The automotive manufacturing sector in the SAM region is witnessing growth owing to the presence of many OEM and automakers in the region. Brazil benefits from being a potentially large domestic market with low vehicle ownership and a growing economy. Moreover, the growing automotive production is supporting the growth of the overhead console market in the region. As per OICA, Brazil witnessed a growth of 2.2% Y-o-Y in the total vehicle production in 2019 and produced 2,448,490 cars before the outbreak of COVID-19. Moreover, the region has the presence of major automakers such as General Motors, Volkswagen, Hyundai, Ford, Toyota, Peugeot, and Renault. The national regulatory bodies of various countries in the region have realized the importance of the automotive sector and are taking initiatives for the development of the automotive industry. For instance, the Brazilian government has formulated favorable trade investment policies to encourage private investments. The government has also made provisions to give investor exemption from custom duties and other taxes on the purchase of certain infrastructure and capital goods. In 2017, the Argentine President Mauricio Macri announced a 1 Million Plan for the automotive industry, under which the country aimed to produce 750,000 cars annually by 2019 and one million units annually by 2023. Therefore, the government initiatives to support the growth of the automotive sector would strengthen the automotive manufacturing industry in the region, which is likely to support the growth of the overhead console market in the region.

In SAM, Brazil has witnessed the highest number of COVID-19 cases, followed by Argentina, Peru, Chile, and Ecuador. Governments have been imposing travel restrictions, lockdowns, and trade bans to contain the spread of virus. Thus, the COVID-19 pandemic has been severely affecting the overhead console’s market growth in this region. Governments need to consider waste management as an urgent and essential public service to respond to emergencies such as the COVID-19 outbreak, to minimize possible secondary impacts upon health and the environment. Response measures need to consider the sudden demand once the pandemic ends. However, recent relaxations in lockdown and arrangement of large-scale vaccination drives would help the economies to bounce back, which would allow industries to regain their operations in the next few quarters

Strategic insights for the South America Overhead Console provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

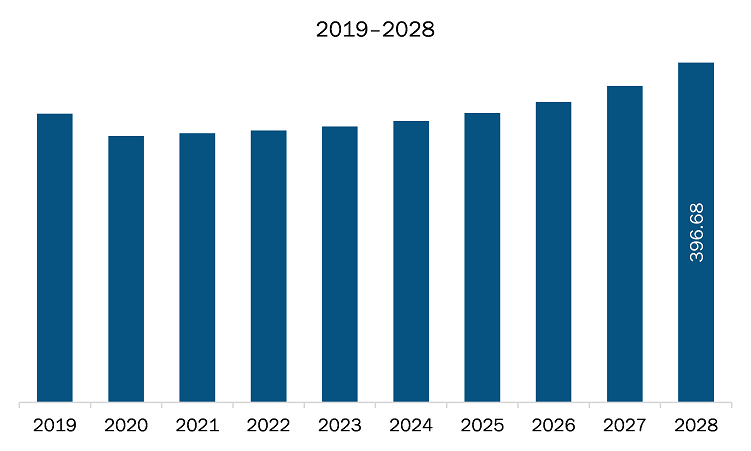

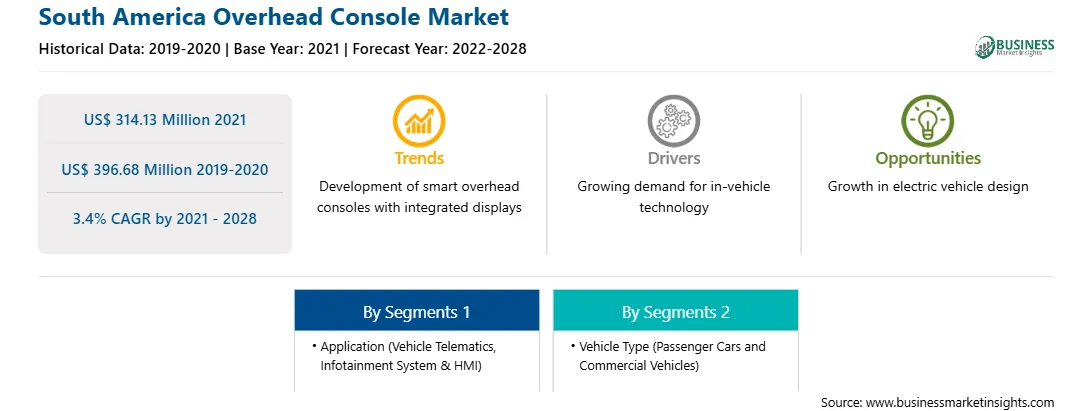

| Market size in 2021 | US$ 314.13 Million |

| Market Size by 2028 | US$ 396.68 Million |

| Global CAGR (2021 - 2028) | 3.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Overhead Console refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The overhead console market in South America is expected to grow from US$ 314.13 million in 2021 to US$ 396.68 million by 2028; it is estimated to grow at a CAGR of 3.4% from 2021 to 2028. The integration of advanced technologies, such as artificial intelligence (AI), is gaining popularity worldwide. AI has its applications in the automotive industry, such as in advanced driver-assistance systems (ADAS) that reacts faster than a human driver. It demands embedded vision to offer real-time analysis of the streaming video, which are visible to the driver through overhead consoles. The integration of AI with the overhead consoles delivers driver-assist and fully autonomous mode functionality to the users. Further, the application of AI cloud platforms enhances the data accessibility whenever required. The advance technology constantly monitors several sensors and detects issues even before they affect the vehicle operation and are displayed in overhead consoles to the drivers. The integration of AI also helps for Blind Spot Detection (AI BSD), by efficiently scanning the blind spots of the vehicle and display alerts to the driver in the overhead consoles when action is required.

In terms of application, the others segment accounted for the largest share of the South America overhead console market in 2020. In terms of vehicle type, the Passenger vehicle segment held the larger market share of the overhead console market in 2020.

A few major primary and secondary sources referred to for preparing this report on the overhead console market in South America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Flex Ltd.; Grupo Antolin; Hella GmbH & Co. KGAA; Magna International Inc.; and Yanfeng Automotive Interiors among others.

The South America Overhead Console Market is valued at US$ 314.13 Million in 2021, it is projected to reach US$ 396.68 Million by 2028.

As per our report South America Overhead Console Market, the market size is valued at US$ 314.13 Million in 2021, projecting it to reach US$ 396.68 Million by 2028. This translates to a CAGR of approximately 3.4% during the forecast period.

The South America Overhead Console Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Overhead Console Market report:

The South America Overhead Console Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Overhead Console Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Overhead Console Market value chain can benefit from the information contained in a comprehensive market report.