The raw tobacco leaves market in South America is segmented into Brazil, Argentina, and the Rest of South and Central America. Several countries in the region are major growers of tobacco, and they supply tobacco leaves across the world. Brazil accounts for 75% of regional tobacco output, whereas Argentina, Colombia, Guatemala, and Cuba account for the remaining 18%. However, the region's tobacco agricultural land area has reduced from 668,890 hectares in 2006 to 556,372 hectares in 2014. 12 Central American countries, including Nicaragua, Cuba, the Dominican Republic, and Honduras, are among the world's largest cigar manufacturers. There is rising consumption of tobacco products in South America. However, the proportion of the population who uses tobacco has nearly halved across the region because of robust tobacco control laws in several countries across the region. South and Central America is seeing an increase in tobacco-related mortality, which reached more than 300,000 in 2016. The Union has been working in the region since 2006 through the Bloomberg Initiative to Reduce Tobacco Use (BI) Funding Program offering grants and tobacco control technical assistance to organizations. For more than a decade, the Union has supported Brazil's tobacco control efforts by collaborating with national organizations on key country-wide tobacco control policy improvements. Brazil is becoming a global leader in tobacco control, with considerable reductions in adult smoking rates.

Brazil has the highest number of COVID-19 cases in South America, followed by Argentina, Chile, Peru, and Ecuador among others. Governments of these countries have taken an array of actions to protect their citizens and contain COVID-19 spread. The region is experiencing lower export revenues, both, from the dropping commodity prices and reduction in export volumes, especially due to lowered export performance in China, Europe, and the US. Containment measures in several South and Central America countries have reduced economic activity in the food and beverages industries; however, the sector is likely to rebound once the country manages to control the epidemic.

Strategic insights for the South America Raw Tobacco Leaves provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

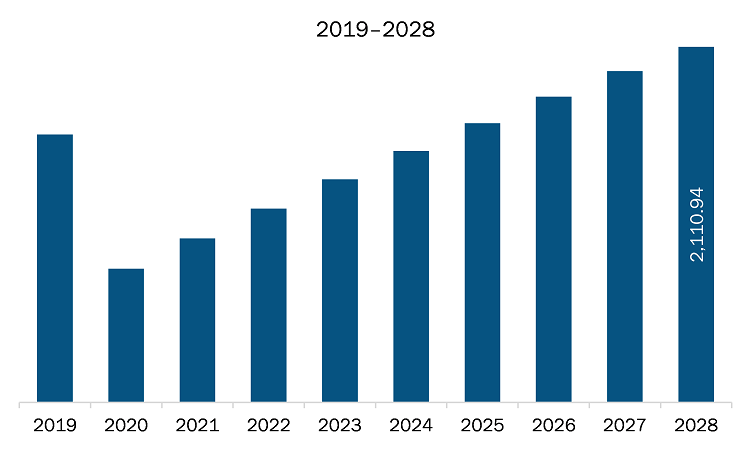

| Market size in 2021 | US$ 1,862.71 Million |

| Market Size by 2028 | US$ 2,110.94 Million |

| Global CAGR (2021 - 2028) | 1.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Leaf Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Raw Tobacco Leaves refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The raw tobacco leaves market in South America is expected to grow from US$ 1,862.71 million in 2021 to US$ 2,110.94 million by 2028; it is estimated to grow at a CAGR of 1.8% from 2021 to 2028. It has been witnessed that the number of smokers has been growing at the global level. Over the past few years, consumers are increasingly inclining toward smoking alternatives, and therefore introducing innovative tobacco products in different taste options such as menthol cigars, e-cigarettes, dissolvable tobacco products, and clove cigarettes. Most dissolvable tobacco products dissolve in mouth and do not require spitting or discarding the product. Dissolvable tobacco products are considered as noncombustible tobacco products. It can be sold as strips, sticks, or lozenges. Although the prevalence of dissolvable tobacco is relatively low to regular smoking, the market is likely to witness considerable growth over years owing to the advantages such as added flavors—apple, peach, strawberry, honeydew, pineapple, and prune. These factors together are anticipated to stimulate the market during the forecast period. As a result, producers are focusing on premium tobacco products manufactured with fine whole tobacco leaves and flue-cured tobacco. For instance, in May 2019, Philip Morris launched IQOS (I quit original smoking). This electronic device heats paper-wrapped tobacco-filled sticks and, as a result, generates nicotine-containing aerosol. The product was launched as an alternative to cigarettes. Larger tobacco product manufacturers can utilize economies of scale and can offer distinctive products. Moreover, new, and smaller organizations are now focusing on creative packaging, attractive discounts, branding, and a few niche categories, such as pipe tobacco and additive-free cigarettes. The increasing emphasis on adopting safer alternatives to smoking is anticipated to propel the adoption of e-cigarettes over the coming years. The growing awareness about e-cigarettes and clove cigarette being safer than traditional cigarettes, particularly among the millennial population, due to various studies carried out by medical institutions and associations, is projected to further drive the market growth. Hence, the increase in the demand for e-cigarettes, flavored products, and other new product developments strongly complement the growth of the raw tobacco leaves market.

In terms of leaf type, the Virginia segment accounted for the largest share of the South America raw tobacco leaves market in 2020. Further, in term of application, the smoking tobacco held a larger market share of the raw tobacco leaves market in 2020.

A few major primary and secondary sources referred to for preparing this report on the raw tobacco leaves market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Universal Corporation; Sopariwala Exports; Alliance One International Inc.; Japan Tobacco International; British American Tobacco plc; Star Agritech International; and BBM Bommidala Group among others.

The South America Raw Tobacco Leaves Market is valued at US$ 1,862.71 Million in 2021, it is projected to reach US$ 2,110.94 Million by 2028.

As per our report South America Raw Tobacco Leaves Market, the market size is valued at US$ 1,862.71 Million in 2021, projecting it to reach US$ 2,110.94 Million by 2028. This translates to a CAGR of approximately 1.8% during the forecast period.

The South America Raw Tobacco Leaves Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Raw Tobacco Leaves Market report:

The South America Raw Tobacco Leaves Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Raw Tobacco Leaves Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Raw Tobacco Leaves Market value chain can benefit from the information contained in a comprehensive market report.