Smart mines with already installed technologies can automate their operations faster than those lagging in technological adoption. By implementing advanced technologies, mining operators can expand their current wireless network of embedded sensors. For instance, installing automation software enables the operator to monitor static and moving assets remotely and program automated interaction between both. Automated trucks carry out mining operations with the help of a physical sensor network and the remotely configured and managed software system, which previously required a truck driver fleet for service. Digitizing a mine by installing a wireless sensor network to perform remote readings can facilitate further digitization, such as automating key mining processes. Growing use of Operational Intelligence (OI) technologies, wireless monitoring and predictive maintenance support mining operators to track operational properties, to overcome the risks associated with mining and other crucial tasks. In real-time, the digital data collection process replaces the manual data collection at the operational site. The pressure of pore water plays a significant role in the dam site. The fluctuation in pore water pressure may lead to a sudden break in the dam. Instead of manual pressure measurement, operators can continuously track pore water pressure levels with real-time digital readings, giving them better capabilities to protect their critical assets. The nation also focuses on setting up broadband networks to collect, monitor, and process data for process optimization. The system allows resource-efficient usage and promotes the effective use of water and electricity to ensure sustainability in the environment and economy.

Numerous mining and technology companies are developing automated mining equipment to improve worker safety and working conditions, increase productivity, improve fuel efficiency and vehicle utilization, reduce driver fatigue and attrition, and reduce unscheduled maintenance.

South America is a favorable market for North American-listed mineral explorers, developers, and miners due to its immense mineral potential and pro-mining business environment. Several corporations in the region are consolidating their gold projects and mines. For instance, Aurania Resources of Toronto is exploring gold in its Lost Cities project in Southern Ecuador's Cordillera del Cutucu region, which is contiguous with the Cordillera del Condor. Porphyry copper deposits, gold-copper skarn deposits, and epithermal gold deposits are all found in the Northern Andean Jurassic metallogenic region, which contains the Cutucu.

In addition, growing corporate investment and favorable government regulations are expected to lead to market expansion in SAM. Furthermore, attractive mining prospects presented to key companies due to low commodity prices and cheap mining taxes are expected to drive the market in South America throughout the forecast period. Favorable government policies are creating a better mining environment; for instance, the government of Argentina is seeking to increase the country's mining yield to improve foreign exchange earnings with the overview of a set of new incentives for the sector. SAM is rich in natural resources and has relatively low labor costs, which makes it an attractive investment destination for smart mining.

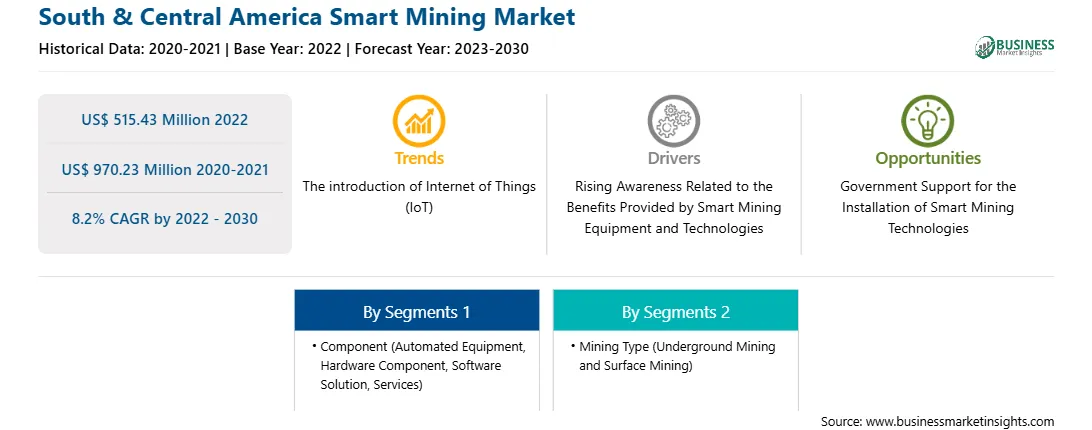

The South & Central America smart mining market is segmented based on component, mining type, and country.

Based on component, the South & Central America smart mining market is segmented into automated equipment, hardware component, software solution, and services. The automated equipment segment held the largest South & Central America smart mining market share in 2022. The automated segment is further subsegmented into load haul dump, robotic truck, driller & breaker, excavator, and other automated equipment. The hardware component is further subsegmented into RFID tags, sensors, intelligent system, and others. The software solutions are further subsegmented into logistics software and solutions, data & operation management software and solutions, safety & security systems, connectivity solutions, analytics solutions, remote management solutions, and asset management solutions.

In terms of mining type, the South & Central America smart mining market is bifurcated into underground mining and surface mining. The surface mining segment held a larger South & Central America smart mining market share in 2022.

Based on country, the South & Central America smart mining market is categorized into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America smart mining market in 2022.

ABB Ltd, Alastri, Caterpillar Inc, Hexagon AB, Hitachi Ltd, MineSense, Rockwell Automation Inc, SAP SE, and Trimble Inc are among the leading companies operating in the South & Central America smart mining market.

Strategic insights for the South & Central America Smart Mining provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 515.43 Million |

| Market Size by 2030 | US$ 970.23 Million |

| Global CAGR (2022 - 2030) | 8.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South & Central America Smart Mining refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. ABB Ltd

2. Alastri

3. Caterpillar Inc

4. Hexagon AB

5. Hitachi Ltd

6. MineSense

7. Rockwell Automation Inc

8. SAP SE

9. Trimble Inc

The South & Central America Smart Mining Market is valued at US$ 515.43 Million in 2022, it is projected to reach US$ 970.23 Million by 2030.

As per our report South & Central America Smart Mining Market, the market size is valued at US$ 515.43 Million in 2022, projecting it to reach US$ 970.23 Million by 2030. This translates to a CAGR of approximately 8.2% during the forecast period.

The South & Central America Smart Mining Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Smart Mining Market report:

The South & Central America Smart Mining Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Smart Mining Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Smart Mining Market value chain can benefit from the information contained in a comprehensive market report.