South America Microwave Transmission Equipment Market

No. of Pages: 120 | Report Code: TIPRE00022802 | Category: Electronics and Semiconductor

No. of Pages: 120 | Report Code: TIPRE00022802 | Category: Electronics and Semiconductor

The ongoing expansion of the automotive manufacturing sector in the South America region is attributed to the presence of market players in the region. Brazil is a potentially large domestic market and a growing economy. However, with time the country is witnessing rising demand of telecom and radar communication is supporting the growth of the microwave transmission equipment market in the region. According to a new study by Nokia and research firm Omdia, 5G technologies could bring up to $3.3 trillion to Latin America by 2035. Further, the need for better quality emergency communications encourages the deployment of network slices, a key feature of the coming versions of 5G. In the future, Industry 4.0, a large part of the new value creation offers the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines with 5G. In Chile, operators are also focusing on bundling packages of fast broadband and TV and keeping up the upgrade from asymmetric digital subscriber line to ultra-fast broadband to protect market share. For instance, the Brazilian government has formulated favourable trade investment policies to encourage private investments in varied industry vertical. The Brazilian government has also made provisions to give exemption to investors from custom duties and other taxes on the purchase of certain infrastructure and capital goods. Such government initiatives to support the growth of the ICT sector would strengthen the telecom industry in the region, which is expected to support the growth of the microwave transmission equipment market in the region in the coming years.

Strategic insights for the South America Microwave Transmission Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

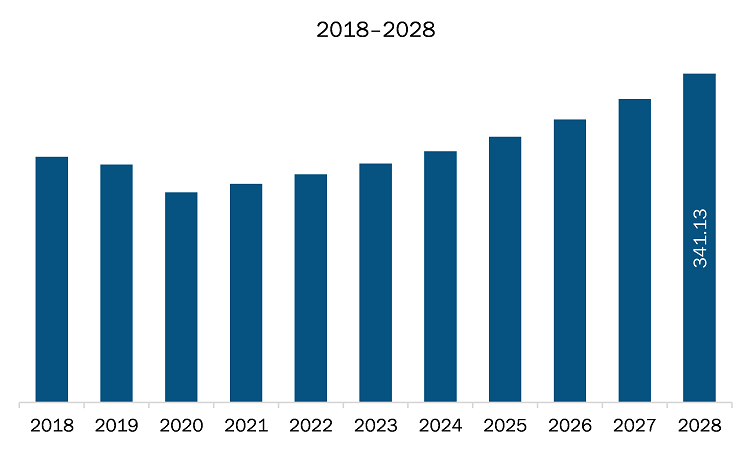

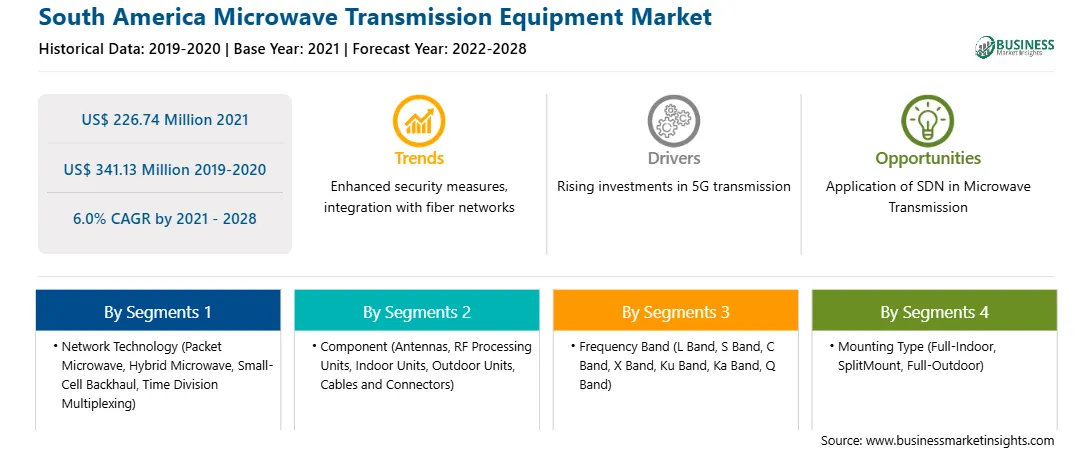

| Market size in 2021 | US$ 226.74 Million |

| Market Size by 2028 | US$ 341.13 Million |

| Global CAGR (2021 - 2028) | 6.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Network Technology

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Microwave Transmission Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Microwave Transmission Equipment Market in SAM is expected to grow from US$ 226.74 million in 2021 to US$ 341.13 million by 2028; it is estimated to grow at a CAGR of 6.0% from 2021 to 2028. Increased Focus on Deployment of 5G Networks. Governments of different countries are investing huge amounts in the improvement of corresponding internet and telecom infrastructure. Large-scale 5G deployments are expected to begin in high fiber penetration areas, such as China, Korea, Japan, and the US. Operators in Western SAM are offering a combination of microwave and fiber and are focusing on the launch of 5G. Using the same radio access technology for access and backhaul links, with dynamic spectrum sharing, is one of the options network operators have while deploying 5G. This can be used in conjunction with microwave backhaul, particularly in dense deployments with numerous small radio nodes. Several companies are heavily investing in 5G network deployment for high-speed internet. In September 2019, telecom companies such as Reliance Jio, Airtel, and Vodafone Idea, collectively, invested US$ 30.5 billion for the launch of 5G services in India. Additionally, in July 2020, SK Telecom, KT, and LG Uplus—South Korean mobile operators—announced the plans to invest a total of US$ 22 billion through 2022 to accelerate 5G infrastructure across the country. Further, Ericsson also invested in microwave technology in September 2019 to add 5G-ready microwave products to its market-leading MINI-LINK portfolio. Thus, increasing focus on deployment on the 5G network acts as a key trend in the microwave transmission equipment market. This is bolstering the growth of the microwave transmission equipment.

In terms of Frequency Band type, the C band segment accounted for the largest share of the SAM microwave transmission equipment in 2020. In terms of Component, type, the Outdoor Units (ODU) segment held a larger market share of microwave transmission equipment market in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM microwave transmission equipment are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are NEC Corporation

The South America Microwave Transmission Equipment Market is valued at US$ 226.74 Million in 2021, it is projected to reach US$ 341.13 Million by 2028.

As per our report South America Microwave Transmission Equipment Market, the market size is valued at US$ 226.74 Million in 2021, projecting it to reach US$ 341.13 Million by 2028. This translates to a CAGR of approximately 6.0% during the forecast period.

The South America Microwave Transmission Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Microwave Transmission Equipment Market report:

The South America Microwave Transmission Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Microwave Transmission Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Microwave Transmission Equipment Market value chain can benefit from the information contained in a comprehensive market report.