Increasing Number of Smart Water Meter Projects is Driving the South America Smart Water Metering Market

One of the most crucial pieces of a city is its water supply system. With the increasing population, it is inevitable anticipated that the demand for water consumption will increase exponentially. A city’s water distribution channel and management systems have to be viable over a longer period of in order to maintain consistent growth and should be integrated with technologies that are capable to monitor and check water loss issues. Various developed and developing nations across the globe are witnessing a paradigm shift to smart cities. The government of various countries are adopting the momentum of smart cities thereby, investing in the development of internet infrastructure in the countries with an aim to bring robust urbanization. The demand for smart water meter is anticipated to witness an exponential growth in these smart cities as the smart city initiatives majorly focus on the energy sector. The water utilities in all countries cater to energy sectors as the energy generation sector is one of the prominent consumers of water. Pertaining to the advancement of energy sectors in smart cities, the future for smart water meters is also anticipated to be promising.

South America Smart Water Metering Market Overview

The recent technological developments have had a direct impact on the economy of Brazil that has advanced to a large extent. A recent study says that due to the changing economic condition in South America, government enterprises, businesses, and consumers in the region are keen to implement and incorporate the upcoming technologies. The cost savings advantage and higher work efficiencies achieved are cited as the major attracting points in South America. Large infrastructural developments in South America have resulted in the growth of commercial complexes, shopping malls, hospitals, educational institutions, universities, and government offices. The recent internet revolution in South America has accelerated growth in internet technologies. Several initiatives are being taken in South American countries for the roll-out of smart water meter systems. Major public–private partnerships are being established by water utilities and municipal corporations operating in South America. Smart water meter is expected to be the enabling connectivity architecture between the consumers and water utilities bodies. Telefonica, Huawei, and Kamstrup have successfully deployed a smart water pilot project in Chile. It is the first instance in South America to combine real user data with NB-IoT. The project involves a telemetry solution for remote monitoring and management of domestic water meters. Itron, Zenner, Landis+Gyr, Kamstrup, and Sensus are among the leading players in the smart water metering market that are active in South America and contributing to the smart water metering market growth across the region.

Strategic insights for the South America Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Smart Water Metering Strategic Insights

South America Smart Water Metering Report Scope

Report Attribute

Details

Market size in 2022

US$ 197.04 Million

Market Size by 2028

US$ 285.47 Million

Global CAGR (2022 - 2028)

6.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Component

By Application

By Meter Type

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Smart Water Metering Regional Insights

South America Smart Water Metering Market Segmentation

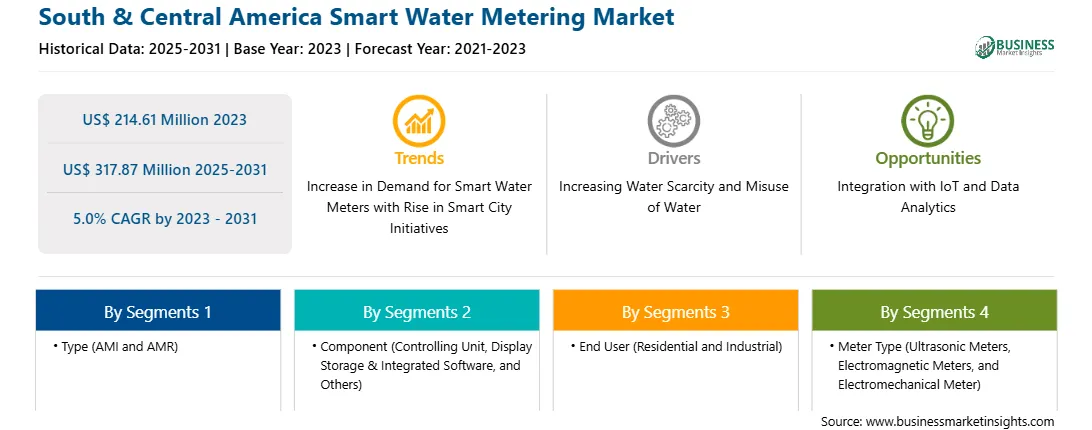

The South America smart water metering market is segmented into type, component, application, and meter type, and country.

On the basis of type, the South America smart water metering market has been segmented into advanced metering infrastructure and automatic meter reader. The automatic meter reader segment registered the largest market share in 2022.

On the basis of component, the smart water metering market has been segmented into controlling units, display/storage and integrated software, and others. The display/storage and integrated software segment held the largest market share in 2022.

On the basis of application, the South America smart water metering market has been segmented into residential and industrial. The residential segment held the largest market share in 2022.

On the basis of meter type, the South America smart water meter has been segmented into ultrasonic meters, electromagnetic meters, and electromechanical meters. Ultrasonic meters segment held the largest market share in 2022.

Based on country, the South America smart water metering market is segmented into Brazil, Argentina, and the Rest of South America. Saudi Arabia dominated the market share in 2022.

Arad Ltd; Diehl Stiftung & Co KG; Itron Inc; Kamstrup AS; Sensus USA Inc; WAVIoT Integrated Systems LLC are the leading companies operating in the South America smart water metering market.

The South America Smart Water Metering Market is valued at US$ 197.04 Million in 2022, it is projected to reach US$ 285.47 Million by 2028.

As per our report South America Smart Water Metering Market, the market size is valued at US$ 197.04 Million in 2022, projecting it to reach US$ 285.47 Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The South America Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Smart Water Metering Market report:

The South America Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.