Thermal scanners detect body heat radiation usually from the forehead, then estimate core body temperature. These cameras are a powerful tool often used by firefighters to track smoldering embers and police to search for suspects who are out of sight. COVID-19 outbreak has increased demand from healthcare facilities for the thermal scanners. The device helps healthcare professionals monitor the patient's body temperature and take necessary action based on scanner results. The airline industry has also increased demand for thermal scanners, where air passengers are screened for any virus symptoms. Those factors will affect market growth over the forecast period. Increasing demand for thermal scanners at airports for mass screening, increasing government spending in the aerospace and defense sectors, increasing R&D investments by companies, governments, and capital firms to develop innovative thermal scanning solutions, and increasing the adoption of thermal scanners in the automotive industry are key factors contributing to this market growth. In addition to increasing demand for additional advanced security solutions, the rapid urbanization of the entire SAM countries would lead to the robust growth of the thermal scanners industry. Infrared heat scanner detects passively absorbed infrared radiation from objects that are more concealed than other active imaging systems that are supplied with the light. The infrared thermal scanners are used in military recognized research, monitoring, and guidance because of its excellent concealment, good anti-interference, strong target detection capabilities, and all weather conditions. It is widely used in weapons and fittings. Thus, the rise in adoption of thermal scanners in automotive industry is expected to create a significant demand for thermal scanners in the coming years, which is further anticipated to drive the SAM thermal scanners market.

In the SAM region, Brazil has the highest number of COVID-19 confirmed cases, followed by other countries such as Ecuador, Peru, Chile, and Argentina. The government bodies of various countries in SAM are taking several initiatives to protect people and to contain COVID-19’s spread in the SAM region through lockdowns. As the lockdown restrictions are getting comfortable, the business units, companies, and commercial areas such as airports are reopening. Due to this lockdown reopening, the risk to the workforce of contacting with the disease is high. Therefore, companies such as Robert Bosch GmbH; FLIR Systems, Inc.; and AMETEK Inc. are some of the prominent players taking active participation in developing thermal scanners for COVID-19. On the contrary, during the first quarter, the use of thermal scanners was limited as manufacturing units and companies were shut down; however, with technological innovations and ease in lockdown situations, the use of thermal scanners is rising across the SAM region.

Strategic insights for the South America Thermal Scanners provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

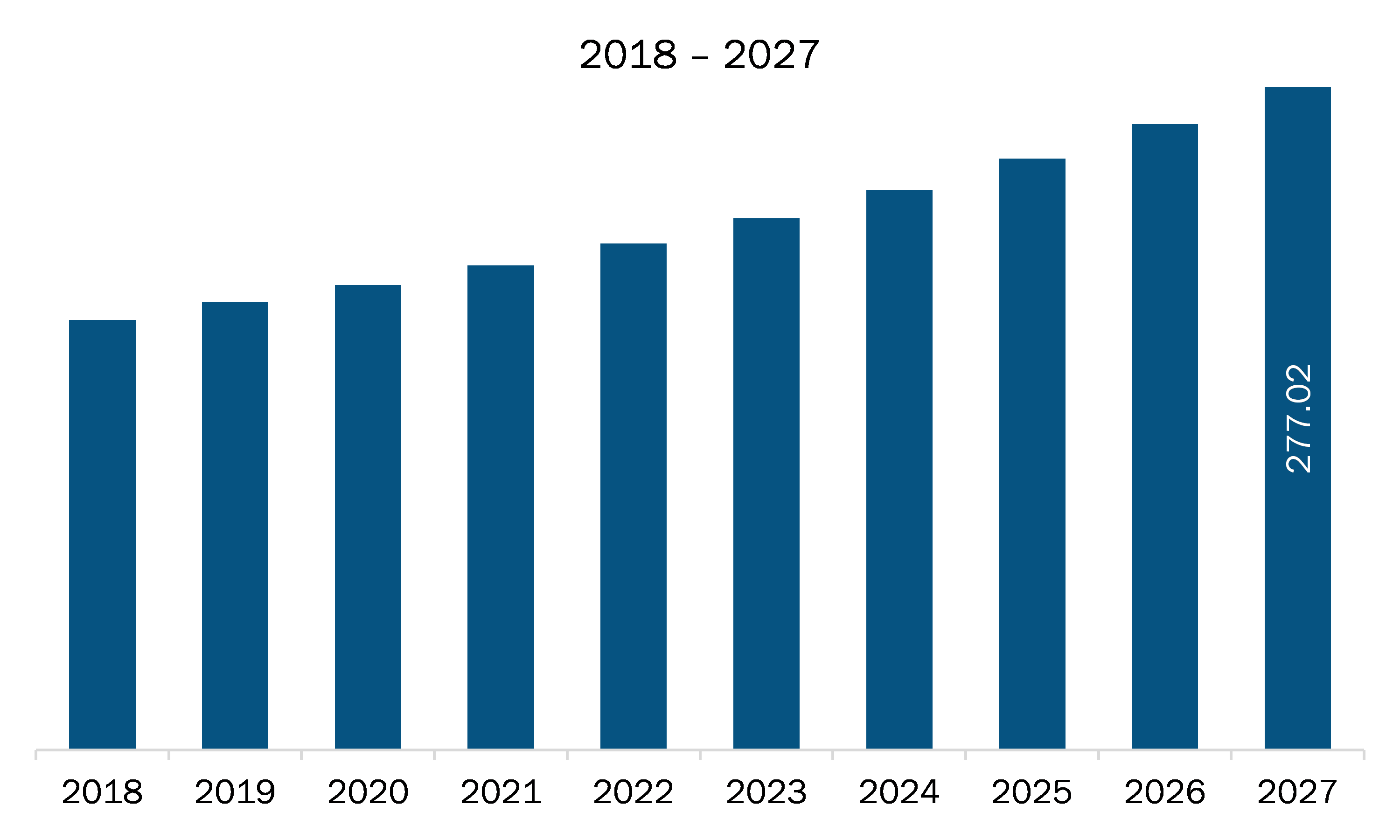

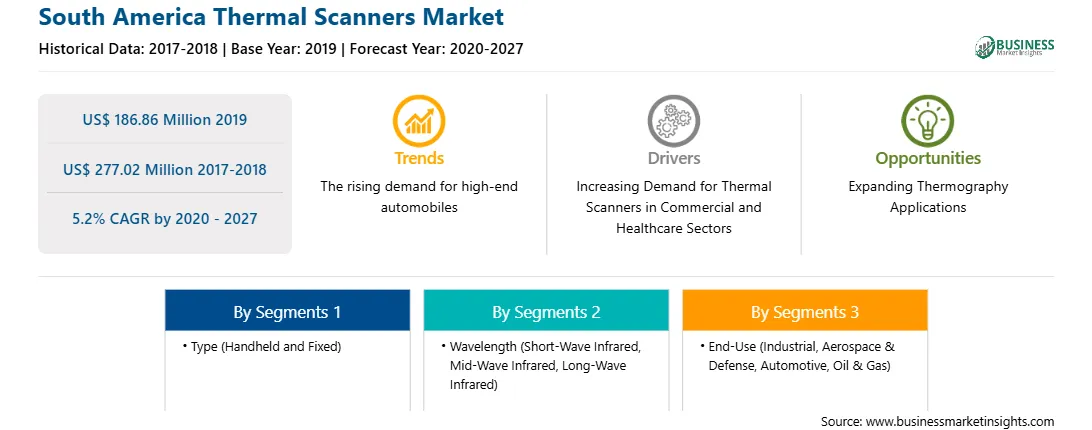

| Market size in 2019 | US$ 186.86 Million |

| Market Size by 2027 | US$ 277.02 Million |

| Global CAGR (2020 - 2027) | 5.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Thermal Scanners refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The thermal scanners market in SAM is expected to grow from US$ 186.86 million in 2019 to US$ 277.02 million by 2027; it is estimated to grow at a CAGR of 5.2% from 2020 to 2027. As many countries undergoing the COVID-19 unlock stages, multiple measures are being taken by the companies to ensure the safety of their employees and partners. They are adopting handheld thermal scanners, compelling the use of masks and sanitizers, and so on. To ensure safety, it has become commonplace to use a handheld thermal scanning device at the entry points of offices, restaurants, hospitals, or any public place. However, these thermal scanners, which were initially designed for industrial use to test large machines' temperature, cannot accurately detect proper temperatures unless they are recalibrated for mediation. But recently, many wireless thermal scanning devices have come into the SAM market that can accurately measure individuals' exact temperature and record that data without any manual intervention. These thermal scanners are designed for medical use, as it is capable of quickly detect, record, and transmit the temperature data without requiring any physical contact with operators. This is bolstering the growth of the SAM thermal scanners market.

In terms of type, the fixed segment accounted for the largest share of the SAM thermal scanners market in 2019. In terms of wavelength, the long-wave infrared held a larger market share of the SAM thermal scanners market in 2019. Similarly, the oil & gas segment held a larger share of the market based on end-use in 2019.

A few major primary and secondary sources referred to for preparing this report on the thermal scanners market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are FLIR Systems, Inc.; AMETEK Inc.; Robert Bosch GmbH; 3M; and Leonardo among others.

The List of Companies - South America Thermal Scanners Market

The South America Thermal Scanners Market is valued at US$ 186.86 Million in 2019, it is projected to reach US$ 277.02 Million by 2027.

As per our report South America Thermal Scanners Market, the market size is valued at US$ 186.86 Million in 2019, projecting it to reach US$ 277.02 Million by 2027. This translates to a CAGR of approximately 5.2% during the forecast period.

The South America Thermal Scanners Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Thermal Scanners Market report:

The South America Thermal Scanners Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Thermal Scanners Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Thermal Scanners Market value chain can benefit from the information contained in a comprehensive market report.