In pharmaceutical and biopharmaceutical product manufacturing, contamination prevention is a crucial part of the process. The proper handling and storage of fluids are essential to limit the possibility of contamination. Facility layout helps determine the method used by companies to handle fluid transfer and storage. The growing adoption of single-use systems (SUS) reduces product cross-contamination and eliminates the need for cleaning between batches, hence improving efficiency. The SUSs are made in a cleanroom; they are double bagged, and gamma, ethylene oxide, or x-ray methods are used to ensure a sterile system for every batch. During the development of several pharmaceutical products such as vaccines, monoclonal antibodies, and personalized medicines, SUS is used as it offers a faster, simpler, and less expensive manufacturing process. Due to the rising prevalence of chronic diseases, there is a growing demand for effective drugs and products. Hence, companies are increasingly opting for SUS because it enhances the efficiency of processes and reduces costs related to cleaning, sterilization, and maintenance. In addition, low risk of contamination and low water consumption are a few factors supporting the pharmaceutical fluid handling market growth. The market growth is also attributed to increased company activities and rapid adoption of various business strategies such as collaborations, partnerships, and product launches. Thus, the increased use of SUS in the production and transfer of sterile fluids is driving the growth of the South America pharmaceutical fluid handling market.

The South America pharmaceutical fluid handling market is segmented into Brazil, Argentina, and the Rest of South America. The market growth in this region is due to the rise of new drug discoveries and key companies' product offerings. Brazil dominated the South America pharmaceutical fluid handling market. Several associations in Brazil such as the Brazilian Association of Generic Medicines Industries (PróGenlicos) and FarmaBrasil Group (GFB) state that the country can produce ~75% of the total demand for medicines. Brazil’s 70% of pharmaceutical business is dependent on imports of pharmaceutical products. Therefore, the demand for pharmaceutical intermediates is expected to increase in the country. In addition, the companies associated with FarmaBrasil Group have commitments because of the Partnerships for Productive Development (PDPs) to produce medicines domestically, including bevacizumab, palivizumab, infliximab, betainterferone 1A, and insulin, among others. Thus, it is expected that such strategic initiatives toward domestic production would increase the demand for pharmaceutical intermediates, which is likely to support the South America pharmaceutical fluid handling market growth in the coming years.

Strategic insights for the South America Pharmaceutical Fluid Handling provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

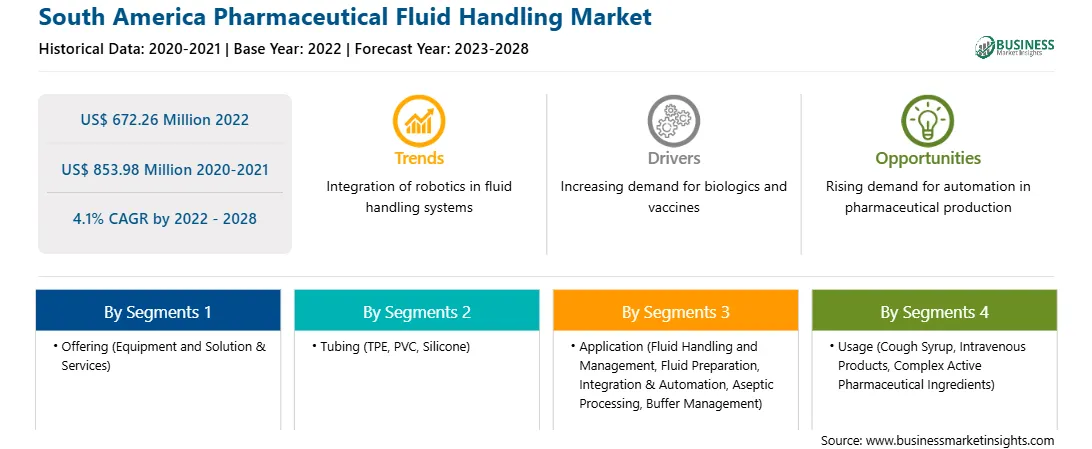

| Market size in 2022 | US$ 672.26 Million |

| Market Size by 2028 | US$ 853.98 Million |

| Global CAGR (2022 - 2028) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Pharmaceutical Fluid Handling refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The South America pharmaceutical fluid handling market is segmented into offering, tubing, application, usage, end user, and country. Based on offering, the South America pharmaceutical fluid handling market is segmented into equipment & solutions and services. The equipment segment registered a larger market share in 2022.

Based on tubing, the South America pharmaceutical fluid handling market is segmented into TPE, PVC, and silicon. The silicon segment registered the largest market share in 2022.

Based on application, the South America pharmaceutical fluid handling market is segmented into fluid handling and management, fluid preparation, integration and automation, aseptic processing, buffer management, and others. The fluid handling and management segment registered the largest market share in 2022.

Based on usage, the South America pharmaceutical fluid handling market is segmented into cough syrup, intravenous products, complex active pharmaceutical ingredients (APIs), and others. The cough syrup segment registered the largest market share in 2022.

Based on end user, the South America pharmaceutical fluid handling market is segmented into biotechnology companies, pharmaceutical and medical companies, and others. The biotechnology companies segment registered the largest market share in 2022.

Based on country, the South America pharmaceutical fluid handling market is segmented into Brazil, Argentina, and the Rest of South America. Brazil registered the largest market share in 2022.

CIRCOR International Inc, Danaher Corp, Merck KGaA, Parker Hannifin Corp, RAUMEDIC AG, Rochling SE & Co KG, Spirax Sarco Engineering plc, and Tef Cap Industries Inc are the leading companies operating in the South America pharmaceutical fluid handling market.

The South America Pharmaceutical Fluid Handling Market is valued at US$ 672.26 Million in 2022, it is projected to reach US$ 853.98 Million by 2028.

As per our report South America Pharmaceutical Fluid Handling Market, the market size is valued at US$ 672.26 Million in 2022, projecting it to reach US$ 853.98 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The South America Pharmaceutical Fluid Handling Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Pharmaceutical Fluid Handling Market report:

The South America Pharmaceutical Fluid Handling Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Pharmaceutical Fluid Handling Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Pharmaceutical Fluid Handling Market value chain can benefit from the information contained in a comprehensive market report.