The slewing bearing market in South America is sub segmented into Brazil, Argentina, and Rest of SAM. The region is rich in oil reserves, with Venezuela having the largest oil reserves in the world. Also, Brazil and Columbia have a large number of oil reserves, which contributes to the demand for slewing bearings in this region. Further, the expansion of renewable energy infrastructure is one of the critical areas of focus in in Latin American countries, to attain sustainable economic development as well as to address the climate change issues. ~25% of the region's energy comes from renewable sources, including hydropower and biofuels. The South American region is rich in minerals and thus attracts investors from all over the world. Chile is the world's leading copper exporter; Brazil is the world's third-biggest iron producer; Mexico is the world's largest silver producer; and Peru is a major exporter of silver, copper, gold, and lead. This is creating favorable conditions for the growth of the slewing bearings market players. Furthermore, slewing bearings are widely used in industries such as aerospace, heavy equipment, defense, medical equipment, industrial machinery, semiconductor production, and renewable energy. Despite the lack of presence of major manufacturers of slewing bearing, SAM holds high growth potential for the slewing bearing market owing to major investments and ongoing infrastructure development. The CODIV-19 pandemic severely affected major production and mining operations in 2020. However, the demand for slewing bearings is increasing in the region with the resumption of major mining and renewable energy projects 2021.

Currently, Brazil has the highest number of COVID-19 cases, followed by Argentina, Colombia, and Peru, in South America. Governments of several countries in SAM have initiated several actions to protect their citizens and contain COVID-19 spread. Brazil is home to the largest manufacturing industries among all SAM countries, and it is also the only modern aircraft manufacturing country in the region. The slowdown in aerospace, manufacturing, oil & gas operations in the SAM has impaired the supply chain. This has hampered the demand for several industrial components, including slewing bearings. Thus, the outbreak of COVID-19 has had a negative impact on the South American slewing bearings market.

Strategic insights for the South America Slewing Bearing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

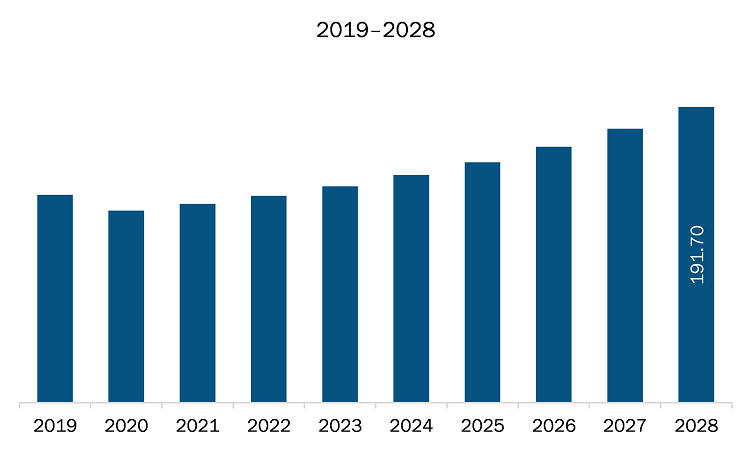

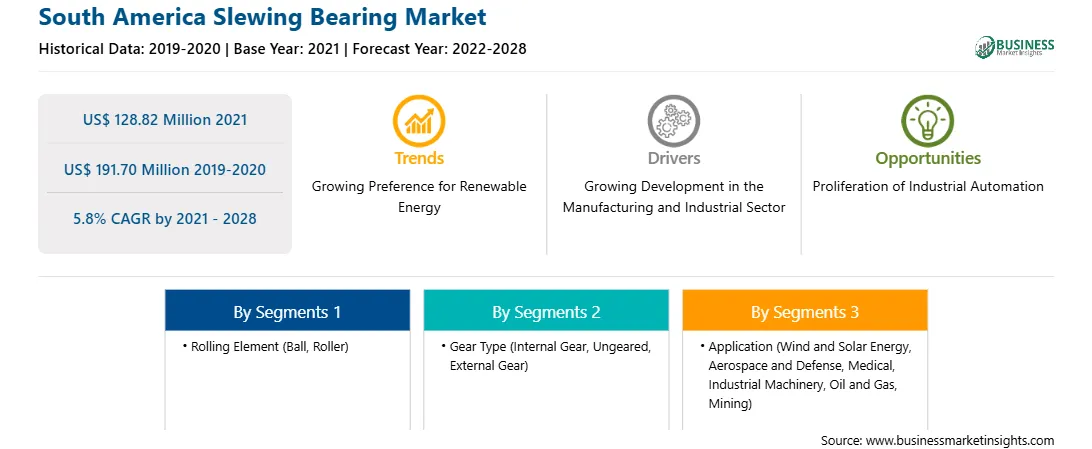

| Market size in 2021 | US$ 128.82 Million |

| Market Size by 2028 | US$ 191.70 Million |

| Global CAGR (2021 - 2028) | 5.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Rolling Element

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Slewing Bearing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The slewing bearing market in South America is expected to grow from US$ 128.82 million in 2021 to US$ 191.70 million by 2028; it is estimated to grow at a CAGR of 5.8% from 2021 to 2028. Increasing defense budgets; owing to the increasing concerns about national security, governments are allocating greater funds to strong-arm their defense forces. Higher military budget allocations enable the military forces to focus on the development of robust arms and ammunition, indigenous technologies, communication system, and various other technologies. Currently, communication and combat system modernization practices are peaking among most military forces, as a significant percentage of defense budget is spent on procuring advanced weapons and electronic equipment such as combat tanks, missile systems, and communication systems. The slewing bearings are widely used turrets of combat tanks, missile launchers, precision radar antennas, communication antennae, and gun mounts. Thus, increasing defense budgets in different countries are driving the slewing bearing market growth.

Based on gear type, the market is segmented into external, internal, and ungeared. The internal gear segment held the largest share of South America slewing bearing market throughout the forecast period. Based on rolling element, the slewing bearing market is segmented into ball and roller. The ball segment held a larger market share throughout the forecast period. Based on application, the slewing bearing market is segmented into wind and solar energy, aerospace & defense, medical, industrial machinery, oil & gas, mining, and others. The industrial machinery segment accounted for a major share of the South America slewing bearing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the slewing bearing market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are IMO Group, Italcuscinetti S.p.A. a Socio Unico, Liebherr, NTN Corporation, Schaeffler Technologies AG & Co. KG, SKF, Thyssenkrupp rothe erde Germany GmbH, and THE TIMKEN COMPANY, among others.

The South America Slewing Bearing Market is valued at US$ 128.82 Million in 2021, it is projected to reach US$ 191.70 Million by 2028.

As per our report South America Slewing Bearing Market, the market size is valued at US$ 128.82 Million in 2021, projecting it to reach US$ 191.70 Million by 2028. This translates to a CAGR of approximately 5.8% during the forecast period.

The South America Slewing Bearing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Slewing Bearing Market report:

The South America Slewing Bearing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Slewing Bearing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Slewing Bearing Market value chain can benefit from the information contained in a comprehensive market report.