The broadcasting industry is undergoing revolutionary technological innovations to provide a better user experience. Emerging technologies and innovative workflows such as playout are transforming live news and sports production. The transition is mainly driven by standalone streaming services, linear over-the-top (OTT) providers, and companies such as Amazon, and Twitter bidding for streaming rights. According to Digital Studio, customer demand for personalized TV services is spurring, due to which over half of broadcasters are investing up to 20% of their budget in trialing new customer content or services. Personalizing broadcasting creates opportunities to meet viewer expectations for relevant and regional content and gain new revenues from targeted ads. On-demand video has radically changed consumer behavior. Consumers increasingly expect relevant and engaging TV and video content that can be accessed anytime, anywhere, and in the format that best suits their immediate needs. As the demand for personalized services increases, broadcasters seek playout solutions to distribute high-quality content in a flexible and scalable way. Hence, the increasing demand for personalized broadcasting services drives the South America playout solutions market.

The South America playout solutions market is segmented into Brazil, Argentina, and the rest of South America. According to the World Bank, Brazil, Argentina, Chile, and Uruguay are considered the most developed countries in South America. With the help of playout solutions such as the IP delivery system, it is easy to expand the reach and media influence cost-effectively. With the IP delivery system, the audience can view content on any platform, through online web streaming, on any device anywhere across the region on a 24/7 basis. It also enables a fully flexible viewing experience with maximum reach.

Strategic insights for the South America Playout Solutions provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

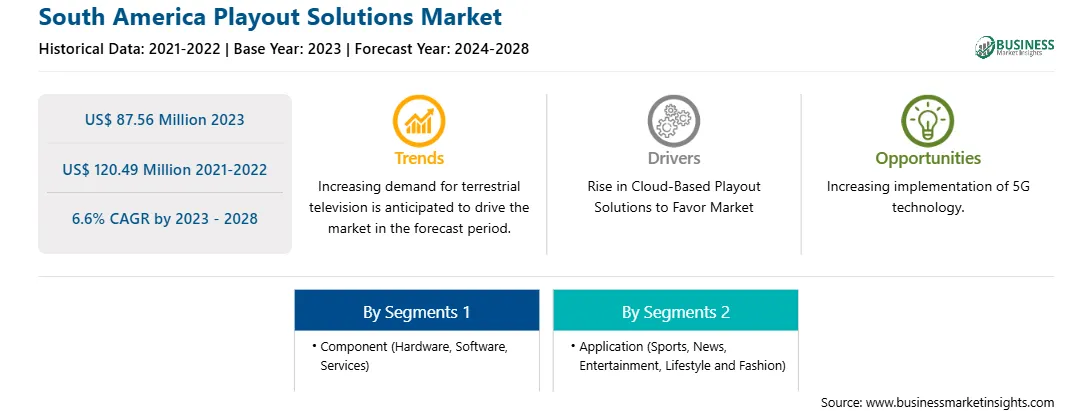

| Market size in 2023 | US$ 87.56 Million |

| Market Size by 2028 | US$ 120.49 Million |

| Global CAGR (2023 - 2028) | 6.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Playout Solutions refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South America playout solutions market is segmented into component, application and country.

Based on component, the South America playout solutions market is segmented into hardware, software, and services. The software segment held the largest share of the South America playout solutions market in 2023.

Based on application, the South America playout solutions market is segmented into sports, news, entertainment, lifestyle and fashion, and others. The entertainment segment held the largest share of the South America playout solutions market in 2023

Based on country, the South America playout solutions market is segmented into Brazil, Argentina, and the Rest of South America. The Brazil dominated the share of the South America playout solutions market in 2023.

Amagi; Belden Incorporated (Grass Valley); Evertz; Florical Systems; Harmonic Inc; Imagine Communications; and Playbox Technology are the leading companies operating in the South America playout solutions market.

The South America Playout Solutions Market is valued at US$ 87.56 Million in 2023, it is projected to reach US$ 120.49 Million by 2028.

As per our report South America Playout Solutions Market, the market size is valued at US$ 87.56 Million in 2023, projecting it to reach US$ 120.49 Million by 2028. This translates to a CAGR of approximately 6.6% during the forecast period.

The South America Playout Solutions Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Playout Solutions Market report:

The South America Playout Solutions Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Playout Solutions Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Playout Solutions Market value chain can benefit from the information contained in a comprehensive market report.