Advanced bioprocess technologies bridge R&D with production. Several players are introducing a wide range of new bioprocessing technologies in the market. On December 4, 2020, IDBS (a provider of software informatics solutions for the biotech and pharmaceutical industries) announced the launch of Polar. Polar creates a new product category called BioPharma Lifecycle Management (BPLM) to streamline drug development and production in biopharma research. Polar is designed and deployed to rapidly solve challenges associated with workflow, process quality, collaboration, and data analysis that have plagued the existing software solutions, including laboratory information management system (LIMS) and electronic laboratory notebook (ELN). As a result, there will be less human errors and an improvement in overall accuracy. It will reduce manual data processing and transcription, leading to fewer human errors and enhanced overall accuracy. It also has extensive search features that make it easier for users to locate what they are searching for, preventing the need for pointless duplication of effort.

METTLER TOLEDO’s Dynochem Biologics is a purpose-built simulation software that supports upstream and downstream unit activities in bioprocessing at any scale. Bioprocess engineers and scientists use the software to choose appropriate process operating parameters and establish scales equivalency. Utilities enable quick evaluation of equipment performance with minimal data, whereas more potent models leverage the existing data streams for process characterization. Initial projects can be completed quickly with the help of responsive application expertise, rich training resources, and a model library that is already built. Peptides, mAbs, vaccinations, and viral vectors are a few examples of the many applications.

Merck’s new BioContinuum Platform advances biotherapeutic drug manufacturing through improved efficiency, simplified plant operations, and greater quality and consistency. In addition, Merck’s Pellicon Single-Pass Tangential Flow Filtration aid in intensifying operations associated with the purification of therapeutic proteins. Thus, the introduction of various new-age bioprocess technologies is likely to provide lucrative opportunities for the market growth during the forecast period.

The bioprocess activity produces purified protein derivative (PPD) using Brazilian strains intended for diagnostic use, per the National Institute of Health (NIH) report. In Brazil, the healthcare system imports and distributes the PPD across various areas. The indigenous production of PPD was undertaken to initiate studies toward developing an indigenous technology for PPD production using the strains of Mycobacterium tuberculosis isolated from patients suffering from TB across Brazil. Therefore, PPD reveals similar indications when tested individually, and better results were obtained. Such advancements in producing strains for targeted therapy through strains are responsible for significant growth for the South & Central America bioprocess technology market during the forecast period.

Strategic insights for the South & Central America Bioprocess Technology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Bioprocess Technology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Bioprocess Technology Strategic Insights

South & Central America Bioprocess Technology Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,531.47 Million

Market Size by 2028

US$ 3,361.13 Million

Global CAGR (2023 - 2028)

17.0%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Type

By Modality

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Bioprocess Technology Regional Insights

South & Central America Bioprocess Technology Market Segmentation

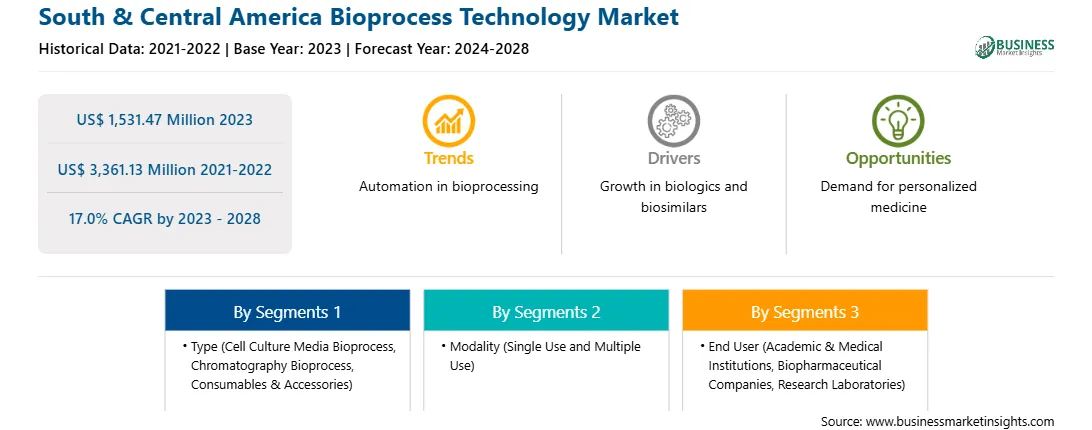

The South & Central America bioprocess technology market is segmented into type, modality, end user, and country.

Based on type, the South & Central America bioprocess technology market is segmented into cell culture media bioprocess, chromatography bioprocess, consumables & accessories, and others. In 2023, the consumables & accessories segment registered the largest share in the South & Central America bioprocess technology market.

Based on modality, the South & Central America bioprocess technology market is bifurcated into single use and multiple use. In 2023, the single use segment registered a larger share in the South & Central America bioprocess technology market.

Based on end-use, the South & Central America bioprocess technology market is segmented into academic & medical institutions, biopharmaceutical companies, research laboratories, and others. In 2023, the biopharmaceutical companies segment registered the largest share in the South & Central America bioprocess technology market.

Based on country, the South & Central America bioprocess technology market is segmented into Brazil, Argentina, and the Rest of South & Central America. In 2023, the Rest of South & Central America segment registered a largest share in the South & Central America bioprocess technology market.

Danaher Corp; Eppendorf SE; Lonza Group AG; Merck KGaA; Repligen Corp; Sartorius AG; and Thermo Fisher Scientific Inc are some of the key companies operating in the South & Central America bioprocess technology market.

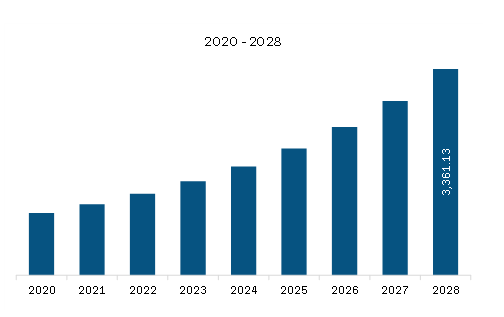

The South & Central America Bioprocess Technology Market is valued at US$ 1,531.47 Million in 2023, it is projected to reach US$ 3,361.13 Million by 2028.

As per our report South & Central America Bioprocess Technology Market, the market size is valued at US$ 1,531.47 Million in 2023, projecting it to reach US$ 3,361.13 Million by 2028. This translates to a CAGR of approximately 17.0% during the forecast period.

The South & Central America Bioprocess Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Bioprocess Technology Market report:

The South & Central America Bioprocess Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Bioprocess Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Bioprocess Technology Market value chain can benefit from the information contained in a comprehensive market report.