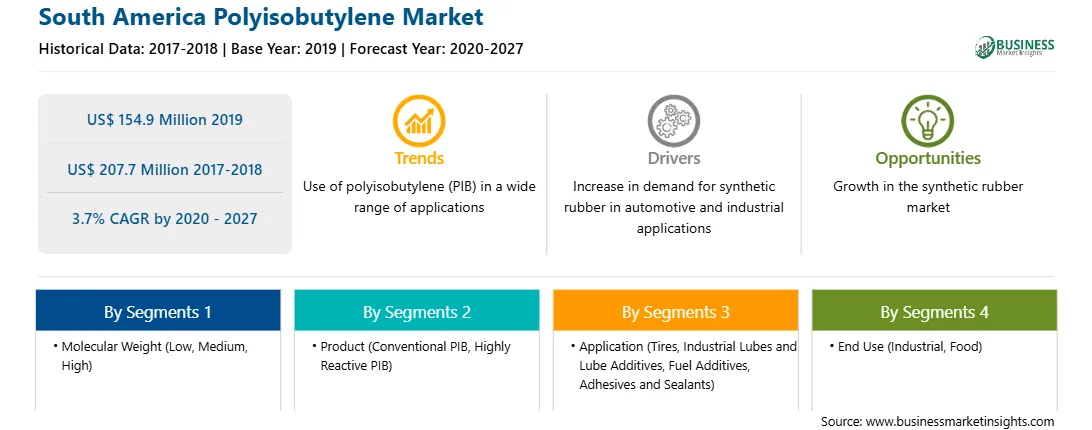

SAM Polyisobutylene Market Forecast to 2027 – COVID-19 Impact and Analysis by Molecular Weight (Low, Medium, and High), Product (Conventional PIB, Highly Reactive PIB), Application (Tires, Industrial Lubes and Lube Additives, Fuel Additives, Adhesives and Sealants), and End Use (Industrial, Food, and Others)

Polyisobutylene (PIB) is an elastomer or a synthetic rubber. It is a very versatile, non-toxic, water-white viscous liquid and has the ability to increase tackiness, to provide water-repellency, to improve viscosity-index and it provides excellent electrical insulation. It is the only rubber, which is gas impermeable, and hence it can hold or store air over long period. The remarkable impermeable property of Polyisobutylene (PIB) has led to its uses in applications such as inner tubes, inner liners of basketball, and liner layers of tires. Polyisobutylene (PIB) in the form of polyisobutylene succinimide finds uses in additives in lubricating oils as well as motor fuels. When added in small amount to the lubricating oils it reduces the generation of oil mist. As a fuel additive it is blended with other fuel and oil additives to form a detergent pack which is added to gasoline and diesel fuels to resist the buildup of deposits and engine knock. The automotive industry has been the key market for several types of fuel additives for many years. The share for automobiles has continuously been higher than that of the other fuel additives market segment due to the lack of efficient fossil fuel alternatives and an increasing middle-class economy. The relative importance of aviation for fuel additives has boosted in recent years, ultimately mounting the demand for polyisobutylene. Thus, the growth in the automotive sector is expected to create a significant demand for polyisobutylene in the coming years, which is further anticipated to drive the Polyisobutylene market.

Strategic insights for the South America Polyisobutylene provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 154.9 Million |

| Market Size by 2027 | US$ 207.7 Million |

| Global CAGR (2020 - 2027) | 3.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Molecular Weight

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Polyisobutylene refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The polyisobutylene market in SAM is expected to grow from US$ 154.9 million in 2019 to US$ 207.7 million by 2027; it is estimated to grow at a CAGR of 3.7% from 2020 to 2027. The growing demand for PIB from developed and developing economies. Demand for polyisobutylene in South American market is expected to grow on account of presence of established leading automotive manufacturers such as Tesla Inc. and Ford Motors which are focused on research and development activities. Moreover, numerous cosmetics and personal care companies like Procter and Gamble, Maybelline, Colgate-Palmolive, Unilever, Avon, Johnson & Johnson present in the region are also expected to create lucrative opportunities for the manufacturers operating in the polyisobutylene market. Furthermore, the packaging industry in the United States is anticipated to showcase a noteworthy growth with respect to increasing consumption of beverages and packaged medicaments in domestic as well as exports to international markets. Increasing investments by petrochemical giants in research and development activities for innovative eco-friendly products is likely to accelerate the market growth in the region. Additionally, increasing demand for packaging in the pharmaceutical industry to preserve the effectiveness of drugs is projected to augment market growth over the forecast period.

The COVID 19 pandemic has impacted the major countries in SAM, and many of these countries are under lockdown, which is adversely affecting the polyisobutylene (PIB) market. Brazil has the highest number of COVID-19 cases in SAM, followed by Ecuador, Chile, Peru, and Argentina, among others. Governments of South American countries have taken several actions to protect their citizens and contain COVID-19 spread.

In terms of molecular weight, the high segment accounted for the largest share of the SAM polyisobutylene market in 2019. In terms of product, the highly reactive PIB segment held a larger market share of the polyisobutylene market in 2019. In terms of application, the industrial lubes and lube additives segment accounts for largest market share in 2019. Further, the industrial segment held a larger share of the market based on end user in 2019.

A few major primary and secondary sources referred to for preparing this report on the polyisobutylene (PIB) market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE, Braskem SA, Ineos AG, Infineum International Limites, and TPC Group are among others.

The List of Companies - South America Polyisobutylene Market

The South America Polyisobutylene Market is valued at US$ 154.9 Million in 2019, it is projected to reach US$ 207.7 Million by 2027.

As per our report South America Polyisobutylene Market, the market size is valued at US$ 154.9 Million in 2019, projecting it to reach US$ 207.7 Million by 2027. This translates to a CAGR of approximately 3.7% during the forecast period.

The South America Polyisobutylene Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Polyisobutylene Market report:

The South America Polyisobutylene Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Polyisobutylene Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Polyisobutylene Market value chain can benefit from the information contained in a comprehensive market report.