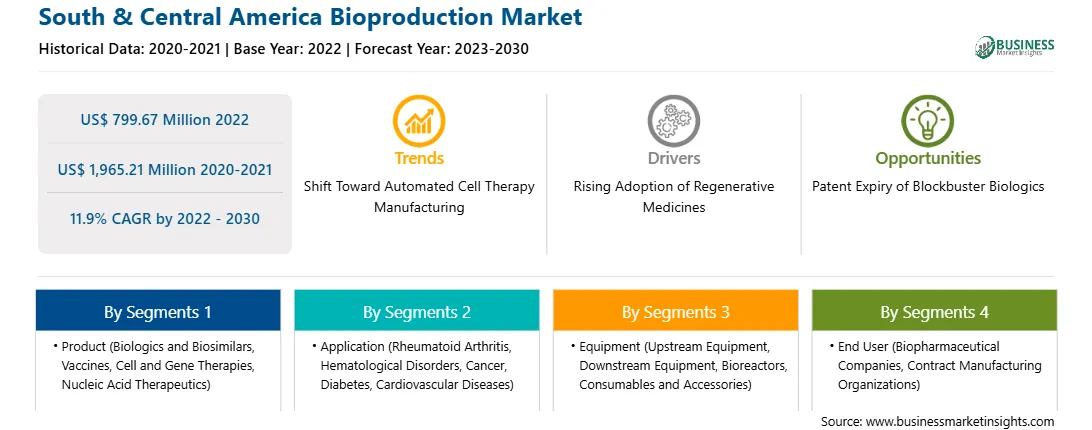

The South & Central America bioproduction market was valued at US$ 799.67 million in 2022 and is expected to reach US$ 1,965.21 million by 2030; it is estimated to register a CAGR of 11.9% from 2022 to 2030.

Biologicals represent promising new therapies for previously incurable diseases and are becoming highly important in the pharmaceuticals market. Patents on originator biologicals are expected to expire in the coming years.

Estimated patent and exclusivity expiry dates for best-selling biologicals are given in the following table.

Biologicals | Expiry Dates |

Avastin | January 2022 |

Cyramza | May 2023 |

Adcetris | August 2023 |

Abthrax | October 2024 |

Gazyva/Gazyvaro | November 2024 |

Darzalex | May 2026 |

Ocrevus | April 2027 |

Emgality | September 2028 |

Hemlibra | February 2028 |

Llumetri | March 2028 |

Imfinzi | September 2028 |

Mylotarg | April 2028 |

Imfinzi | September 2028 |

Mylotarg | April 2028 |

Sylvant | July 2034 |

The patent expiration and other intellectual property rights for originator biologicals will create a need to introduce new biosimilars in the future. As a result, competition among market players will surge in the industry in the coming years. Thus, the patent expiry of blockbuster biologics is expected to create lucrative opportunities for the bioproduction market during the forecast period.

The bioproduction market in South & Central America is subsegmented into Brazil, Argentina, and the Rest of South & Central America. Growing developments in the medical industry and increasing awareness regarding cell therapy in Brazil are likely to create significant growth opportunities for market growth. Similarly, the growing healthcare industry in Argentina is expected to offer growth opportunities for the bioproduction market.

According to an article published in Biomaterials Research, in 2020, Brazil was among the top ten countries in the world in terms of the highest number of people having diabetes, and it currently ranks fifth. Currently, Brazil is the fifth top country in the world with the highest prevalence of diabetes mellitus (DM) in adults. According to the International Diabetes Federation (IDF), it is estimated that an increase of 54.7% of new cases of diabetes by 2045.

According to GaBI, in 2022, the Brazilian Health Regulatory Agency (Agência Nacional de Vigilância Sanitária, ANVISA) approved 30 biosimilars within the product classes of insulin, monoclonal antibodies, tumor necrosis factor (TNF) inhibitor, human growth hormone, anticoagulants and heparins, and granulocyte colony-stimulating factor for use in Brazil. The ANVISA approved Admelog biosimilar by Sanofi in Brazil to treat diabetes. Thus, growing diabetic cases and increasing product approvals in Brazil are driving the bioproduction market.

Strategic insights for the South & Central America Bioproduction provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 799.67 Million |

| Market Size by 2030 | US$ 1,965.21 Million |

| Global CAGR (2022 - 2030) | 11.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Bioproduction refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South & Central America bioproduction market is categorized into product, application, equipment, end user, and country.

Based on product, the South & Central America bioproduction market is segmented into biologics and biosimilars, vaccines, cell and gene therapies, nucleic acid therapeutics, and others. The biologics and biosimilars segment held the largest South & Central America bioproduction market share in 2022.

In terms of application, the South & Central America bioproduction market is segmented into rheumatoid arthritis, hematological disorders, cancer, diabetes, cardiovascular diseases, and others. The cancer segment held the largest South & Central America bioproduction market share in 2022.

By equipment, the South & Central America bioproduction market is divided into upstream equipment, downstream equipment, bioreactors, and consumables and accessories. The consumables and accessories segment held the largest South & Central America bioproduction market share in 2022.

In terms of end user, the South & Central America bioproduction market is categorized into biopharmaceutical companies, contract manufacturing organizations, and others. The biopharmaceutical companies segment held the largest South & Central America bioproduction market share in 2022.

By country, the South & Central America bioproduction market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America bioproduction market share in 2022.

Lonza Group AG, Danaher Corp, Sartorius AG, Thermo Fisher Scientific Inc, Merck KGaA, F. Hoffmann-La Roche Ltd, and Bio-Rad Laboratories Inc. are some of the leading companies operating in the South & Central America bioproduction market.

1. Lonza Group AG

2. Danaher Corp

3. Sartorius AG

4. Thermo Fisher Scientific Inc

5. Merck KGaA

6. F. Hoffmann-La Roche Ltd

7. Bio-Rad Laboratories Inc

The South & Central America Bioproduction Market is valued at US$ 799.67 Million in 2022, it is projected to reach US$ 1,965.21 Million by 2030.

As per our report South & Central America Bioproduction Market, the market size is valued at US$ 799.67 Million in 2022, projecting it to reach US$ 1,965.21 Million by 2030. This translates to a CAGR of approximately 11.9% during the forecast period.

The South & Central America Bioproduction Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Bioproduction Market report:

The South & Central America Bioproduction Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Bioproduction Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Bioproduction Market value chain can benefit from the information contained in a comprehensive market report.