Several players operating in the vision care market are developing and launching new products. The strategic expansion of the region presence and manufacturing capacities, along with the launch of new products, helps companies cater to a broad customer base. A few of the recent developments contributing to the growth of the vision care market are mentioned below.

In May 2019, the company launched Menicon Bloom Myopia Control Management System. Menicon Co., Ltd., a leading contact lens developer, received US FDA PMA approval for its Menicon Z Night (tisilfocon A) contact lenses for overnight wear. The Menicon Bloom Night therapy of the company includes the overnight wear of a specifically designed reverse geometry orthokeratology contact lens, which is manufactured in hyper-oxygen-permeable Menicon Z rigid material that guarantees ideal corneal oxygenation for comfortable contact lens wear.

In August 2019, Alcon, a global leader in eye health, launched PRECISION1 as the latest addition to its robust contact lens portfolio. PRECISION1 are the daily disposable, silicone hydrogel (SiHy) contact lenses that are the first and only contact lenses with Alcon’s proprietary SMARTSURFACE technology, which delivers lasting visual performance from morning to night.

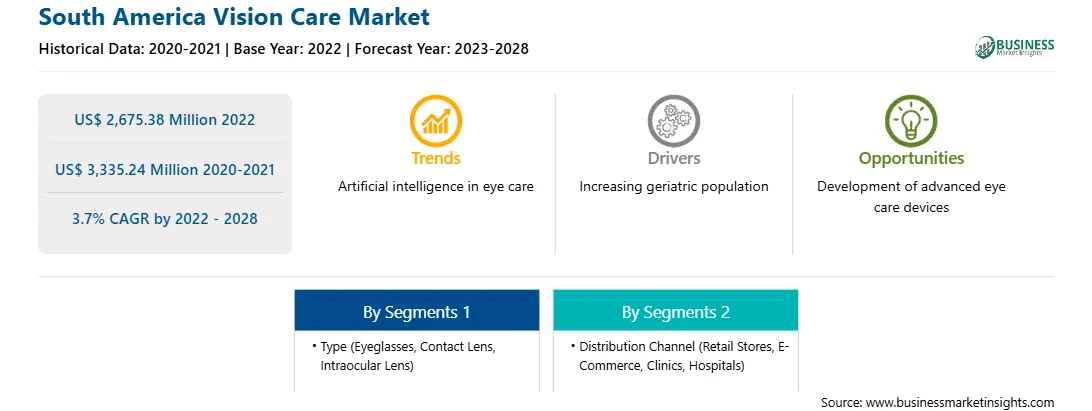

The South America vision care market is segmented into Brazil, Argentina, and the Rest of South America. The high burden of dry eyes, the increase in the geriatric population, and efforts by government to create awareness about eye health are among the factors contributing to the growth of vision care market in South America.

Strategic insights for the South America Vision Care provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Vision Care refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Vision Care Strategic Insights

South America Vision Care Report Scope

Report Attribute

Details

Market size in 2022

US$ 2,675.38 Million

Market Size by 2028

US$ 3,335.24 Million

Global CAGR (2022 - 2028)

3.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Distribution Channel

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Vision Care Regional Insights

The South America vision care market is segmented based on type, distribution channel, and country. Based on type, the South America vision care market is segmented into eyeglasses, contact lens, intraocular lens, and others. The eyeglasses segment held the largest market share in 2022.

Based on distribution channel, the South America vision care market is segmented into retail stores, e-commerce, clinics, and hospitals. The retail stores segment held the largest market share in 2022.

Based on country, the South America vision care market is segmented into Brazil, Argentina, and the Rest of South America. Brazil dominated the South America vision care market share in 2022.

Alcon Inc.; Bausch Health Companies Inc.; Carl Zeiss AG; Cooper Companies Inc; Essilor International SAS; Johnson & Johnson; Hoya Corp; Rodenstock GMBH; Menicon Co., Ltd; and Rayner Intraocular Lenses Limited are the leading companies operating in the South America vision care market.

The South America Vision Care Market is valued at US$ 2,675.38 Million in 2022, it is projected to reach US$ 3,335.24 Million by 2028.

As per our report South America Vision Care Market, the market size is valued at US$ 2,675.38 Million in 2022, projecting it to reach US$ 3,335.24 Million by 2028. This translates to a CAGR of approximately 3.7% during the forecast period.

The South America Vision Care Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Vision Care Market report:

The South America Vision Care Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Vision Care Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Vision Care Market value chain can benefit from the information contained in a comprehensive market report.