Rising Demand and Emphasis on Co-Processed Excipients is fueling the growth of South America pharmaceutical excipients market

Formulation scientists have recognized that single-component excipients do not always provide the requisite performance to allow certain APIs to be manufactured adequately. These scientists focus on producing co-processed and multifunctional excipients with enhanced performance. Co-processed excipients are a mixture of two or more existing excipients at the sub-particle level, offering substantial benefits of the incorporated excipients and minimizing their drawbacks. These multipurpose excipients have dramatically reduced the number of incorporating excipients in the tablet. The co-processed excipients are used to improve the drug's flow, disintegration, lubrication, and compressibility. The excipients also simplify the formulation process and make it cost-effective. They are increasingly used to convert complicated and labor-intensive formulation processes, such as wet granulation, to quick direct-compression processes, without affecting the final product quality or performance. Co-processed excipients play a crucial role in creating a stable, result-oriented drug delivery system with enhanced chemical, physical, and mechanical properties. The companies are focusing on developing co-processed excipients for drug formulations. For instance, in July 2021, DFE Pharma launched a co-processed excipient, Pharmacel sMCC 90, silicified microcrystalline cellulose (MCC). It has been developed as the synergistic solution for challenging oral solid dosage formulations. A co-processed excipient is a promising tool in the production of pharmaceutical products. Existing co-processed adjuvants cannot fulfill all the needs for the preparation of various novel formulations. There is also enough space for the production of new co-processed excipients to satisfy the demand of the pharmaceutical industries, which is expected to act as an opportunity for the growth of the South America pharmaceutical excipients market during the forecast period.

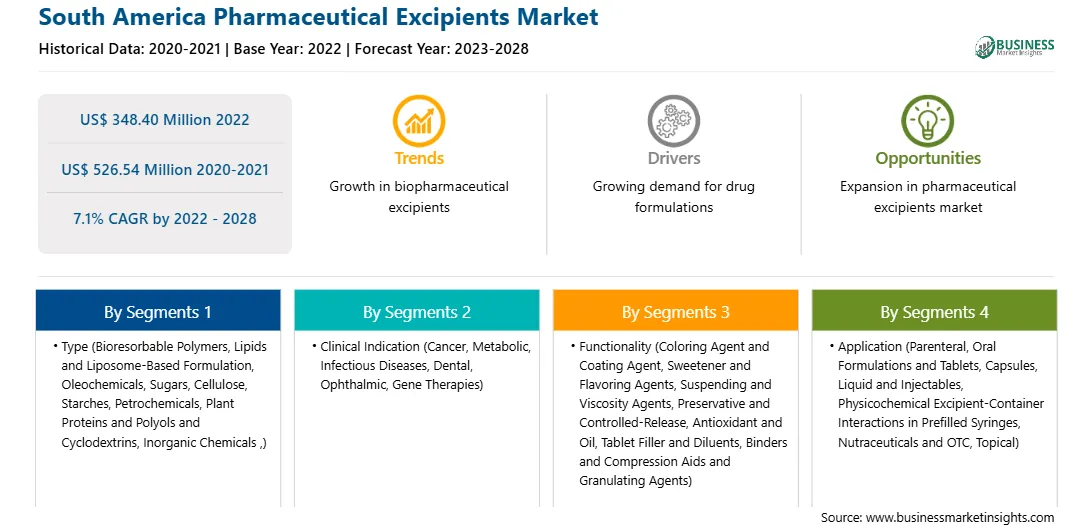

South America Pharmaceutical Excipients Market Overview

South America includes Argentina and Brazil. The pharmaceutical excipients market in the region is expected to have growth opportunities in both countries. Growing geriatric population in both countries and increasing prevalence of chronic diseases are driving the market. Moreover, developments in the healthcare industry and a rise in research and development in the pharmaceutical sector are likely to foster the market’s growth during the forecast period. Hence, the need for functional excipients is growing across the country, driving the pharmaceutical excipients market in the country. Brazil is the fifth-largest country globally by area and population. The country is experiencing the fastest demographic aging and a rise in the prevalence of noncommunicable Diseases (NCD), which is expected to serve wider growth opportunities for the market. For instance, in 2020, the elderly population accounted for 30.1 million, about 14.3% of the population. In addition, as per the Brazil Statistical Institute, people aged 65 and above are expected to reach 36% by 2050. As the geriatric population in Brazil grows, it leads to an increased incidence of various health illnesses such as lifestyle heart disorders and other cardiovascular diseases, which may lead to increased morbidities and demand for services in the healthcare system. Most companies are increasing their presence in the Brazilian market to capture the significant potential available in the pharmaceutical excipients market.

Strategic insights for the South America Pharmaceutical Excipients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 348.40 Million |

| Market Size by 2028 | US$ 526.54 Million |

| Global CAGR (2022 - 2028) | 7.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Pharmaceutical Excipients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

South America Pharmaceutical Excipients Market Segmentation

The South America pharmaceutical excipients market is segmented into type, clinical indication, functionality, application, end user, and country. Based on type, the South America pharmaceutical excipients market is segmented into bioresorbable polymers & lipids & liposome-based formulation, oleochemicals, sugars, cellulose, starches, petrochemicals, plant protein & polyols & cyclodextrins, inorganic chemicals, and others. The plant protein & polyols & cyclodextrins segment registered the largest market share in 2022.

Based on clinical indication, the South America pharmaceutical excipients market is segmented into cancer, metabolic, infectious diseases, dental, ophthalmic, gene therapies, and others. The cancer segment registered the largest market share in 2022.

Based on functionality, the South America pharmaceutical excipients market is segmented into coloring agent & coating agents, sweetener & flavoring agents, suspending & viscosity agents, preservative & controlled-release, antioxidant & oil, tablet filler & diluents, binders & compression aids & granulating agents, emulsifiers, and others. The tablet filler and diluents segment registered the largest market share in 2022.

Based on application, the South America pharmaceutical excipients market is segmented into parenteral, orals formulations & tablets, capsules, liquid & injectable, physicochemical excipient container interactions in prefilled syringes, nutraceuticals & OTC, topical, and others. The orals formulations & tablets segment registered the largest market share in 2022.

Based on end user, the South America pharmaceutical excipients market is segmented into biopharma industries, pharma industries, animal health, and others. The pharma industries segment registered the largest market share in 2022.

Based on country, the South America pharmaceutical excipients market is segmented into Brazil, Argentina, and the Rest of South America. Saudi Arabia dominated the market in 2022.

Archer-Daniels-Midland Co, AshLand Inc, Avantor Inc, BASF SE, Evonik Industries AG, JRS PHARMA GmbH & Co. KG, MEGGLE GmbH & Co KG, Roquette Freres SA, The Dow Chemical Co, and The Lubrizol Corp are among the leading companies operating in the South America pharmaceutical excipients market.

The South America Pharmaceutical Excipients Market is valued at US$ 348.40 Million in 2022, it is projected to reach US$ 526.54 Million by 2028.

As per our report South America Pharmaceutical Excipients Market, the market size is valued at US$ 348.40 Million in 2022, projecting it to reach US$ 526.54 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The South America Pharmaceutical Excipients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Pharmaceutical Excipients Market report:

The South America Pharmaceutical Excipients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Pharmaceutical Excipients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Pharmaceutical Excipients Market value chain can benefit from the information contained in a comprehensive market report.