Technological Advancements Across Firearms Industry

Technological advancements in the firearm industry are generating huge demand for new and advanced ammunition across the world. It has been witnessed that the introduction of new guns and launchers has been rising over the past few years, which is increasing the demand for new and innovative firearm components. For instance, the introduction of longer 52 caliber barrels has led to an increased range of 155mm guns, which has been adopted by several armed forces such as army, navy, and air forces. These barrels are also likely to replace the traditional 39 caliber systems and cater to the low range challenges of such barrels.

Further, several projects launched by armed forces to introduce new guns and firearms are also likely to propel the introduction of new firearm parts that are expected to catalyze the ammunition market growth. Moreover, the use of composite materials in the missiles and guided munitions across different armed forces are expected to boost the market in the coming years.

Market Overview

The ammunition market in South America is bifurcated into Brazil and the Rest of South America. The Rest of South American countries include Argentina, Chile, Colombia, and others. South American countries have experienced a rise in military expenditure over the years. This growth is attributed to the rising government initiatives to strengthen their military and law enforcement agencies to protect against external and internal threats by acquiring advanced equipment and weapons across South American countries. South American countries such as Brazil, Peru, Argentina, Bolivia, and Colombia are involved in the production and export of munitions. This growth in ammunition trade across South America is also boosting the growth of the ammunition market in the region. The constant supply, availability, and proliferation of ammunition to civilians, law enforcement, and the military is one of the major factors driving the ammunition market in South America. Brazil and Argentina, for example, are involved in the production and export of ammunition. The expansion of the ammunition trade in South America is also boosting the market growth. Changing laws and regulations regarding civilian use of arms and ammunition are expected to provide growth opportunities for the SAM ammunition market during the forecast period. Major players in the South America ammunition market are CBC, FAMAE - Fábricas y Maestranzas del Ejército Todos Los Derechos Reservados, Aguila Ammunition, IMBEL, and OTIC-CAVIM. Most of the players are local players and state-owned enterprises, providing support of ammo to relevant local border guards, military personnel, and law enforcement officers, such as police officers. Global players can enter the South America market based on brand equity and capture a large market share with a few local players in the region. Further, ongoing ammunition deals and renewals with existing local state market players are likely to be an entry barrier for foreign players. Such involvement of local players in the ammunition market is driving the growth of ammo and creating the revenue for the South America region.

Strategic insights for the South & Central America Ammunition provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Ammunition refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Ammunition Strategic Insights

South & Central America Ammunition Report Scope

Report Attribute

Details

Market size in 2022

US$ 2,528.09 Million

Market Size by 2028

US$ 3,270.05 Million

Global CAGR (2022 - 2028)

4.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product

By Application

By Guidance

By Lethality

By Caliber

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Ammunition Regional Insights

South & Central America Ammunition Market Segmentation

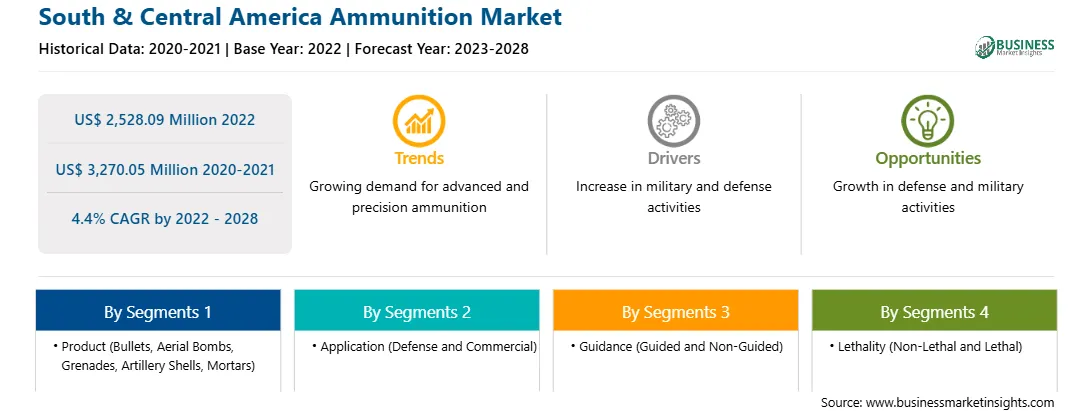

The South & Central America ammunition market is segmented into product, application, guidance, lethality, caliber, and country.

The South & Central America ammunition market, by product type, is segmented into bullets, aerial bombs, grenades, artillery shells, mortars, and others. In 2021, the aerial bombs segment dominated market.

The ammunition market by application is segmented into defense and commercial. In 2021, the defense segment dominated the South & Central America ammunition market.

The South & Central America ammunition market, by guidance, is segmented into guided and non-guided. In 2021, the guided segment held a larger market share in 2021.

The South & Central America ammunition market by lethality is segmented into non-lethal and lethal. In 2021, the lethal segment held a larger market share in 2021.

The South & Central America ammunition market, by caliber, is segmented into small caliber ammunitions, medium caliber ammunitions, and large caliber ammunitions. In 2021, the large caliber ammunitions segment held the largest market share in 2021.

Based on country, the market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the market in 2021.

BAE Systems, Elbit Systems Ltd, Northrop Grumman Corporation, Raytheon Technologies Corporation, and Thales Group are the leading companies operating in the ammunition market in the region.

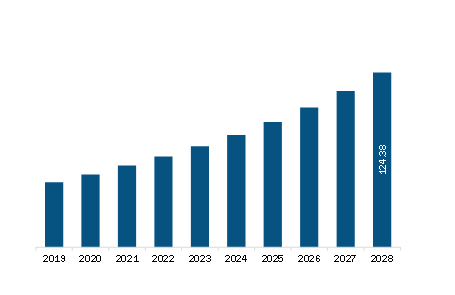

The South & Central America Ammunition Market is valued at US$ 2,528.09 Million in 2022, it is projected to reach US$ 3,270.05 Million by 2028.

As per our report South & Central America Ammunition Market, the market size is valued at US$ 2,528.09 Million in 2022, projecting it to reach US$ 3,270.05 Million by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The South & Central America Ammunition Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Ammunition Market report:

The South & Central America Ammunition Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Ammunition Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Ammunition Market value chain can benefit from the information contained in a comprehensive market report.