A set-top box (STB), also referred to colloquially as a cable box, is an information system that typically includes a TV tuner input and shows the output of a TV set and an external signal source, converting the source signal into material in a format that can then be shown on a TV screen or other display device. They are found in, among other applications of, cable television, satellite television, and over-the-air television networks. A device that connects to your TV makes it possible for you to use a telephone line or cable to access the Internet and exchange electronic mail on your TV. Since technical standards were introduced, open digital television (ODT) has been in service for four or five years, as digital terrestrial television (DTT) is known in Argentina. With almost universal government support, the introduction of the system took place at a frenzied rate, and the results are impressive: 82 percent of the country's population has coverage, there are 15 national as well as local signals, and customers have shown a great deal of acceptance of DTT. Despite the delays, considering that the analog switch-off is due to take place in 2019, a high degree of coverage has been achieved. Argentina's penetration level is twice as high as that of Brazil, which has a coverage rate of 46.8% and an analog switch-off planned for 2018. Thus, above-mentioned factors are expected to influence the adoption of set-top box across the region, thereby contributing to the growth of the market.

Furthermore, in case of COVID-19, Brazil has the largest number of cases, followed by Ecuador, Chile, Peru, and Argentina amongst others. The COVID-19 pandemic has led to the closure of all economic activities across the region, in order to combat the spread of the virus. This has led to the increase in unemployment across the country thereby impacting the spending capacity of the country on television cable connections. The unemployment rate rose from 11.0 percent in the fourth quarter of 2019 to 12.2 percent in the first quarter of 2020, according to the official statistics agency IBGE, reaching 12.9 million people. Operators revealed they would provide free previews for premium networks in the early days of the coronavirus outbreak, as a way to persuade viewers to stay at home and minimize churn. Since free forecasts have ended, along with rising unemployment pressures and lower wages, cord-cutting is expected to intensify in the coming months as the pandemic and quarantine steps affect an economy that is still emerging from recession. Thus, the above-mentioned factors are expected to negatively impact the set top box market over the years owing to the outbreak of the pandemic.

Strategic insights for the South America Set Top Box (STB) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

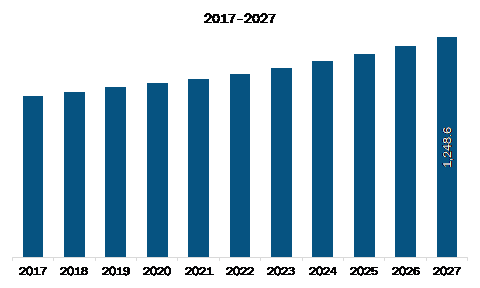

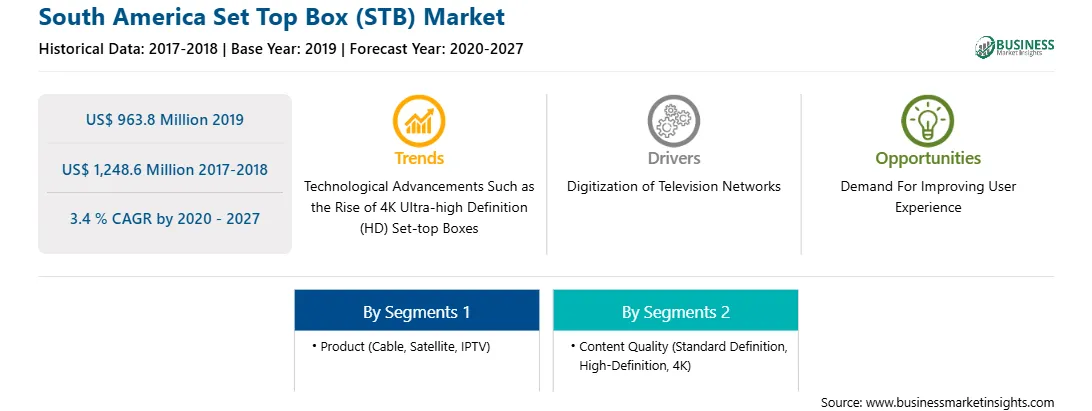

| Market size in 2019 | US$ 963.8 Million |

| Market Size by 2027 | US$ 1,248.6 Million |

| Global CAGR (2020 - 2027) | 3.4 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Set Top Box (STB) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM set top box (STB) market is expected to grow from US$ 963.8 million in 2019 to US$ 1,248.6 million by 2027; it is estimated to grow at a CAGR of 3.4 % from 2020 to 2027. Burgeoning technological transformations in set-top box (STB) is expected to drive the SAM set top box (STB) market. Technological advancements have led to the introduction of a wide variety of STBs exhibiting different characteristics. This has eventually led to fierce rivalry among the set-top box providers. Digital video capture is one of the most desired functionality of set-top boxes as it allows audiences to record their favorite shows and watch them later as per their convenience. A standalone set-top box that allows viewers to transmit and record TV programs is an over-the-air digital video recorder (DVR) system. Apart from DVRs, subscription-based TV service providers also sell STBs to consumers. Companies are integrating features such as voice command with the help of technologies such as natural language processing (NLP) to simplify searching channels and shows. Interactive features such as video-on-demand and electronic program guide are also increasingly being incorporated in satellite STB units. In addition to basic features, the set-top box units also include a range of interactive and multimedia facilities directly via a consumer television device, such as internet browsing, email, and instant messaging. The DVR feature is also included in cable and satellite set-top boxes, enabling viewers to enjoy content at their convenience. Using MPEG-4.10 (H.264) and SMPTE 421 M (VC-1) allows more content sources and decreases the risk of early product obsolescence. Thus, the abovementioned technological advancements are contributing to the growth of the SAM set top box (STB) market.

In terms of product, the cable segment accounted for the largest share of the SAM set top box (STB) market in 2019. In terms of content quality, the standard definition (SD) segment held a larger market share of the SAM set top box (STB) market in 2019.

A few major primary and secondary sources referred to for preparing this report on the SAM set top box (STB) market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Advanced Digital Broadcast SA; Altech UEC; CommScope; Huawei Technologies Co., Ltd; Humax; Kaonmedia Co., Ltd.; Sagemcom; Skyworth Group Co., Ltd.

The South America Set Top Box (STB) Market is valued at US$ 963.8 Million in 2019, it is projected to reach US$ 1,248.6 Million by 2027.

As per our report South America Set Top Box (STB) Market, the market size is valued at US$ 963.8 Million in 2019, projecting it to reach US$ 1,248.6 Million by 2027. This translates to a CAGR of approximately 3.4 % during the forecast period.

The South America Set Top Box (STB) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Set Top Box (STB) Market report:

The South America Set Top Box (STB) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Set Top Box (STB) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Set Top Box (STB) Market value chain can benefit from the information contained in a comprehensive market report.