The offshore pipeline, often known as, submarine or subsea pipeline is used for the transportation of oil, gas, and refined products. The SAM offshore pipeline market is increasingly gaining traction on account of higher efficiency and large capacity. In addition to this, the offshore pipeline provides faster, safer, and more reliable connectivity for oil and gas transportation. With the recovery of the crude oil markets across SAM region, companies are now looking for oil and gas. SAM will be at the center of offshore pipeline development in the next five years. The region's oil and gas pipeline industries are expected to see significant developments in the gas pipeline infrastructure, reflecting a strong pattern of high demand for crude oil. Natural gas pipelines are estimated to comprise more than 80 per cent of the pipelines installed. The increasing demand for cost-effective transportation method for oil and gas is one of the major factors that is expected to boost the demand for offshore pipeline in the oversea oil & gas sector across SAM region. Other factors such as refinement in flexible pipe technology and mounting demand for natural gas and crude oil across SAM region are expected to drive the SAM offshore pipeline market.

Moreover, in case of COVID-19, SAM is highly affected specially the Brazil, followed by Ecuador, Chile, Peru, and Argentina, among others. The COVID-19 pandemic continues to negatively affect the overall oil & gas industry owing to considerable disruption in the industry supply chain activities coupled with the SAM countries like the Brazil and Argentina sealing off their international trade in wake of the pandemic. Among the SAM countries, Brazil continues to occupy a dominant position in the region’s overall oil producing capabilities. The country also witnessed a major decline in its oil & gas related activities following the huge decline in oil prices and subsequent limited construction activities similar to other global market players. Thus, the country also registered a sharp decline in the demand for offshore pipelines owing to the outbreak of COVID-19 across the SAM region and subsequent lower business activities in the oil & gas sector. The coronavirus outbreak's impact is anticipated to be quite severe in the year 2020 and likely in 2021. Hence, the ongoing COVID-19 crisis and critical situation will impact the offshore pipeline market growth of the SAM region negatively for the next few quarters.

Strategic insights for the South America Offshore Pipeline provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

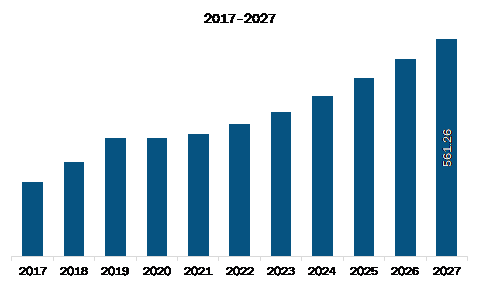

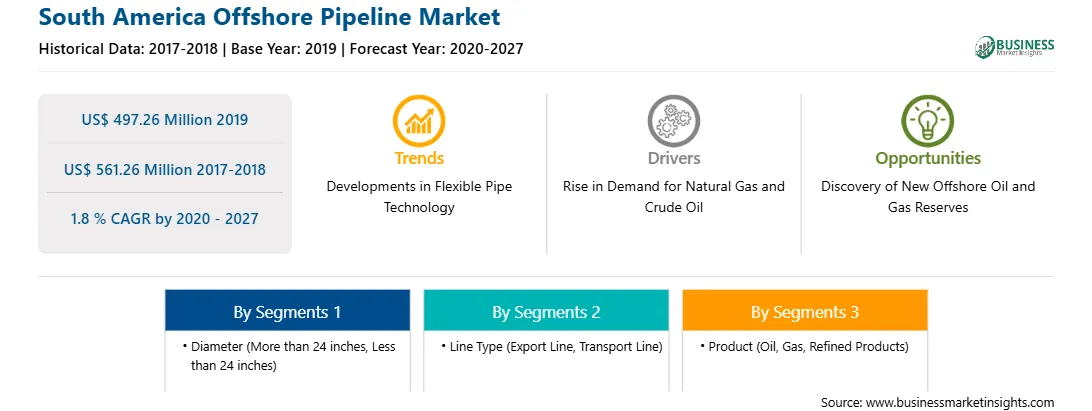

| Market size in 2019 | US$ 497.26 Million |

| Market Size by 2027 | US$ 561.26 Million |

| Global CAGR (2020 - 2027) | 1.8 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Diameter

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Offshore Pipeline refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM offshore pipeline market is expected to grow from US$ 497.26 million in 2019 to US$ 561.26 million by 2027; it is estimated to grow at a CAGR of 1.8 % from 2020 to 2027. Safe, cost-effective, and efficient connectivity requirement for pipelines is expected to upswing the SAM offshore pipeline market. Presently, several advancements in technology are taking place, intending to enhance the efficiency, safety, and reliability of offshore pipelines. For instance, the development of hydrate-phobic coating for the construction of methane hydrates in the deep sea. These crystals can develop inside underwater pipes and block the flow of oil & gas. Moreover, several companies across SAM region are focused on the development of innovative coatings, which would primarily evade corrosion of pipes. For instance, in April 2020, material scientists in across SAM region developed a super hydrophobic coating for offshore drilling pipes. The coating moderates or avoids hydrates as well as other deposits from cohering to subsea pipelines. Such developments focused on enhancing the robustness of offshore oil & gas pipelines are expected to surge investments in offshore pipelines compared to other modes of oil & gas transportation, thereby boosting the SAM offshore pipeline market.

In terms of diameter, the less than 24 inches’ segment accounted for the largest share of the SAM offshore pipeline market in 2019. In terms of line type, the transport line segment held a larger market share of the SAM offshore pipeline market in 2019. Further, the refined products segment held a larger share of the SAM offshore pipeline market based on product in 2019.

A few major primary and secondary sources referred to for preparing this report on the SAM offshore pipeline market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bechtel Corporation; Fugro; John Wood Group PLC; McDermott International, Inc.; Saipem S.p.A.; Sapura Energy Berhad; Subsea 7 S.A.; TechnipFMC plc.

Some of the leading companies are:

The South America Offshore Pipeline Market is valued at US$ 497.26 Million in 2019, it is projected to reach US$ 561.26 Million by 2027.

As per our report South America Offshore Pipeline Market, the market size is valued at US$ 497.26 Million in 2019, projecting it to reach US$ 561.26 Million by 2027. This translates to a CAGR of approximately 1.8 % during the forecast period.

The South America Offshore Pipeline Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Offshore Pipeline Market report:

The South America Offshore Pipeline Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Offshore Pipeline Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Offshore Pipeline Market value chain can benefit from the information contained in a comprehensive market report.