the growing focus on hygiene and product safety, the demand for PVC-based packaging materials has soared, further contributing to the chlorine demand from the PVC industry. In the electrical sector, PVC cables and wires are extensively used for electrical insulation due to their excellent electrical properties and fire-retardant characteristics. As the demand for electricity and electrical infrastructure continues to rise, the need for PVC-based electrical materials propels, consequently bolstering the chlorine demand. Thus, since PVC remains a preferred material in construction, automotive, packaging, and electrical applications, the need for chlorine in the polymerization process remains strong.

The South & Central America chlorine market is segmented into Brazil, Argentina, and the Rest of South & Central America. South & Central America is one of the largest pulps and paper producers due to the availability of raw materials. Chlorine is used in the pulp & paper industry for bleaching processes to improve paper quality. According to the Indústria Brasileira de Árvores (Ibá) and Food and Agriculture Organization (FAO), Brazil accounted for 11.3%, and Chile held 2.8% of global pulp production in 2020. Thus, the large quantity of pulp and paper production in the region is anticipated to drive the chlorine demand.

Strategic insights for the South & Central America Chlorine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Chlorine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Chlorine Strategic Insights

South & Central America Chlorine Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,235.60 Million

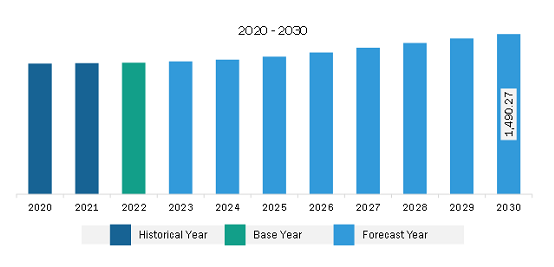

Market Size by 2030

US$ 1,490.27 Million

Global CAGR (2023 - 2030)

2.7%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Application

By End-Use Industry

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Chlorine Regional Insights

The South & Central America chlorine market is segmented into application, end-use industry, and country.

Based on application, the South & Central America chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates and oxygenates, solvents, and others. The ethylene dichloride/polyvinylchloride production segment held the largest share of the South & Central America chlorine market in 2023.

Based on end-use industry, the South & Central America chlorine market is segmented into water treatment, chemicals, pulp and paper, plastics, pharmaceuticals, and others. The plastics segment held the largest share of the South & Central America chlorine market in 2023.

Based on country, the South & Central America chlorine market has been categorized into the Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America dominated the share of the South & Central America chlorine market in 2023.

Aditya Birla Chemicals India Ltd; BASF SE; Ercros SA; Hanwha Solutions Corp; INEOS Group Holdings SA; Occidental Petroleum Corp; Olin Corp; Tata Chemicals Ltd; and Sumitomo Chemical Co Ltd are some of the leading companies operating in the South America chlorine market.

The South & Central America Chlorine Market is valued at US$ 1,235.60 Million in 2023, it is projected to reach US$ 1,490.27 Million by 2030.

As per our report South & Central America Chlorine Market, the market size is valued at US$ 1,235.60 Million in 2023, projecting it to reach US$ 1,490.27 Million by 2030. This translates to a CAGR of approximately 2.7% during the forecast period.

The South & Central America Chlorine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Chlorine Market report:

The South & Central America Chlorine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Chlorine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Chlorine Market value chain can benefit from the information contained in a comprehensive market report.