The growing aging population directly translates to a more extensive customer base for adult diapers. Incontinence can significantly impact an individual's sense of dignity and independence. By using adult diapers, people can maintain their dignity and sense of self-worth and manage their incontinence discreetly and confidently. Adult diapers enable individuals to engage in social interactions, travel, and participate in various activities without fear of accidents or leakage. Therefore, the growing awareness of the benefits of adult diapers is surging its market growth. Moreover, various awareness campaigns by industry players and healthcare organizations have helped educate the public about the prevalence of incontinence and the availability of effective solutions like adult diapers. For instance, in 2023, GAMA Healthcare launched a campaign to raise awareness about incontinence-associated dermatitis during World Continence Week.

The incontinence awareness campaigns aim to reduce the stigma surrounding incontinence and promote the use of adult diapers to maintain life. Also, in recent years, there has been a shift in societal attitudes toward adult diapers. As societal attitudes towards incontinence and using adult diapers have become more accepting and supportive, people feel more comfortable seeking help and adopting appropriate solutions. The major market players and organizations are growing focus on spreading awareness regarding bladder issues, and incontinence. This changing perspective has increased the acceptance of adult diapers as a practical solution to manage incontinence. Furthermore, effective management of incontinence through adult diapers can lead to an improved overall quality of life. By using adult diapers, individuals can avoid the physical discomfort, skin irritation, and emotional distress associated with incontinence. Thus, increasing awareness and acceptance of incontinence products is expected to drive the South & Central America Adult Diaper Market.

According to a report published by the International Trade Administration in 2023, Brazil invests 9.1% of its GDP in the healthcare sector, comprising 532,645 hospital beds, 88,000 supplementary healthcare services, 502,000 physicians, and 89,000 drug stores as of 2021. According to the World Health Organization, Brazil spends US$ 1,035 per capita on healthcare annually. In the past few years, there has been a considerable rise in the number of hospitals in Brazil, majorly due to increasing number of traffic accidents and surgeries. As per ProColombia (the Government of Colombia), 21,000 patients entered Colombia for healthcare service-related purposes in 2019. The health services offered to foreign patients include cardiology, bariatric surgery, and reconstructive surgery studies and procedures. The patients with limited mobility and those patients confined with wheelchair require adult diapers. Adult diapers are also used during recovery period after certain surgical procedures and in several medical conditions such as cognitive impairment. The prominence of healthcare services & investment and the rising number of foreign patients in the region are expected to fuel the South & Central America adult diaper market.

Strategic insights for the South & Central America Adult Diapers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Adult Diapers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Adult Diapers Strategic Insights

South & Central America Adult Diapers Report Scope

Report Attribute

Details

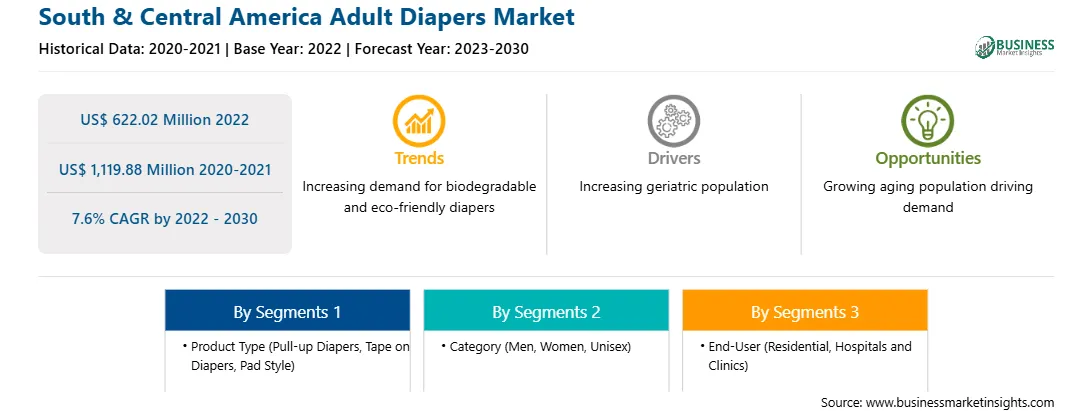

Market size in 2022

US$ 622.02 Million

Market Size by 2030

US$ 1,119.88 Million

Global CAGR (2022 - 2030)

7.6%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Category

By End-User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Adult Diapers Regional Insights

South & Central America Adult Diapers Market Segmentation

The South & Central America adult diapers market is segmented into product type, category, end user, and country.

Based on product type, the South & Central America adult diapers market is segmented into pull-up diapers, tape on diapers, pad style, and others. The tape on diapers segment held the largest share of the South & Central America adult diapers market in 2022.

Based on category, the South & Central America adult diapers market is segmented into men, women, and unisex. The unisex segment held the largest share of the South & Central America adult diapers market in 2022.

Based on end user, the South & Central America adult diapers market is segmented into residential, hospitals and clinics, and others. The residential segment held the largest share of the South & Central America adult diapers market in 2022.

Based on country, the South & Central America adult diapers market is segmented into the Brazil, Argentina, and Rest of South & Central America. The Rest of South & Central America dominated the South & Central America adult diapers market in 2022.

Nippon Paper Industries Co Ltd, Drylock Technologies NV, Ontex BV, Kimberly-Clark Corp, Essity AB, Paul Hartmann AG, and Abena AS are some of the leading companies operating in the South & Central America adult diapers market.

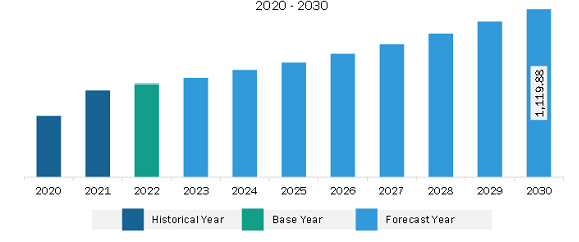

The South & Central America Adult Diapers Market is valued at US$ 622.02 Million in 2022, it is projected to reach US$ 1,119.88 Million by 2030.

As per our report South & Central America Adult Diapers Market, the market size is valued at US$ 622.02 Million in 2022, projecting it to reach US$ 1,119.88 Million by 2030. This translates to a CAGR of approximately 7.6% during the forecast period.

The South & Central America Adult Diapers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Adult Diapers Market report:

The South & Central America Adult Diapers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Adult Diapers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Adult Diapers Market value chain can benefit from the information contained in a comprehensive market report.