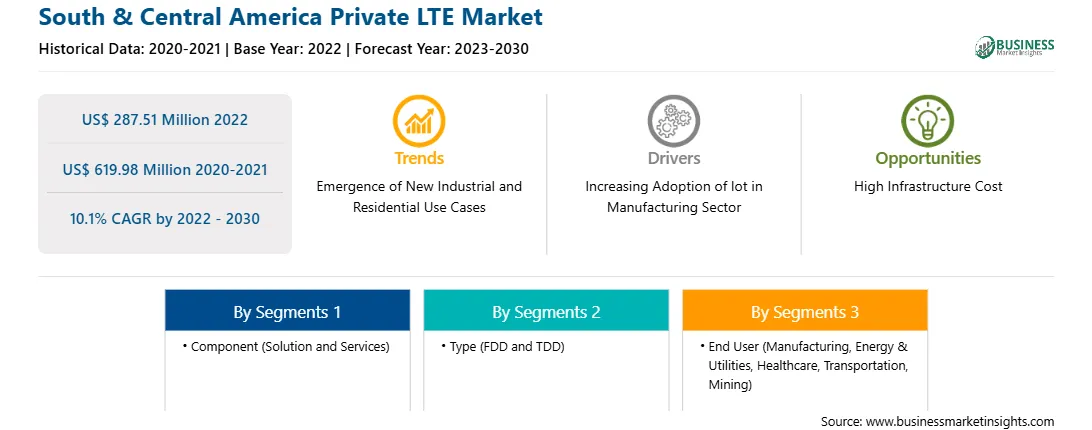

The South & Central America private LTE market was valued at US$ 287.51 million in 2022 and is expected to reach US$ 619.98 million by 2030; it is estimated to grow at a CAGR of 10.1% from 2022 to 2030.

The demand for greater bandwidth grows as people interact in high-definition video and receive increasingly immersive experiences with virtual reality and cloud gaming. Machines, too, rely on high-speed, low-latency networking, especially as industrial processes become more automated.

Private LTE is being built to enable services for latency-sensitive devices in applications such as autonomous driving, factory automation, remote surgery, mission-critical communications, and VR/AR entertainment. These applications require sub-millisecond latency and error rates of fewer than one packet per 105. Ultra-reliable low-latency communications (URLLC) application cases have stringent latency and reliability requirements.

Cellular networks encounter challenges due to channel fading, interference levels, and user equipment (UE) movement. Private LTE technology enables high reliability, low latency, and optimal multiplexing of URLLC and other traffic in the system. Throughout the projection period, remote LTE deployment must be planned to meet high latency and reliability standards for URLLC, i.e., be suitable for the private LTE market.

The private LTE market in South & Central America has been further segmented into Brazil, Argentina, and the Rest of South & Central America. Countries in SAM are attracting huge FDIs. The availability of cheap labor, low entry barriers, and low interest rates are the key factors driving FDI in the region's manufacturing sector. Certain countries in the region have relaxed FDI regulations. Thus, they are attracting investments from several companies. For instance, Argentina is concentrating on attracting FDIs by taking several initiatives, such as easing import restrictions, signing international bilateral agreements, and lifting restrictions on foreign investment. These initiatives are expected to help in the development of the manufacturing sector in SAM. To boost the overall production process in the manufacturing industry, the implementation of a private LTE network is growing in the region.

Due to an increase in innovative city projects, there is a proliferation in demand for mobiles, smartphones, and enhanced internet service among the South American masses. More than 82% of the South American population lives in urban areas, and the percentage is anticipated to grow to 90% by 2050. Economic development is one of the most significant drivers of urbanization, and it surges the interest in smart cities in the region. The increasing deployment of private LTE networks across various industries is boosting the region's market.

Strategic insights for the South & Central America Private LTE provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Private LTE refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Private LTE Strategic Insights

South & Central America Private LTE Report Scope

Report Attribute

Details

Market size in 2022

US$ 287.51 Million

Market Size by 2030

US$ 619.98 Million

Global CAGR (2022 - 2030)

10.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Type

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Private LTE Regional Insights

The South & Central America private LTE market is segmented based on component, type, end user, and country. Based on component, the South & Central America private is segmented into solution and services. The services segment is further bifurcated into professional and managed services. The solution segment held a larger market share in 2022.

Based on type, the South & Central America private LTE market is bifurcated into FDD and TDD. The FDD segment held a larger market share in 2022.

Based on end user, the South & Central America private LTE market is segmented into manufacturing, energy & utilities, healthcare, transportation, mining, and others. The manufacturing segment held the largest market share in 2022.

Based on country, the South & Central America private LTE market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America private LTE market share in 2022.

Cisco Systems Inc, Telefonaktiebolaget LM Ericsson, Huawei Investment & Holding Co Ltd, Samsung Group, Star Solutions, and Kyndryl Holdings Inc are some of the leading companies operating in the South & Central America private LTE market.

The South & Central America Private LTE Market is valued at US$ 287.51 Million in 2022, it is projected to reach US$ 619.98 Million by 2030.

As per our report South & Central America Private LTE Market, the market size is valued at US$ 287.51 Million in 2022, projecting it to reach US$ 619.98 Million by 2030. This translates to a CAGR of approximately 10.1% during the forecast period.

The South & Central America Private LTE Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Private LTE Market report:

The South & Central America Private LTE Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Private LTE Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Private LTE Market value chain can benefit from the information contained in a comprehensive market report.