The growth of the market for the Point of care diagnostics in the region is attributed to the growing initiatives of the major players in the medical device industry. The Brazil led the market growth during forecast period. Brazil is the largest economy in Latin America, and its healthcare sector is segregated into public and private. The local manufacturing is restricted to consumables and ordinary articles, and there are few high-tech devices manufacturers. Therefore, Brazil imports a large number of medical devices from other countries. Cancer is one of the primary epidemic diseases, and the number of people diagnosed with cancer has reached duplicated in the past three decades. According to data presented in an article, Revista Brasileira de Cancerologia 2018, during 2018–2019, there would be ~600,000 new cases of cancer in the country. Brazil is the sixth-largest economy in the world and by far the largest in South America. It has one of the world’s most rapidly developing economies and a GDP per head that is greater than India and China. HAIs challenge public health in developing countries such as Brazil, which harbor social inequalities and variations in the complexity of healthcare and regional development. Increasing incidence of HAIs, particularly in the high-risk hospital settings, such as those in ICUs, has allowed hospitals in Brazil to improve their infection control and healthcare quality. On the back of the factors mentioned above, Brazil is likely to serve various growth opportunities for the Point of care diagnostics market players during the forecast period.

In case of COVID-19, SAM is highly affected specially Brazil. SAM have been witnessing a growing number of COVID-19 cases since its outbreak. For instance, according to Worldometer, the number of cases has reached around 28.8 million with 0.7 million deaths reported in South America as of June 2021. The cases are increasing in Brazil, Argentina, Colombia. The COVID-19 is expected to result in the region's worst recession, causing a 9.1% contraction in regional GDP in 2020. This is expected to increase the number of poor up by 45 million and the extremely poor number by 28 million. The increasing incidence supports the growth of the market. The pharmaceutical & biotechnology invested in R&D for the new molecule entity. The pandemic as no impact on R&D process, due to pandemic R&D activity increase to find better medicines to cure the life-threatening disease. In addition, surge in demand for modernized diagnostic solutions for diagnosis of COVID-19 is also anticipated to have positive impact on the growth of SAM point of care diagnostics market by 2028.

Strategic insights for the South America Point of Care Diagnostics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,406.72 Million |

| Market Size by 2028 | US$ 2,973.02 Million |

| Global CAGR (2021 - 2028) | 11.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Point of Care Diagnostics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

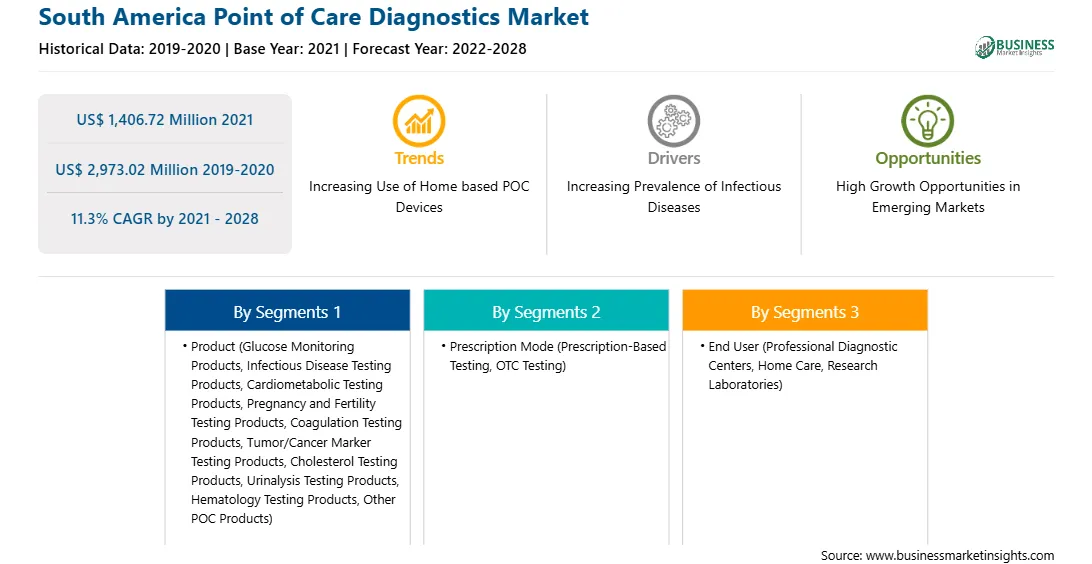

The SAM point of care diagnostics market is expected to grow from US$ 1,406.72 million in 2021 to US$ 2,973.02 million by 2028; it is estimated to grow at a CAGR of 11.3% from 2021 to 2028. The increasing awareness about point of care testing is bringing the test conveniently and quickly to the patient at home. Most clinicians recognize POC testing as a requirement for early detection of life-threatening situations because laboratory results can be made available in real-time. POC diagnostic and monitoring devices are anticipated to become universal in-home setups as well as at doctor’s offices or hospitals, in low- and middle-income countries. Consumers are frequently using smartphones as platform devices. The health and monitoring applications of smartphones commonly include imaging, sensing, and diagnostics. Although glucose meters are widely used in home settings by diabetic patients, they can also be repurposed to perform common clinical assays such as immunoassays, molecular diagnostics, and enzymatic assays. The rise in geriatric population has resulted in increased expenditure on healthcare for health checkups, disease diagnoses, and treatments. The most constant health problems affecting this population include digestive disorders, cardiovascular diseases, bone and joint diseases, diabetes, and different types of cancer. The people of this age group claim diagnostic testing on a regular basis, owing to their low immunity and metabolism. Therefore, these factors have increased the demand of POCs for diagnostic purposes across SAM region.

In terms of product, the glucose monitoring products segment accounted for the largest share of the SAM point of care diagnostics market in 2020. In terms of prescription mode, the prescription-based testing segment held a larger market share of the SAM point of care diagnostics market in 2020. Further, the professional diagnostic centers segment held a larger share of the SAM point of care diagnostics market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM point of care diagnostics market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott; BD; bioMerieux SA; BIO-RAD LABORATORIES INC.; Danaher; F. HOFFMANN-LA ROCHE LTD.; Johnson and Johnson Services, Inc.; Nova Biomedical; Polymer Technology Systems, Inc. (PTS); and Siemens AG.

The South America Point of Care Diagnostics Market is valued at US$ 1,406.72 Million in 2021, it is projected to reach US$ 2,973.02 Million by 2028.

As per our report South America Point of Care Diagnostics Market, the market size is valued at US$ 1,406.72 Million in 2021, projecting it to reach US$ 2,973.02 Million by 2028. This translates to a CAGR of approximately 11.3% during the forecast period.

The South America Point of Care Diagnostics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Point of Care Diagnostics Market report:

The South America Point of Care Diagnostics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Point of Care Diagnostics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Point of Care Diagnostics Market value chain can benefit from the information contained in a comprehensive market report.