South & Central America Abrasive Market

No. of Pages: 131 | Report Code: BMIRE00030653 | Category: Chemicals and Materials

No. of Pages: 131 | Report Code: BMIRE00030653 | Category: Chemicals and Materials

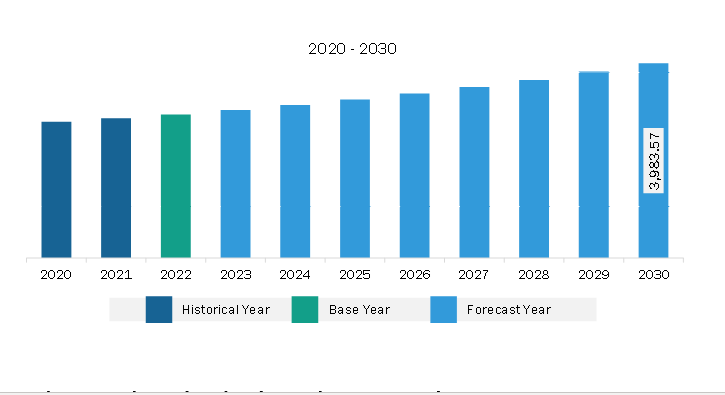

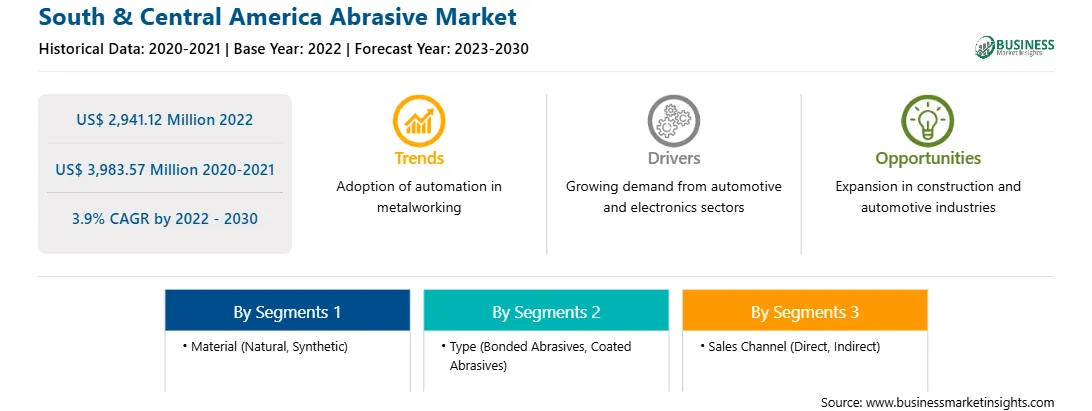

The South & Central America abrasive market was valued at US$ 2,941.12 million in 2022 and is expected to reach US$ 3,983.57 million by 2030; it is estimated to register a CAGR of 3.9% from 2022 to 2030. Development of Sustainable Abrasives Fuels South & Central America Abrasive Market

Governments of various European countries have imposed a few regulations on using sustainable materials to manufacture products in processing industries, including chemicals & materials, to ensure better protection of human health and the environment. These regulations are set to reduce greenhouse emissions and have compelled manufacturing companies to increase investments in developing naturally derived raw materials. Rising awareness regarding greenhouse gas (GHG) emissions and environmental pollution is projected to surge the demand for bio-based and sustainable products. Governments of various countries are adopting several initiatives to increase the awareness and development of sustainable materials. Emerging trends in sustainability have spurred innovation in the abrasive market. Advancements in abrasive manufacturing techniques, such as precision engineering and surface modification, are leveraged to enhance efficiency and reduce waste generation. Several manufacturers are also focused on minimizing energy consumption and emissions caused during the production and usage of abrasives. Therefore, the development of sustainable abrasives is expected to drive the abrasive market during the forecast period. South & Central America Abrasive Market Overview

The abrasive market growth in South & Central America is attributed to the surging industrial activities across the region, ranging from manufacturing to mining. According to the International Organisation Internationale des Constructeurs d'Automobiles (OICA), the total number of vehicles manufactured in South & Central America grew from ~2.72 million in 2021 to ~2.96 million in 2022, registering an increase of 9%. In addition, rising car ownership due to increased spending power and higher living standards fuel the market for automotive refinishes. Moreover, major market players in the automotive sector have strategized development and expansion of their operational capacities in South & Central America to tap the lucrative automotive market. In 2022, Audi AG invested US$ 19.2 million to restart production at its plant in Parana, Brazil, registering a capacity of 4,000 vehicles per year. The rise in passenger car production is the prime factor driving the abrasive market in the region. As South & Central America becomes an important hub for automobile manufacturing, a greater number of precision tools and abrasives will be required for shaping and finishing metal components in the production of vehicles. Abrasives play a pivotal role in achieving the necessary level of precision and quality, thereby supporting the region's automotive growth.

In South & Central America, "Jubarte Offshore Oil Field Development" and "Pre-Salt Submarine Fiber Optic Cable Network" are among the major ongoing infrastructure projects. Governments of various countries in this region focus on supporting the development of more infrastructure projects to catch up with the pace of urbanization. Thus, constant infrastructure development efforts have surged the demand for construction machinery and equipment, thereby positively favoring the abrasive market.

Brazil is one of the strongest markets for aircraft manufacturing across the globe. Brazilian-based Embraer is the fourth largest aircraft manufacturer in the world, after Airbus, Boeing, and Bombardier Aerospace. Furthermore, the rising number of air passengers in the region is supporting the aircraft manufacturing industry. According to the International Air Transport Association (IATA), passenger numbers recorded in 2019 are projected to surpass in 2023, i.e., Central America (102%), followed by South America in 2024 (103%), and the Caribbean in 2025 (101%). Furthermore, regional manufacturers are investing in strategic initiatives such as product development, mergers, and acquisitions to gain a competitive position in the market. For instance, in September 2022, South American rotorcraft operator Ecocopter collaborated with Airbus on possible plans to launch urban air mobility (UAM) services with eVTOL aircraft in markets including Chile, Ecuador, and Peru. Under a memorandum of understanding signed in September 2021, the companies are working on possible use cases for air taxis and other eVTOL operations, including early-adopter markets in the three countries.

South & Central America Abrasive Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the South & Central America Abrasive provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Abrasive refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South & Central America Abrasive Strategic Insights

South & Central America Abrasive Report Scope

Report Attribute

Details

Market size in 2022

US$ 2,941.12 Million

Market Size by 2030

US$ 3,983.57 Million

Global CAGR (2022 - 2030)

3.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Material

By Type

By Sales Channel

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Abrasive Regional Insights

South & Central America Abrasive Market Segmentation

The South & Central America abrasive market is categorized into material, type, application, sales channel, and country.

By material, the South & Central America abrasive market is bifurcated into natural and synthetic. The synthetic segment held a larger share of South & Central America abrasive market in 2022.

In terms of type, the South & Central America abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held a larger share of South & Central America abrasive market in 2022. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

By application, the South & Central America abrasive market is segmented into automotive, aerospace, marine, metal fabrication, woodworking, electrical & electronics, and others. The automotive segment held the largest share of South & Central America abrasive market in 2022.

Based on sales channel, the South & Central America abrasive market is bifurcated into direct and indirect. The indirect segment held a larger share of South & Central America abrasive market in 2022.

By country, the South & Central America abrasive market is segmented into Brazil, Argentina, Chile, Colombia, and the Rest of South & Central America. Brazil dominated the South & Central America abrasive market share in 2022.

Deerfos Co., Ltd; CUMI AWUKO Abrasives GmbH; Robert Bosch GmbH; Tyrolit Schleifmittelwerke Swarovski AG & Co KG; Sun Abrasives Co Ltd; Compagnie de Saint-Gobain S.A.; sia Abrasives Industries AG; RHODIUS Abrasives GmbH; 3M Co; and Ekamant AB are some of the leading companies operating in the South & Central America abrasive market.

1. Deerfos Co., Ltd

2. CUMI AWUKO Abrasives GmbH

3. Robert Bosch GmbH

4. Tyrolit Schleifmittelwerke Swarovski AG & Co KG

5. Sun Abrasives Co Ltd

6. Compagnie de Saint-Gobain S.A.

7. sia Abrasives Industries AG

8. RHODIUS Abrasives GmbH

9. 3M Co

10. Ekamant AB

The South & Central America Abrasive Market is valued at US$ 2,941.12 Million in 2022, it is projected to reach US$ 3,983.57 Million by 2030.

As per our report South & Central America Abrasive Market, the market size is valued at US$ 2,941.12 Million in 2022, projecting it to reach US$ 3,983.57 Million by 2030. This translates to a CAGR of approximately 3.9% during the forecast period.

The South & Central America Abrasive Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Abrasive Market report:

The South & Central America Abrasive Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Abrasive Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Abrasive Market value chain can benefit from the information contained in a comprehensive market report.