The South America region consists of Brazil, Argentina, and rest of South America. Brazil is expected to have the major market share in this region. Brazil is among one of the two South American countries that have its pharmaceutical and biotechnology companies, research and academic laboratories. A study done by CEBRAP (The Brazilian Center of Analysis and Planning) mapped 237 biotechnology companies in Brazil, and according to SINDUSFARMA (The Syndicate of the Pharmaceutical Products Industry in the State of São Paulo) in 2017 the Brazilian biopharmaceutical and biotechnology market was worth about US$ 18 billion. That South Americae research mapped 222 startups and research projects in Brazil that focus on biotechnology for human and animal health. Those numbers show that Brazil has the potential to grow and develop new biotech companies, but it is necessary to invest in the alignment between all players, such as investors, startups, researchers, consumers, etc. That alignment is being done by government agencies, innovation centers within universities and private institutions, such as Biominas Brasil, that are dedicated to fomenting the biotech ecosystem. Increase in investments by pharmaceutical and biotechnology industry and adoption of automation in pharmaceutical isolator are the major factor driving the growth of the South America pharmaceutical isolator market

In case of COVID-19, South America is highly affected especially Brazil. The COVID-19 is expected to result in the region's worst recession, causing a 9.1% contraction in regional GDP in 2020. This is expected to increase the number of poor up by 45 million and the extremely poor number by 28 million. The increasing incidence of COVID 19 supports the growth of the market. International market players are entering the region and offering various aseptic systems required by the pharmaceutical industry. For instance, in November 2020, Optima Pharma has conducted seminar in Brazil regarding use of Isolator and RABS Solutions during pandemic. Such an initiatives will support the market growth in the region. Also, the pharmaceutical & biotechnology invested in R&D for the new molecule entity. The pandemic as no impact on R&D process, due to pandemic R&D activity increase to find better medicines to cure the life-threatening disease. These factors had a high impact on the South America pharmaceutical isolator market. According to the Brazilian Association of Generic Medicines Industries (PróGenlicos), 75% of the pharmaceutical product is done domestically. However, it is widely dependent on the imports of APIs. The rise in the demand for aseptic processing has created several opportunities for the manufacturers in the country. Similarly, it is a vital challenge in other countries such as Brazil, and Argentina. Therefore, the government is collaborating with the private market player to supply vaccines against COVID–19. Such factors are also expected to create opportunities for countries. It is further expected to show a positive impact on market growth.

Strategic insights for the South America Pharmaceutical Isolator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

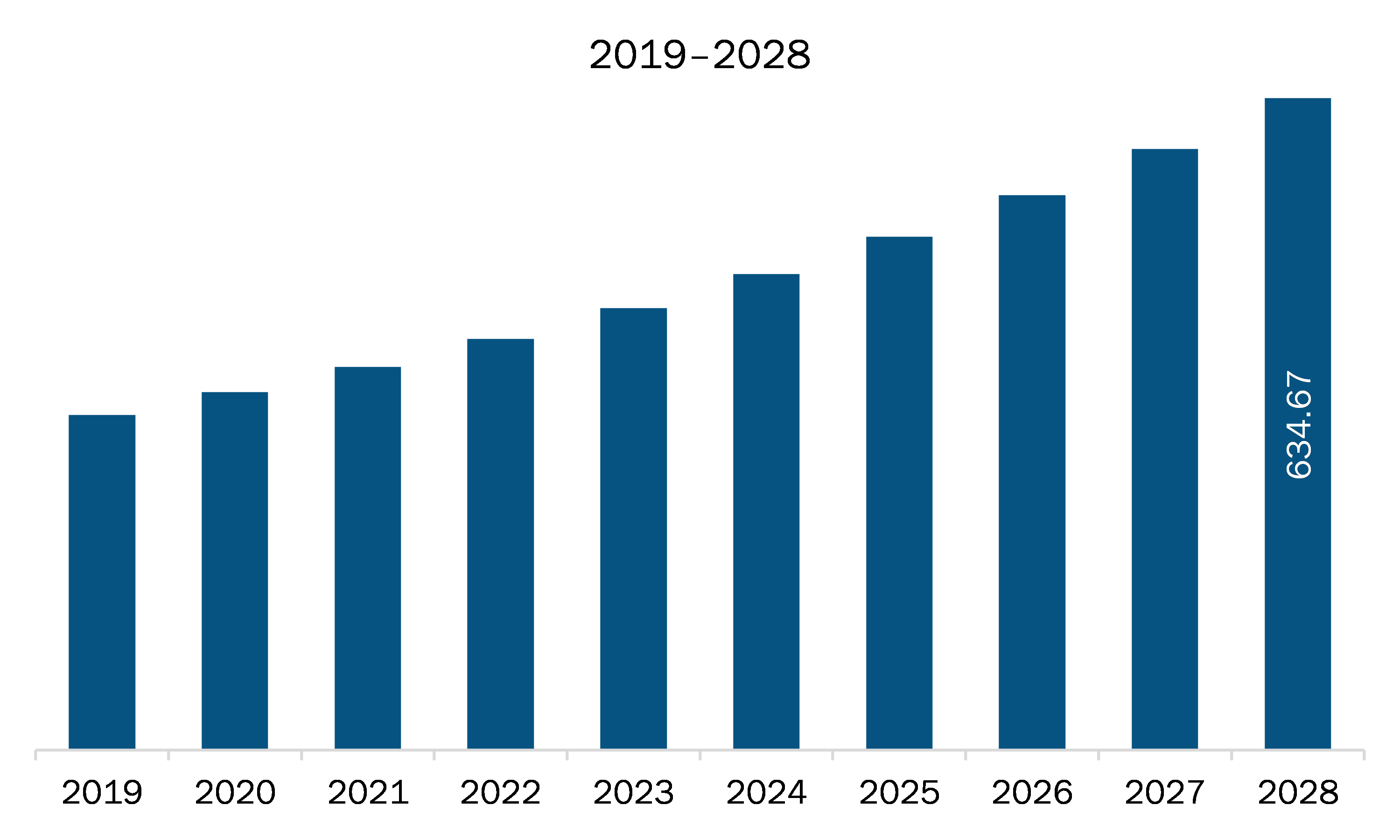

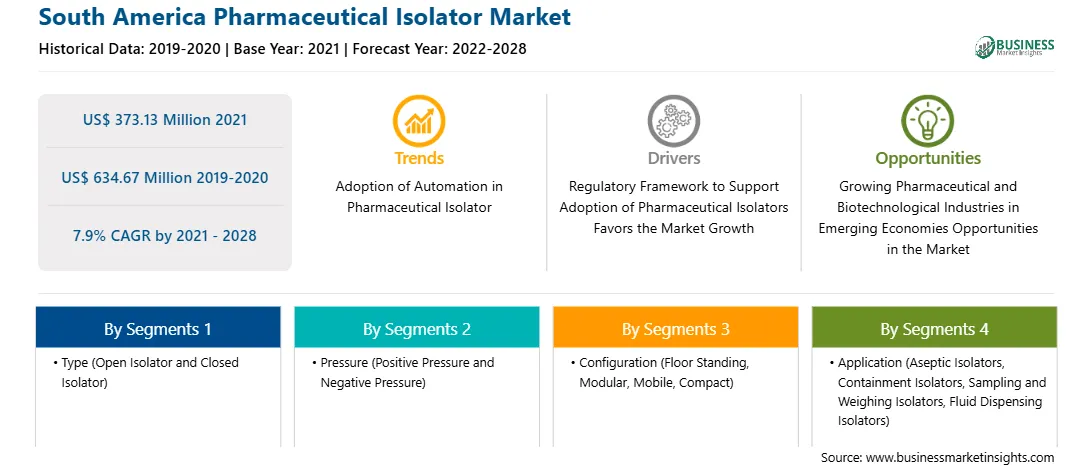

| Market size in 2021 | US$ 373.13 Million |

| Market Size by 2028 | US$ 634.67 Million |

| Global CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Pharmaceutical Isolator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South America pharmaceutical isolator market is expected to grow from US$ 373.13 million in 2021 to US$ 634.67 million by 2028; it is estimated to grow at a CAGR of 7.9% from 2021 to 2028. A pharmaceutical isolator offers a superior sterile environment than conventional clean rooms. Positive or negative pressures inside the chamber prevent contamination due to operator interference. It ensures long-lasting sterility in accordance with pharmaceutical regulations related to the manufacturing of sterile medicine products. Moreover, most of the experts agree that regulatory agencies are no longer impeding progress when it comes to technologies such as pharmaceutical isolators. The guidelines set by the agencies have an important role in the adoption of isolators in comparison to cleanrooms. Administartion mentions isolators 55 times in its latest guideline of manufacturing in an aseptic environment. A well-designed positive pressure isolator, supported by adequate procedures for its maintenance, monitoring, and controls, offers significant advantages over traditional aseptic processing, including fewer opportunities for microbial contamination during processing. Isolators have become a core component of the pharmaceutical industry, as the cost of noncompliance with the regulatory guidelines is much high. Pharmaceutical isolators are critical for a range of processes to ensure aseptic conditions and containment. Stringent aseptic conditions are essential to maintain quality control and meet the administration current good manufacturing practice guidelines and other regulatory demands. WHO good manufacturing practices guidelines for sterile pharmaceutical products, section 8 of Annex 6 also mention the use of isolator technology to minimize human interventions in processing areas. All these regulatory guidelines fuel the adoption of pharmaceutical isolators in the South America market.

In terms of type, the open isolator segment accounted for the largest share of the South America pharmaceutical isolator market in 2020. In terms of pressure, the positive pressure segment held a larger market share of the South America pharmaceutical isolator market in 2020. In terms of configuration, the floor standing segment held a larger market share of the South America pharmaceutical isolator market in 2020. In terms of application, the aseptic isolators segment held a larger market share of the South America pharmaceutical isolator market in 2020. Further, the pharmaceutical and biotechnology companies segment held a larger share of the South America pharmaceutical isolator market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the South America pharmaceutical isolator market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Azbil Telstar, Bioquell (Ecolab Solution), Comecer, Fedegari Autoclavi S.p.A., Getinge AB, Hosokawa Micron Group, and Nuaire Inc.

The South America Pharmaceutical Isolator Market is valued at US$ 373.13 Million in 2021, it is projected to reach US$ 634.67 Million by 2028.

As per our report South America Pharmaceutical Isolator Market, the market size is valued at US$ 373.13 Million in 2021, projecting it to reach US$ 634.67 Million by 2028. This translates to a CAGR of approximately 7.9% during the forecast period.

The South America Pharmaceutical Isolator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Pharmaceutical Isolator Market report:

The South America Pharmaceutical Isolator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Pharmaceutical Isolator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Pharmaceutical Isolator Market value chain can benefit from the information contained in a comprehensive market report.