SAM region consists of Brazil, Argentina, and rest of SAM. Brazil led the market in 2021. Brazil is the fifth largest country in the world both by area and by population and experiencing the fastest demographic aging worldwide. In Brazil, the aging population is at a rapid pace and in a context of regional and historical socioeconomic inequalities. According to the study conducted in Brazil, the community of women estimated at the vast majority with 16.9 million (56%) of elderly persons, whereas older adults estimated approx. 13.3 million (44%). The growing aging population leads to several chronic conditions such as cancer, orthopedic conditions, neurovascular disorders, diabetes amongst others. Such growing conditions are likely to drive the adoption of medical devices, which will eventually drive the Brazil medical devices market during the forecast period. In addition, across the country, institutes are working towards the growth of the neuroscience in Brazil. For instance, The Brazilian Institute of Neuroscience and Neurotechnology (BRAINN) is a São Paulo Research Foundation (FAPESP)-funded institute that inspects the molecular mechanisms underlying epilepsy, stroke, and lesions associated with these diseases. These research activities have shown vital applications related to prevention, diagnosis, treatment for better understanding of normal and abnormal brain function. Thus, the developments in the neurological segments are expected to grow the radiopharmaceuticals Market during the forecast period.

In case of COVID-19, SAM is highly affected especially Brazil, followed by Peru, Chile, Ecuador, and Venezuela. With the outbreak of second wave COVID-19, there has been an increasing number of cases in the South American countries. According to the International Council of Nurses, the number of deaths of health professionals in Brazil are above other countries due to high transmission of the virus. Brazil has many populated regions with small houses with 6-7 people per house, the virus spreads like wildfire. Currently, the countries in this region are rapidly increasing its clinical programs to fight against the novel corona virus. In this scenario, Brazil has observed enormous difficulties in management of chronic neurological disorders, from headache to neurodegenerative diseases. Due to inadequate monitoring, many patients end up being admitted to emergency departments due to decompensation of their neurological disease. During the pandemic, stroke patients as well as other neurological conditions have been arriving late at the hospital, outside the therapeutic window for acute intervention. In addition, the country also faced difficulties in obtaining beds in the intensive care unit for management of the diseases during the acute phase. These factors are likely to have negative impact on the market growth.

Strategic insights for the South America Radiopharmaceuticals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

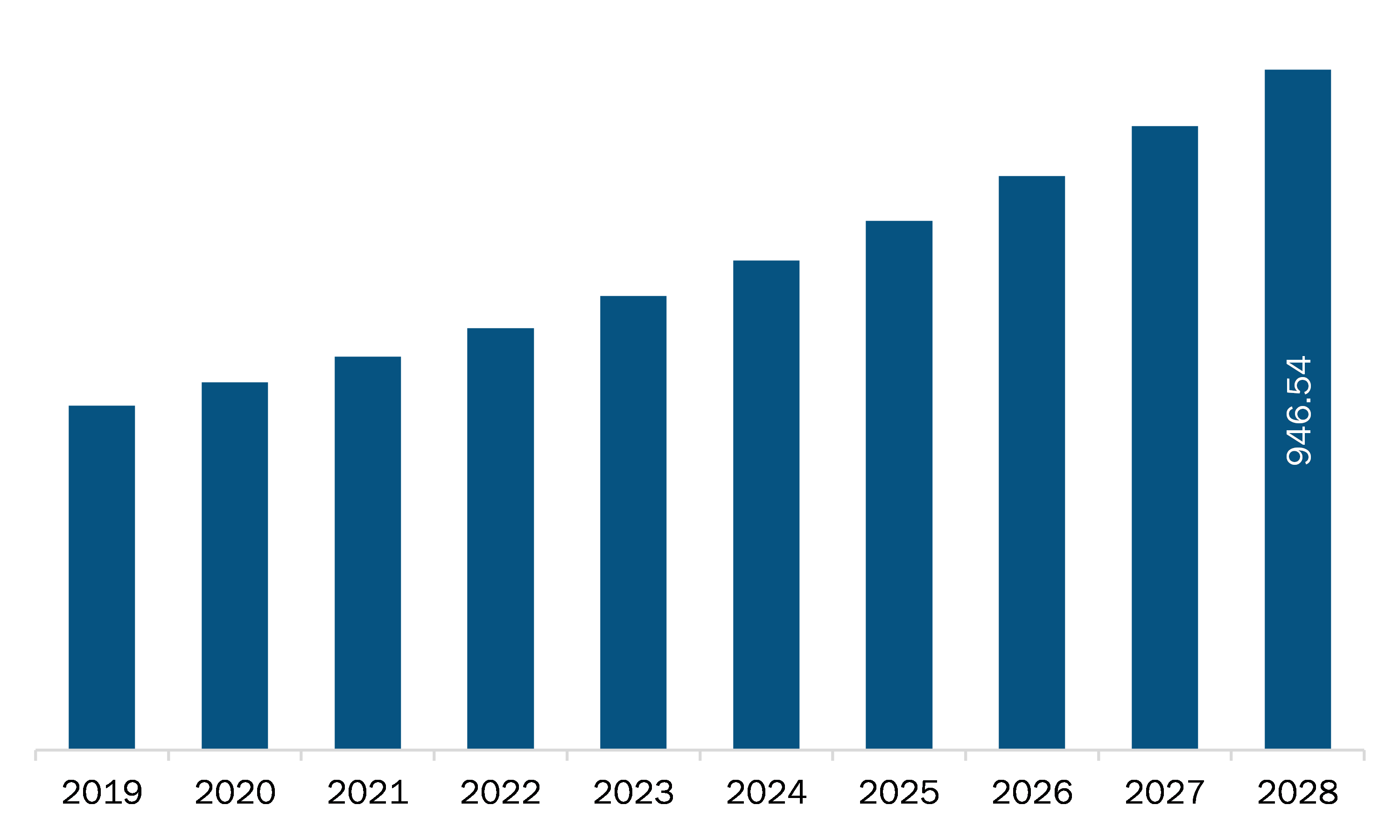

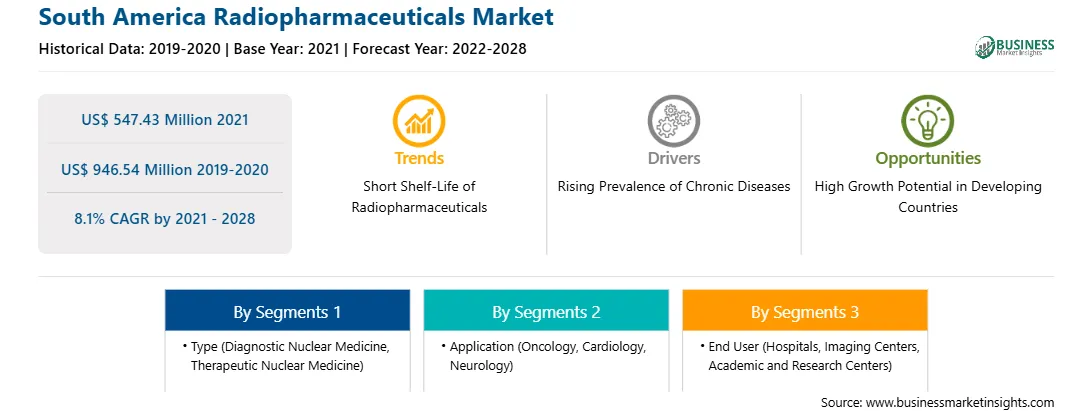

| Market size in 2021 | US$ 547.43 Million |

| Market Size by 2028 | US$ 946.54 Million |

| Global CAGR (2021 - 2028) | 8.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Radiopharmaceuticals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM radiopharmaceuticals market is expected to grow from US$ 547.43 million in 2021 to US$ 946.54 million by 2028; it is estimated to grow at a CAGR of 8.1% from 2021 to 2028. The use of nuclear medicine procedures is expanding rapidly, as PET and SPECT continue to improve the accuracy of detection, localization, and characterization of disease. PET and SPECT are among the nuclear medicine radiology modalities employed in clinical settings. As per the Society of Nuclear Medicine, every year, millions of nuclear medicine procedures are performed with radiopharmaceuticals and imaging instruments to diagnose disease and deliver targeted treatments in the countries across the region. These techniques have also been adopted in immunology, infection, gastroenterology, cardiology, oncology, neurology, and psychiatry, among other fields, for diagnosis and other applications. Advanced nuclear medicines and modern imaging equipment are assisting doctors in diagnosing diseases in a better manner and in less time. Continuous development of new radiopharmaceuticals for the PET/CT and SPECT/CT platforms, which are used in novel clinical applications such as neurology and orthopedics, along with the increasing accuracy of different tumor staging methods, are further contributing to the market growth. In September 2020, Curium launched Detectnet, a positron emission tomography (PET) agent, indicated for the localization of somatostatin receptor-positive neuroendocrine tumors (NETs) in adult patients. Thus, the technological advancements for improving the quality and efficacy of nuclear imaging techniques are favoring the SAM radiopharmaceuticals market growth.

In terms of type, the diagnostic nuclear medicine segment accounted for the largest share of the SAM radiopharmaceuticals market in 2020. In terms of application, the oncology segment held a larger market share of the SAM radiopharmaceuticals market in 2020. Further, the hospitals segment held a larger share of the SAM radiopharmaceuticals market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM radiopharmaceuticals market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cardinal Health Inc; Curium; GENERAL ELECTRIC; Lantheus Medical Imaging, Inc.; Bayer AG; Bracco Imaging S.p.A; and Nordion.

The South America Radiopharmaceuticals Market is valued at US$ 547.43 Million in 2021, it is projected to reach US$ 946.54 Million by 2028.

As per our report South America Radiopharmaceuticals Market, the market size is valued at US$ 547.43 Million in 2021, projecting it to reach US$ 946.54 Million by 2028. This translates to a CAGR of approximately 8.1% during the forecast period.

The South America Radiopharmaceuticals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Radiopharmaceuticals Market report:

The South America Radiopharmaceuticals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Radiopharmaceuticals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Radiopharmaceuticals Market value chain can benefit from the information contained in a comprehensive market report.