South America (SAM) region consists of Brazil, Argentina, and Rest of South America. The countries are likely to offer growth opportunities due to growing domestic’s production of pharmaceutical and biopharmaceutical production, increasing support from governments, and rising research and developments. Brazil’s 70% of pharmaceutical business is dependent on imports of pharmaceutical products. For instance, in 2019, medicines worth US$ 7 billion were imported, among which biological medicines were worth US$ 2 billion, i.e., 30% of the total import. However, the COVID-19 pandemic has offered vital growth opportunities for the domestic production of medicines to Brazil and various countries across the world. Associations in Brazil such as the Brazilian Association of Generic Medicines Industries (PróGenlicos) and FarmaBrasil Group (GFB) state that the country can produce nearly 75% of the total demand for medicines in the country. Therefore, it is expected to increase the demand for pharmaceutical intermediates in the country. Also, in 2019, the country has imported a significant number of biological products or immunotherapeutic drugs worth US$ 1 billion. Therefore, it is expected that investing a huge amount in importing pharmaceutical products. The country can invest in the domestic production of medicines and will only incur in importing pharmaceutical intermediates. In addition, the companies operating in the country that are associated with FarmaBrasil Group have commitments, through the Partnerships for Productive Development (PDPs), to produce medicines domestically, including bevacizumab, palivizumab, infliximab, betainterferone 1A, and insulin, among others. Thus, it is expected that such strategic moves for domestic production will enhance the demand for pharmaceutical intermediate and eventually lead to market growth in the following years. Rise in prevalence of chronic diseases and infectious diseases is the major factor driving the growth of the SAM pharmaceutical intermediates market.

The South America region includes countries such as Brazil and Argentina. These countries have also registered a significant number of positive coronavirus infection cases. In the South American region, the virus continues to spread aggressively in Brazil, Peru, and Chile. Many South American countries have faced shortages of resources to manufacture and supply medical products. Some of the hard-hit countries such as Brazil, where case number surpassed 13,521,409, and Argentina, the case recorded as 2,551,999 as of April 2021. It is expected that the region is likely to impose a second lockdown, which will eventually hamper the healthcare industry in the area. COVID-19 continues to have a tremendous impact on the region. Although Peru established one of the strictest lockdowns in the South America region, it suffered the highest mortality rate due to COVID-19. The coronavirus pandemic has become an enormous challenge to this region, as they are low-cost regions. The Brazilian pharmaceutical industry is facing challenges of trying to contain the COVID-19 pandemic while dealing with enormous cost pressures. In Brazil, the rise in the dollar has made importing APIs more expensive and also there is increase in logistics costs, due to the reduction in air traffic, with the consequent upsurge in freight costs. Additionally, there is also significant increase in the prices of raw materials, inputs and finished products. These factors are likely to have negative impact on the market.

Strategic insights for the South America Pharmaceutical Intermediates provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 997.56 Million |

| Market Size by 2028 | US$ 1,197.02 Million |

| Global CAGR (2021 - 2028) | 2.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Pharmaceutical Intermediates refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

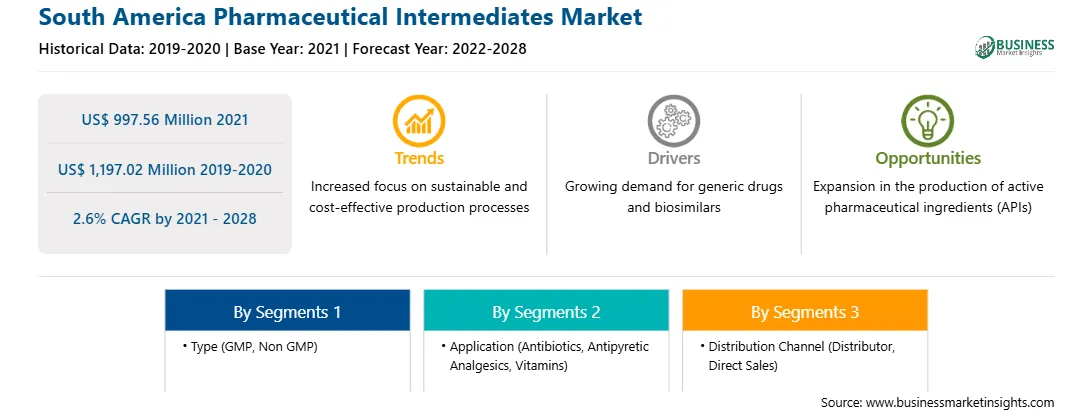

The pharmaceutical intermediates market in SAM is expected to grow from US$ 997.56 million in 2021 to US$ 1,197.02 million by 2028; it is estimated to grow at a CAGR of 2.6% from 2021 to 2028. Countries such as Argentina and Chile are emerging as attractive outsourcing locations for pharmaceuticals and biopharmaceuticals industries. Low manufacturing and operating costs in these countries are key factors driving the pharmaceutical manufacturing business in the region. Recent growth in the pharmaceutical industry indicate a positive outlook for the pharmaceutical intermediates market. Flourishing domestic pharmaceutical market in the region and increasing number of pipeline drugs are further opening new avenues for the contract manufacturers as well as generic drug manufacturing in the region. Additionally, to meet the growing demand, many contract-based organizations are expanding their manufacturing capabilities, further boosting the growth of the market. Thus, the emerging markets hold high potential and huge revenue generation opportunities for the pharmaceutical manufacturing companies across SAM region.

The SAM pharmaceutical intermediates market is segmented on the bases of type, application, distribution channel, and country. Based on type, the market is segmented into GMP and Non GMP. The GMP segment dominated the market in 2020 is expected to be the fastest growing during the forecast period. On the basis of application, the pharmaceutical intermediates market is segmented into antibiotics, antipyretic analgesics, vitamins, and others. The others segment dominated the market in 2020 and vitamins segment is expected to be the fastest growing during the forecast period. On the basis of distribution channel, the pharmaceutical intermediates market is segmented into distributor and direct sales. The direct sales segment dominated the market in 2020 and distributor segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on the pharmaceutical intermediates market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE; chiracon GmbH; Codexis; Dishman Carbogen Amcis Ltd; Midas Pharma GmbH; Pfizer Inc.; and Sanofi are among others.

The South America Pharmaceutical Intermediates Market is valued at US$ 997.56 Million in 2021, it is projected to reach US$ 1,197.02 Million by 2028.

As per our report South America Pharmaceutical Intermediates Market, the market size is valued at US$ 997.56 Million in 2021, projecting it to reach US$ 1,197.02 Million by 2028. This translates to a CAGR of approximately 2.6% during the forecast period.

The South America Pharmaceutical Intermediates Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Pharmaceutical Intermediates Market report:

The South America Pharmaceutical Intermediates Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Pharmaceutical Intermediates Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Pharmaceutical Intermediates Market value chain can benefit from the information contained in a comprehensive market report.