Market Introduction

Water treatment biocides are used to control the microbial growth in water bodies. Biocides have found a wide range of applications ranging from swimming pools and municipality water treatment to industrial water treatment such as oil & gas, power plants, mining, paper, and pulp. The water treatment biocides have been gaining increasing importance all over the South America region owing to its wide range of applications. Complications that occurred due to uncontrolled microbial growth can range from the breakdown of chemicals, health hazards, heat transfer losses, the development of biofilms, restriction of flow, and under deposit corrosion. Therefore, the increasing awareness of water treatment bodies' applications has created an upsurge in the South America market. Thus, the increasing demand from numerous end- applications is expected to create a significant demand for biocides in the coming years, which is further anticipated to drive the South America water treatment biocides market.

Strategic insights for the South America Water Treatment Biocides provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Water Treatment Biocides refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Water Treatment Biocides Strategic Insights

South America Water Treatment Biocides Report Scope

Report Attribute

Details

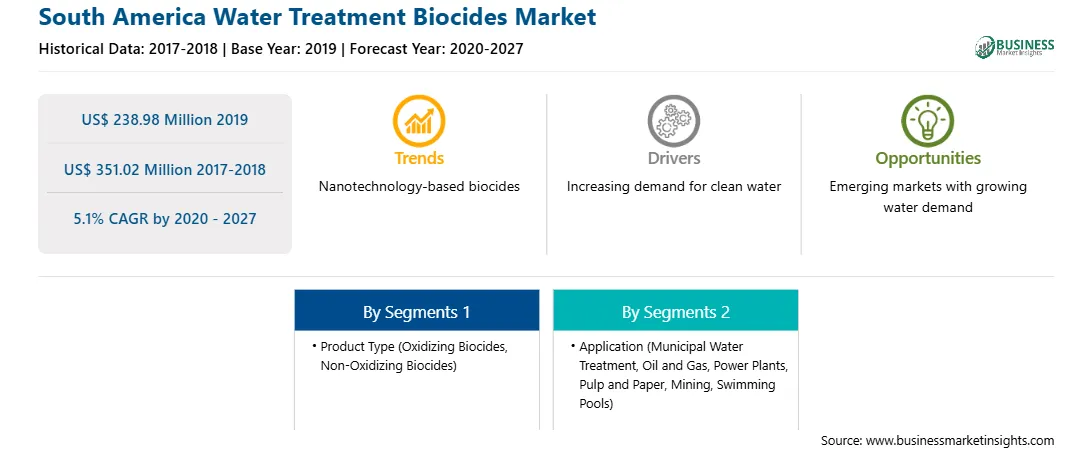

Market size in 2019

US$ 238.98 Million

Market Size by 2027

US$ 351.02 Million

Global CAGR (2020 - 2027)

5.1%

Historical Data

2017-2018

Forecast period

2020-2027

Segments Covered

By Product Type

By Application

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Water Treatment Biocides Regional Insights

Market Overview and Dynamics

The water treatment biocides market in South America is expected to grow from US$ 238.98 million in 2019 to US$ 351.02 million by 2027; it is estimated to grow at a CAGR of 5.1% from 2020 to 2027. Water treatment biocides are chemical agents used in water treatment processes. They are synthesized to eliminate micro-organisms of all life stages and sizes. They are formulated to control the microbial growth in potable water, process water, open cooling systems, down water services, etc. The water treatment biocides are mainly utilized for municipal water treatment, oil & gas, power plants, pulp & paper, mining, swimming pools. The oil and gas industry is fueling the worldwide water treatment biocides market to a greater extent and is expected to lead the market over the forecast period. Moreover, rising oil & gas exploration activities in countries, including Canada and the United States is fueling the demand for water treatment biocides in the oil & gas industry. Municipal water treatment, mining, and swimming pools are some of the niche applications where the water treatment biocides market has witnessed astonishing growth over the past few years. The increasing use of non-oxidizing biocides in applications, including pulp & paper and power plants is expected to create lucrative opportunities for the players operating in the segment. Some of the prominent leading players such as DuPont, Ecolab Inc., and Lanxess Group are flourishing the market growth with their increased research and development activities of water treatment biocides in diverse applications. Overall the water treatment biocides market is mainly dependent on its application areas increasing demand for them is boosting the market growth significantly.

Brazil has the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina, among others. The government of South America has taken an array of actions to protect their citizens and contain COVID-19’s spread. It is anticipated that South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe, and the United States, which are important trade partners. Containment measures in several countries of South America will reduce economic activity in the manufacturing sectors for at least the next quarter, with a rebound once the epidemic is contained.

Key Market Segments

In terms of product type, the Non- oxidizing Biocides segment accounted for the largest share of the South America water treatment biocides market in 2019. Further, the Oil and Gas segment held a larger share of the market based on application in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Water treatment biocides market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Albemarle Corporation, DuPont de Nemours, Inc., Ecolab Inc., Kemira Oyj, Nouryon, and Italmatch Chemicals SpA. among others.

Reasons to buy report

South America Water Treatment Biocides Market Segmentation

South America Water Treatment Biocides Market

- by Product Type

South America Water treatment biocides Market

- by

Application

South America Water Treatment Biocides Market

- By Country

South America Water Treatment Biocides - Company Profiles

The South America Water Treatment Biocides Market is valued at US$ 238.98 Million in 2019, it is projected to reach US$ 351.02 Million by 2027.

As per our report South America Water Treatment Biocides Market, the market size is valued at US$ 238.98 Million in 2019, projecting it to reach US$ 351.02 Million by 2027. This translates to a CAGR of approximately 5.1% during the forecast period.

The South America Water Treatment Biocides Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Water Treatment Biocides Market report:

The South America Water Treatment Biocides Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Water Treatment Biocides Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Water Treatment Biocides Market value chain can benefit from the information contained in a comprehensive market report.