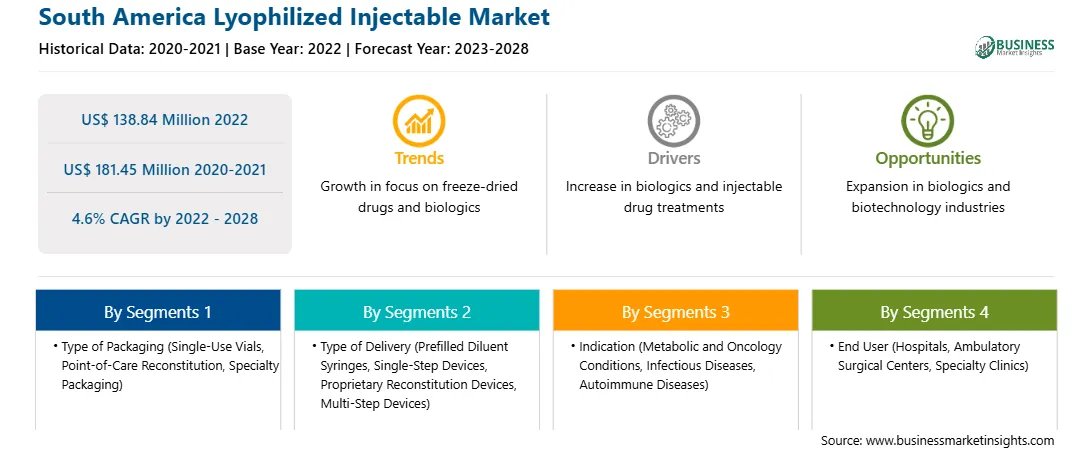

The SAM lyophilized injectable market is expected to grow from US$ 138.84 million in 2022 to US$ 181.45 million by 2028. It is estimated to grow at a CAGR of 4.6% from 2022 to 2028.

Expansion of Pipeline of Lyophilized Injectable Drugs

The continuous research on developing drugs to treat chronic diseases has driven the development of lyophilized injectable drugs in the pharmaceutical industry. Product innovation and strategic activities by critical key players provide opportunities to penetrate a new therapeutic area/market. About 2,400 injectable products are present in the development pipeline. Drug developers are increasingly interested in lyophilization technique as it can extend the shelf life of small and large molecule drugs. The prevalence of formulation stability challenges for complex APIs and biologics resulted in more pharmaceutical and biopharmaceutical manufacturers turning to lyophilization. The use of lyophilization for pharmaceutical and biopharmaceutical product manufacturing has grown around 13.5% per year over the last five years. Because liquids are the preferred formulation for commercial-scale production of many parenteral products, lyophilization is increasingly essential in bringing liquid products to market. Lyophilization is significant for two reasons increasing numbers of new drug applications and decreasing review times for new drug approvals. More than 3,000 drug candidates are in the pipeline in therapeutic areas where parenteral delivery dominates. Of these 3,000 products, about 2,250 are in pre-clinical development/ Phase I. The remaining candidates, around 750 are in Phase II and Phase III. And this pipeline of lyophilized products will only add to the established list of lyophilized drugs in the upcoming period. Thus, it is expected to augment the lyophilized injectable market.

Market Overview

The SAM lyophilized injectable market is segmented into Brazil, Argentina, and the Rest of SAM. Brazil dominated the market in 2022. 70% of the pharmaceutical business in Brazil is dependent on imports of pharmaceutical products. For instance, in 2019, medicines worth US$ 7 billion were imported, among which biological medicines were worth US$ 2 billion, i.e., 30% of the total import. However, the COVID-19 pandemic offered vital growth opportunities for the domestic production of medicines in Brazil and various countries worldwide. Associations in Brazil, such as the Brazilian Association of Generic Medicines Industries (PróGenlicos) and FarmaBrasil Group (GFB), state that the country can produce nearly 75% of the total demand for medicines in the country. Therefore, it is expected to increase the demand for lyophilized injectables in the country. Also, in 2019, the country imported a significant number of biological products or immunotherapeutic drugs worth US$ 1 billion. Therefore, it is expected that investing a huge amount in importing pharmaceutical products. The country can invest in the domestic production of medicines and will only incur in importing lyophilized injectables. In addition, the companies operating in the country that are associated with FarmaBrasil Group have commitments, through the Partnerships for Productive Development (PDPs), to produce medicines domestically, including bevacizumab, palivizumab, infliximab, betainterferone 1A, and insulin. Thus, such strategic moves for domestic production will enhance the demand for lyophilized injectables and eventually lead to market growth in the following years.

SAM Lyophilized Injectable Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the South America Lyophilized Injectable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Lyophilized Injectable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Lyophilized Injectable Strategic Insights

South America Lyophilized Injectable Report Scope

Report Attribute

Details

Market size in 2022

US$ 138.84 Million

Market Size by 2028

US$ 181.45 Million

Global CAGR (2022 - 2028)

4.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type of Packaging

By Type of Delivery

By Indication

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Lyophilized Injectable Regional Insights

SAM Lyophilized Injectable Market Segmentation

The SAM lyophilized injectable market is segmented based on type of packaging, type of delivery, indication, end user, and country.

Based on type of packaging, the SAM lyophilized injectable market is segmented into single-use vials, point-of-care reconstitution, and specialty packaging. The single-use vials segment held the largest market share in 2022.

In terms of type of delivery, the SAM lyophilized injectable market is segmented into prefilled diluent syringes, single-step devices, proprietary reconstitution devices, and multi-step devices. The prefilled diluent syringes segment held the largest market share in 2022.

Based on indication, the SAM lyophilized injectable market is categorized into metabolic and oncology conditions, infectious diseases, autoimmune diseases, and others. The metabolic and oncology conditions segment held the largest market share in 2022.

Based on end user, the SAM lyophilized injectable market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others. The hospitals segment held the largest market share in 2022.

Based on country, the SAM lyophilized injectable market is segmented into Brazil, Argentina, and the Rest of SAM. Brazil dominated the market in 2022.

Aristopharma Ltd.; Baxter; Credence MedSystems, Inc.; Jubilant HollisterStier (Jubilant Pharma Limited); Nipro; Recipharm AB; S.G. Biopharm Pvt. Ltd.; and Vetter Pharma are among the leading companies operating in the SAM lyophilized injectable market.

The South America Lyophilized Injectable Market is valued at US$ 138.84 Million in 2022, it is projected to reach US$ 181.45 Million by 2028.

As per our report South America Lyophilized Injectable Market, the market size is valued at US$ 138.84 Million in 2022, projecting it to reach US$ 181.45 Million by 2028. This translates to a CAGR of approximately 4.6% during the forecast period.

The South America Lyophilized Injectable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Lyophilized Injectable Market report:

The South America Lyophilized Injectable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Lyophilized Injectable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Lyophilized Injectable Market value chain can benefit from the information contained in a comprehensive market report.