The aviation industry is adopting advanced information technologies, which are anticipated to transform the decision-making capability of the industry and make the new implementations faster than before. The demand for advanced technology drives the airline industry and demands more integration of such techniques to get a smarter cockpit. The smarter cockpit helps provide better communication with ground support staff, including maintenance and dispatcher’s personnel, for making better decisions associated with flight performance and weather avoidance for efficient operations and better fuel efficiency. Aircraft modernization includes modern digital communication systems, new engines, inflight entertainment, advanced armaments, navigation flight systems, and data recorders. The transformation of aircraft is beneficial for the aircraft interface device (AID) manufacturers as the advanced AID is reliable, has enhanced connectivity and communication, has a high capacity to store data, and is more accurate. These benefits of aircraft interface devices increase the scope of their adoption among the defense forces and commercial airliners to modernize the connectivity and communication system to have efficient aircraft functioning.

South America is undergoing rapid transformations, and thereby with a significant growth in investment by global companies, the region has immense potential for growing trade with other countries of the world. Countries such as Brazil and Venezuela witnessed a recent economic crisis; however, the global trade in South American countries is anticipated to grow in the coming years. The impact of the economic crisis resulted in a slowdown in the growth of GDPs. .

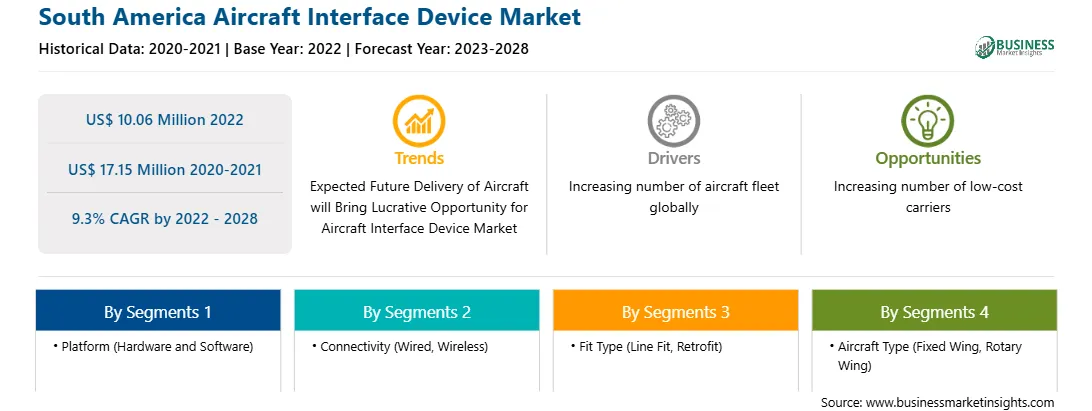

The South America aircraft interface device market is witnessing growth, owing to the increased air traffic due to the rise in the tourism & trading market. The rapid increase of air traffic in Brazil is propelling the airlines to procure more aircraft and modernize the existing aircraft. For instance, according to the Airbus market Forecasts report, 1,440 aircraft were operating in 2019, which is expected to increase two times by 2040, with an operating aircraft fleet of 2,820. This rise in procuring aircraft across the region is expected to increase the demand for aircraft AIDs across the South America market. Moreover, the Brazilian defense forces are increasing their interest in equipping their aircraft with the latest technologies, demanding the integration of aircraft interface devices. These factors boost the market for aircraft interface devices in South America. The rising number of aircraft operating across the region and the SAM military sector’s modernization and upgrades of their military aircraft fleet also contribute to the growth of the SAM aircraft MRO service industry. Thus, the growth of the MRO service providers across the region is directly expected to contribute to the rising demand for AIDs, thereby contributing to the growth of the SAM aircraft interface device market.

Strategic insights for the South America Aircraft Interface Device provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10.06 Million |

| Market Size by 2028 | US$ 17.15 Million |

| Global CAGR (2022 - 2028) | 9.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Aircraft Interface Device refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South America aircraft interface device market is segmented into platform, connectivity, fit type, aircraft type and country.

Based on platform, the South America aircraft interface device market is segmented into hardware and software. The hardware segment held a larger share of the South America aircraft interface device market in 2022.

Based on connectivity, the South America aircraft interface device market is segmented into wired and wireless. The wired segment held a larger share of the South America aircraft interface device market in 2022.

Based on fit type, the South America aircraft interface device market is segmented into line fit and retrofit. The line fit segment held a larger share of the South America aircraft interface device market in 2022.

Based on aircraft type, the South America aircraft interface device market is segmented into fixed wing and rotary wing. The fixed wing segment held a larger share of the South America aircraft interface device market in 2022.

Based on country, the South America aircraft interface device market is segmented into Brazil, and the Rest of South America. Brazil dominated the share of the South America aircraft interface device market in 2022.

Boeing; Collins Aerospace; Honeywell International Inc.; Thales Group; Viasat, Inc. ; and Anuvu are the leading companies operating in the South America aircraft interface device market.

The South America Aircraft Interface Device Market is valued at US$ 10.06 Million in 2022, it is projected to reach US$ 17.15 Million by 2028.

As per our report South America Aircraft Interface Device Market, the market size is valued at US$ 10.06 Million in 2022, projecting it to reach US$ 17.15 Million by 2028. This translates to a CAGR of approximately 9.3% during the forecast period.

The South America Aircraft Interface Device Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Aircraft Interface Device Market report:

The South America Aircraft Interface Device Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Aircraft Interface Device Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Aircraft Interface Device Market value chain can benefit from the information contained in a comprehensive market report.