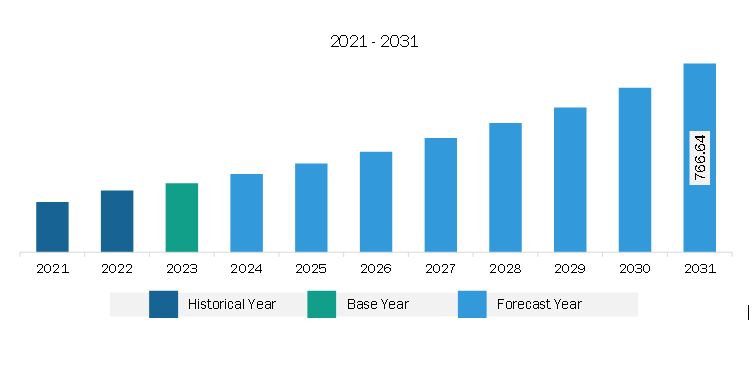

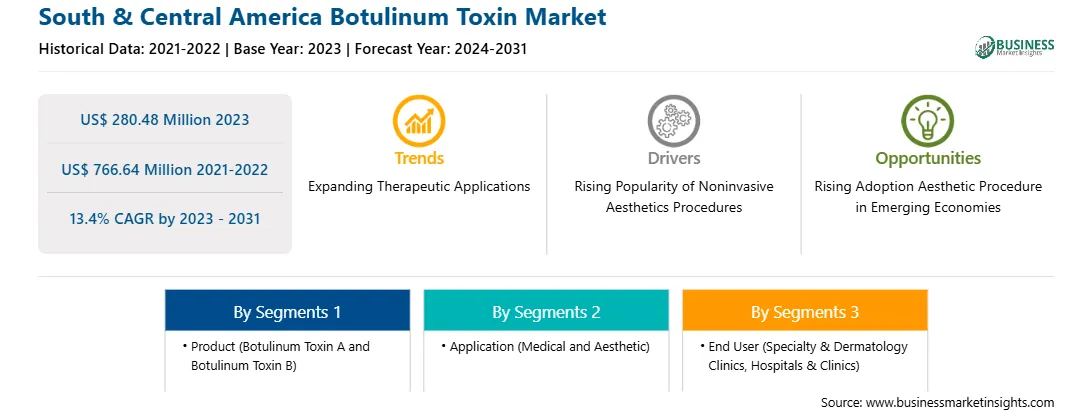

The South & Central America botulinum toxin market was valued at US$ 280.48 million in 2023 and is expected to reach US$ 766.64 million by 2031; it is estimated to register a CAGR of 13.4% from 2023 to 2031.

The botulinum toxins type A and B block vesicular acetylcholine released at neuromuscular and neurosecretory junctions, thereby delivering powerful therapeutic outcomes for treating patients requiring neurorehabilitation intervention. As per clinical reports, botulinum toxins have been proven to have therapeutic effects against headache, salivate, and hyperhidrosis, among others. Botulinum treatment can be adopted as an alternative to surgery. It appears to be a promising alternative to sphincterotomy in patients with chronic anal fissures. Patients suffering from a few autonomic disorders such as ptyalism or gustatory sweating, and hypersecretion of glands (a condition that often occurs after patients undergo surgeries involving parotid glands) respond well to botulinum toxins. Despite numerous advancements in the field of assisted reproductive technology, a significant number of patients still suffer from repeated implantation failure. Adequate endometrial growth plays a crucial role in embryo implantation and pregnancy continuation in an assisted reproductive procedure. For several years, botulinum toxins have been widely used in plastic and aesthetic surgeries; it has been revealed that botulinum toxins have a positive influence on the re-epithelialization of human keratinocytes and the angiogenesis of endothelial cells. Clinical results reveal that botulinum toxin administration facilitates the recovery of damaged structure and impaired function of the thin endometrium by increasing cellular proliferation and vessel formation, reducing collagen-accumulated lesions, and ultimately contributing to successful embryo implantation. Thus, the expanding therapeutic applications of botulinum toxins are likely to bring new botulinum toxins market trends in the coming years.

The botulinum toxin market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America. Market growth in this region is mainly driven by the rising public awareness about cosmetic procedures, the accessibility of technologically advanced user-friendly products, and the increasing demand for aesthetic treatments. In Brazil, minimally invasive and noninvasive cosmetic procedures are being performed for the treatment of a broad range of indications. BOTOX, Xeomin, Dysport, Botulift, and Prosigne are among the botulinum toxin A formulations available in Brazil. The ISAPS report reveals that botulinum toxin-based treatment was the most common non-surgical procedure performed in Brazil in 2021. Nearly 542,520 botulinum toxin procedures, accounting for 49.8% of the total nonsurgical procedures, were performed in the country in the said year. Moreover, the presence of key players positively impacts the growth of the botulinum toxin market in Brazil. In February 2020, Daewoong Pharmaceuticals announced receiving approval from ANVISA for using and selling Nabota, a botulinum toxin product type, in Brazil. Also, Hugel, one of the prominent aesthetics and therapeutics companies, has marketed its botulinum toxin brand in 27 countries, including Brazil.

Strategic insights for the South & Central America Botulinum Toxin provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 280.48 Million |

| Market Size by 2031 | US$ 766.64 Million |

| Global CAGR (2023 - 2031) | 13.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Botulinum Toxin refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America botulinum toxin market is categorized into product, application, end user, and country.

Based on product, the South & Central America botulinum toxin market is bifurcated into botulinum toxin A and botulinum toxin B. The botulinum toxin A segment held a larger share of South & Central America botulinum toxin market share in 2023.

In terms of application, the South & Central America botulinum toxin market is bifurcated into medical and aesthetic. The medical segment held a larger share of South & Central America botulinum toxin market in 2023. Furthermore, the medical segment is subcategorized into chronic migraine, muscle spasm, over reactive bladder, hyperhidrosis, and others. Additionally, the aesthetic segment is subcategorized into frown lines/ glabellar, forehead lines, crow’s feet, square jaw/ masseter, and others.

By end user, the South & Central America botulinum toxin market is divided into specialty & dermatology clinics, hospitals & clinics, and others. The specialty and dermatology clinics segment held the largest share of South & Central America botulinum toxin market in 2023.

Based on country, the South & Central America botulinum toxin market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America botulinum toxin market share in 2023.

Merz Pharma GmbH & Co KGaA, AbbVie Inc, Ipsen SA, Medytox Inc, and Galderma SA are some of the leading companies operating in the South & Central America botulinum toxin market.

The South & Central America Botulinum Toxin Market is valued at US$ 280.48 Million in 2023, it is projected to reach US$ 766.64 Million by 2031.

As per our report South & Central America Botulinum Toxin Market, the market size is valued at US$ 280.48 Million in 2023, projecting it to reach US$ 766.64 Million by 2031. This translates to a CAGR of approximately 13.4% during the forecast period.

The South & Central America Botulinum Toxin Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Botulinum Toxin Market report:

The South & Central America Botulinum Toxin Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Botulinum Toxin Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Botulinum Toxin Market value chain can benefit from the information contained in a comprehensive market report.