High demand for lithium-ion battery

The production of automotive lithium-ion battery was 160 GWh in 2020 with an increase of 33% from 2019. Thus, rise is attributed to 41% increase in electric car registrations and constant average battery capacity of 55 KWh and 14 kWH for BEVs and PHEVs, respectively. The increase of 10% has been registered for other modes of transport. Although the market share of lithium-ion phosphate batteries has increased, it is still less than 4%. The weighted average cost of automotive batteries declined by 13% in 2020 form 2019, reaching USD 137/KWh at a pack level as per BNEFs yearly survey of battery prices. Low pricing is made available for large quantities of purchases, which is supported by a teardown investigation of a VW ID3 that revealed an approximate cost of USD 100/KWh for its battery cells. As most of the plug-in hybrids and all the electric vehicles use lithium-ion batteries higher demand for the same is attributed to drive the growth of the market.

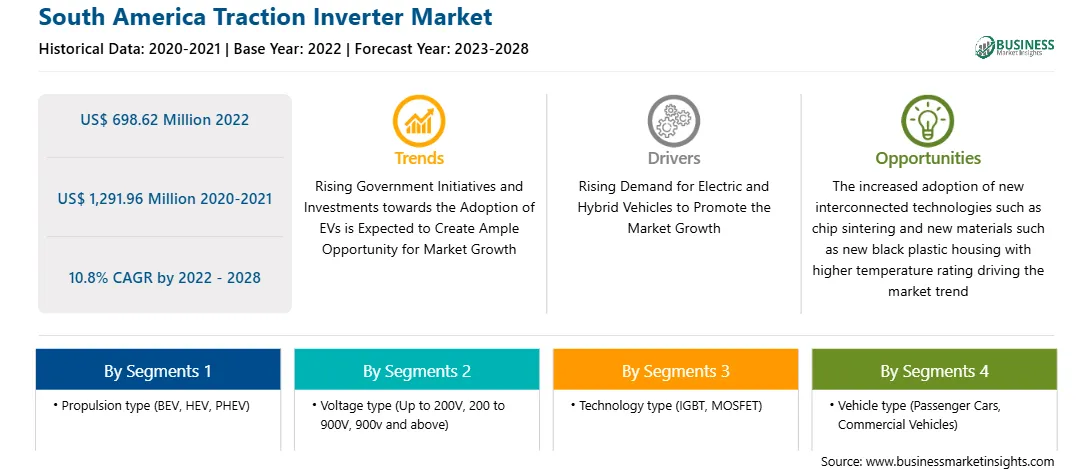

Market Overview

The traction inverter market in SAM is primarily categorized into Brazil and Argentina. The Rest of the SAM countries include Chile, Colombia, Guatemala, and Peru. SAM economies mainly depend upon imported goods and commodities. However, with the rise in FDIs, several industries are coming up and contributing substantially to the respective country’s GDP. Rapid urbanization, rising environmental concerns, traffic congestion, evolving mobility patterns, and government initiatives to promote public transportation are expected to drive demand for electric buses in SAM throughout the forecast period. Many countries in the region employ electric vehicles to cut emissions and air pollution. Although some are ahead of the curve, others are still lagging. According to the United Nations Environment Programme's Integrated Assessment of Short-Lived Climate Pollutants in SAM and the Caribbean assessment, around 64,000 persons in SAM and the Caribbean die prematurely each year due to air pollution produced by vehicles.

Strategic insights for the South America Traction Inverter provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Traction Inverter refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Traction Inverter Strategic Insights

South America Traction Inverter Report Scope

Report Attribute

Details

Market size in 2022

US$ 698.62 Million

Market Size by 2028

US$ 1,291.96 Million

Global CAGR (2022 - 2028)

10.8%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Propulsion type

By Voltage type

By Technology type

By Vehicle type

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Traction Inverter Regional Insights

SAM Traction Inverter Market Segmentation

The SAM traction inverter market is segmented into propulsion type, voltage type, technology type, vehicle type, and country. Based on propulsion type, the market is segmented into BEV, HEV, PHEV, and others. The BEV segment registered the largest market share in 2022.

BorgWarner Inc.; Continental AG; Curtiss-Wright Industrial Group; Dana TM4; Delphi Technologies Plc; Hitachi, Ltd.; Mitsubishi Electric Corporation; Siemens AG; Toshiba Corporation; and Voith GmbH & Co. KGaA are the leading companies operating in the traction inverter market in the region.

The South America Traction Inverter Market is valued at US$ 698.62 Million in 2022, it is projected to reach US$ 1,291.96 Million by 2028.

As per our report South America Traction Inverter Market, the market size is valued at US$ 698.62 Million in 2022, projecting it to reach US$ 1,291.96 Million by 2028. This translates to a CAGR of approximately 10.8% during the forecast period.

The South America Traction Inverter Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Traction Inverter Market report:

The South America Traction Inverter Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Traction Inverter Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Traction Inverter Market value chain can benefit from the information contained in a comprehensive market report.