The SAM region includes Brazil, Argentina, and the Rest of SAM. The industrial sector contributes significantly to the region's growth. The region's manufacturing industry includes the contribution of different manufacturing industries such as food processing, industrial, aerospace, and metal fabrication. Brazil has a core manufacturing center established in São Paulo, which is expanding into a huge industrial sector. Other countries such as Argentina, Chile, and Venezuela are following the trend. Also, the construction industry has played a substantial role in boosting the demand for water cooling towers in South American countries. Further, Brazil hosts a huge food & beverages industry, which provides considerable growth potential for the water cooling tower market. The food & beverages industry is capitalizing on the upgrading of facilities to enhance their production scale and quality. Also, pharmaceutical and chemicals are prominent industries, which are witnessing constant growth for years. Some of the manufacturers which are present in SAM are Babcock & Wilcox Enterprises, Inc.; EVAPCO, Inc.; and Alpina Equipamentos. Similarly, the government is making substantial progress in boosting water cooling tower usage across different manufacturing industries. Rising adoption of advanced technologies and increasing public and private cooperation have encouraged the water cooling tower manufacturers in this region to efficiently carry out the cooling process in the oil, gas, construction, and manufacturing industries, thereby generating massive demand for water cooling towers in the region.

In case of COVID-19, SAM is highly affected specially Brazil, followed by Ecuador, Peru, Chile, and Argentina. Governments have been imposing travel restrictions, lockdowns, and trade bans to contain the spread of novel coronavirus. The region is witnessing operational halt in various sectors including manufacturing, energy & power, and industrial based companies and these sectors are one of the major end users of the water cooling towers. Thus, the COVID-19 pandemic is severely affecting the water cooling tower market growth in the region. However, recent relaxations in lockdown and the arrangement of large-scale vaccination drives would help the economies to bounce back, which would allow industries to regain their operations in the next few quarters in upcoming years. Amid the COVID-19 pandemic, the demand for the power from commercial and residential sector has increased significantly, owing to the rising trend of work from home culture among corporates across the region. This development has stabilized the demand for water cooling towers to some extent. However, the limited production activities and disrupted supply chain has hampered the market growth. Lowered production ration and declined sale of industrial products in first half of 2020 has negatively impacted the market growth. However, the demand for water cooling towers is expected to increase at considerable rate with the resumption of economic activities in many countries. Thus, the SAM water cooling tower market is projected to recover in upcoming years as many industries are dependent on it.

Strategic insights for the South America Water Cooling Tower provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

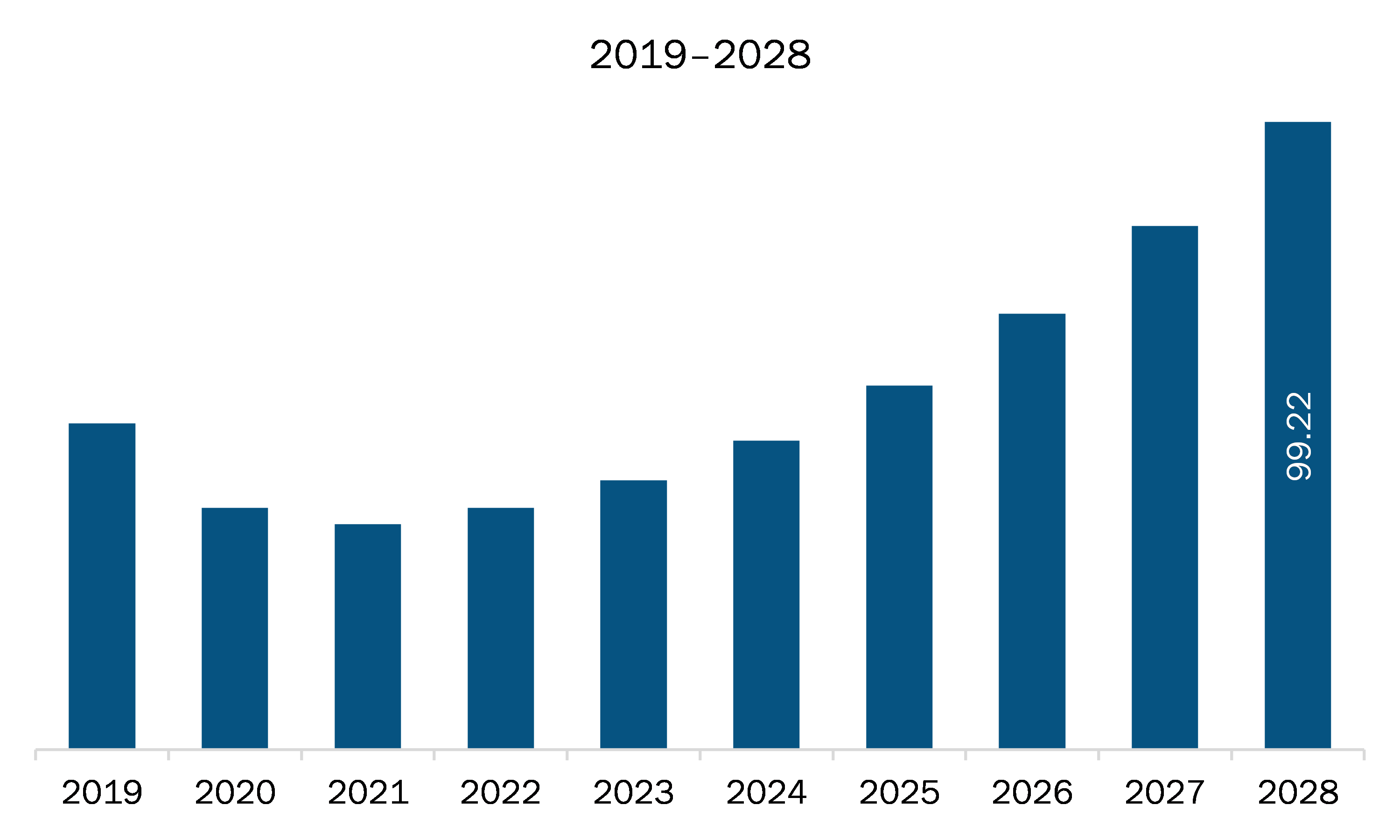

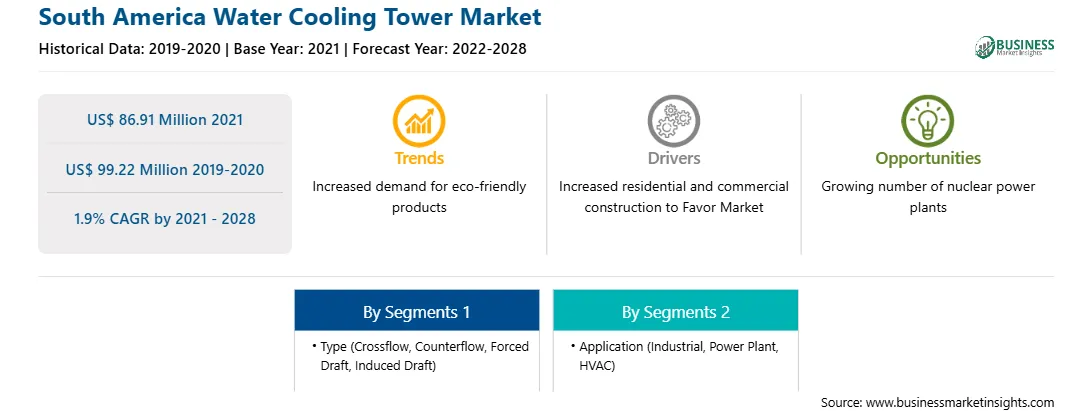

| Market size in 2021 | US$ 86.91 Million |

| Market Size by 2028 | US$ 99.22 Million |

| Global CAGR (2021 - 2028) | 1.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Water Cooling Tower refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM water cooling tower market is expected to grow from US$ 86.91 million in 2021 to US$ 99.22 million by 2028; it is estimated to grow at a CAGR of 1.9% from 2021 to 2028. With the rising regional demand for power consumption, the number of nuclear and geothermal power plants is rapidly increasing. Developing countries such as Chile have shown a significant demand for power generation. To fulfill this power requirement, many nuclear power plants are under construction. Furthermore, several countries with existing nuclear power plants are planning for additional nuclear power plants to meet their power requirement and some of those SAM countries are Brazil and Argentina. In addition to this, as per the International Energy Agency (IEA), nuclear plants’ contribution to power generation is expected to be about 8.5% by 2040. Hence, with the growing trend of rapid urbanization and industrialization across the region, the power consumption rates are expected to surge significantly in the coming years, and to fulfill this demand, the number of power plants will be increased. Thus, the growing power consumption is expected to create a lucrative opportunity for the SAM water cooling tower market as the power plants are the major end users of the water cooling towers in SAM region.

In terms of type, the crossflow segment accounted for the largest share of the SAM water cooling tower market in 2020. In terms of application, the industrial segment held a larger market share of the SAM water cooling tower market in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM water cooling tower market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Babcock & Wilcox Enterprises, Inc.; Baltimore Aircoil Company; EVAPCO, Inc.; Hamon; MESAN Group; and SPX Cooling Technologies, Inc.

The South America Water Cooling Tower Market is valued at US$ 86.91 Million in 2021, it is projected to reach US$ 99.22 Million by 2028.

As per our report South America Water Cooling Tower Market, the market size is valued at US$ 86.91 Million in 2021, projecting it to reach US$ 99.22 Million by 2028. This translates to a CAGR of approximately 1.9% during the forecast period.

The South America Water Cooling Tower Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Water Cooling Tower Market report:

The South America Water Cooling Tower Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Water Cooling Tower Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Water Cooling Tower Market value chain can benefit from the information contained in a comprehensive market report.