South and America (SAM) region consists of Brazil, Argentina, and the rest of South America. The growth of the virology market can be attributed to increasing research and development investment by private and public organizations. Also, increasing incidence of HIV, hepatitis, and viral infections is driving the adoption of various therapeutics in coming years. Brazil has made huge strides in the healthcare sector owing to increasing healthcare expenditure. As per the International Trade Administration (ITA), Brazil is the largest healthcare market in Latin America and spends 9.1% of its GDP on healthcare. Brazil is currently facing one of the biggest public health crises. In addition, the previous epidemics caused by the Zika virus (ZIKV) coexist in Brazil has increased the burden on the health sector. The outbreak of Zika infection began in Brazil in 2015. In 2019, a total of 10,768 cases of Zika infection were identified in Brazil, and in 2020 the health system was severely hit by the COVID-19 in the country. The recent virus outbreaks are paving the way for more investment in research in infectious disease, further driving the virology market. Also, The HIV and AIDS epidemic in Brazil is stable, with a prevalence in the general population of 0.5%. As per the Avert Organization, in 2019, around 920,000 people were living with HIV, and around 48,000 new infections were recorded. Many steps have been taken by the country with regards to HIV prevalence, driving the virology market. For instance, in 2017, Brazil started providing dolutegravir (DTG) to 100,000 people. Thus, increasing healthcare expenditure and the adoption of new treatments drive market growth in the forecast period. Rise in prevalence of viral infectious diseases is the major factor driving the growth of the SAM virology market.

COVID-19 has created shock waves with severe health, economic and social consequences, which will affect many countries in South America in the future. The COVID-19 pandemic has brought the risk of major disease outbreaks and highlighted countries’ lack of preparedness to fight them. Climate change, urbanization, and the lack of water and sanitation are contributing to fast-spreading outbreaks. Argentina was already in a fragile socio-economic situation before the COVID-19. According to the National Institute of Statistics and Censuses (INDEC), economic activity fell by 10.3% in May 2020, while annual inflation reached 42.8% in June 2020. The fragile health systems in many of these countries and their limited means to finance or drive vaccine development on their own have also put the large population at heightened risk. The COVID-19 pandemic has disrupted healthcare services across South America. For instance, in Guatemala, the COVID-19 has severely impacted HIV services; HIV testing decreased by 54.7% in 2020. As per the PAHO, since the onset of the pandemic, the number of people being tested for HIV in Latin America has dropped sharply. COVID-19 is expected to exacerbate this situation, especially in countries with fragile health systems.

Strategic insights for the South America Virology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 254.48 Million |

| Market Size by 2028 | US$ 314.27 Million |

| Global CAGR (2021 - 2028) | 3.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Virology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

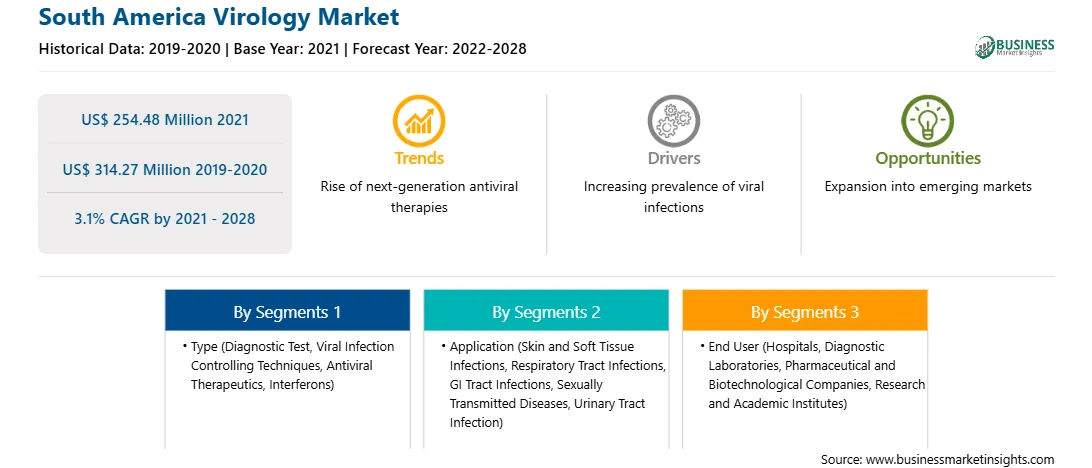

The virology market in SAM is expected to grow from US$ 254.48 million in 2021 to US$ 314.27 million by 2028; it is estimated to grow at a CAGR of 3.1% from 2021 to 2028. Countries such as Argentina and Chile are attractive outsourcing locations for the pharmaceutical and biopharmaceutical industries across the region. Low manufacturing and operating costs and recent growth in the pharmaceutical industry in Argentina and Chile are key factors driving the growth of the virology-related markets in these countries. Moreover, the growing domestic market and its pipelines are opening new access for the manufacturing of generic drugs in the region. In addition, several contract-based organizations are expanding their manufacturing capacities in European nations to meet the rising demand for products, such as vaccines. Thus, the emerging markets are likely to create lucrative opportunities for the growth of the virology market in the coming years across the SAM region.

The SAM virology market is segmented on the bases of type, application, end user, and country. Based on type, the market is segmented into diagnostic test, viral infection controlling techniques, antiviral therapeutics, and interferons. The antiviral therapeutics segment dominated the market in 2020, and viral infection controlling techniques segment is expected to be the fastest growing during the forecast period. The diagnostic test segment is further categorized into DNA virus testing, RNA virus testing, others. Similarly, the viral infection controlling techniques is bifurcated into active prophylaxis, and passive prophylaxis. Likewise, the antiviral therapeutics segmented is categorized into virucidal agents, antiviral agents, immunomodulators, and interferons. On the basis of application, the virology market is segmented into skin and soft tissue infections, respiratory tract infections, GI tract infections, sexually transmitted diseases, urinary tract infections, and others. The respiratory tract infections segment dominated the market in 2020, and is expected to be the fastest growing during the forecast period. On the basis of end user, the virology market is segmented into hospitals, diagnostic laboratories, pharmaceutical and biotechnological companies, and research and academic institutes. The hospitals segment dominated the market in 2020, and diagnostic laboratories segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the virology market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott; AbbVie Inc.; F. Hoffmann-La Roche Ltd.; Gilead Sciences, Inc.; GlaxoSmithKline Plc; Illumina, Inc.; Johnson and Johnson Services, Inc.; QIAGEN; Siemens AG; and Thermo Fisher Scientific Inc. are among others.

The South America Virology Market is valued at US$ 254.48 Million in 2021, it is projected to reach US$ 314.27 Million by 2028.

As per our report South America Virology Market, the market size is valued at US$ 254.48 Million in 2021, projecting it to reach US$ 314.27 Million by 2028. This translates to a CAGR of approximately 3.1% during the forecast period.

The South America Virology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Virology Market report:

The South America Virology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Virology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Virology Market value chain can benefit from the information contained in a comprehensive market report.