Rising need for electricity across the SAM is expected to drive the medium voltage cable market. Growth in urban population, particularly in developing economies, has resulted in increased construction activities in commercial, residential, industrial, and infrastructure sectors. This, in turn, is directly creating more demand for electricity generation and distribution, which is boosting the deployment of medium voltage cables for SAM region. Furthermore, rising focus on power generation through renewable energy sources has further resulted in development of new power grids as well as distribution lines. This, in turn, is bolstering the growth of the SAM medium voltage cable market. Technological developments have been directly impacting the economy of Brazil and Argentina. Due to their durability, medium voltage cables effortlessly provide desired outputs in applications in harsh environments in various industries. The region is highly focused on boosting its oil & gas sector to stay ahead in the global market. As per the International Energy Agency (IEA), expenditure on upstream SAM activities is set to rise due to the huge investment by SAM countries such as Brazil, Argentina, Venezuela, and Colombia. The increasing oil & gas production in Brazil, Bolivia, Colombia, and Peru is encouraging numerous firms to invest in this sector. Petrobras, a Brazil-based state-held oil firm, is expected to invest ~US$ 75.7 billion during the next five years to boost oil production. Factors such as technological advancement and renewal energy generation are expected to drive the SAM medium voltage cable market.

Moreover, in case of COVID-19, SAM is highly affected specially the Brazil which has the highest number of COVID-19 cases, followed by Peru, Chile, and Argentina, among others. The government of SAM countries has taken an array of actions to protect its citizens and contain COVID-19’s spread. The containment protocols have been implemented for the construction sector to ensure the safety of construction workers. However, some of the new protocols and restrictions require construction to continue if the project is considered critical. For instance, in Panama, the president placed an executive mandate to stop all construction for 30 days. In Chile, CODELCO stopped all projects and started reviewing all construction contracts individually to identify the next steps to follow. The coronavirus spread has resulted in the slowdown of the region's construction industry, which has negatively affected the growth of medium voltage cable in the region.

Strategic insights for the South America Medium Voltage Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

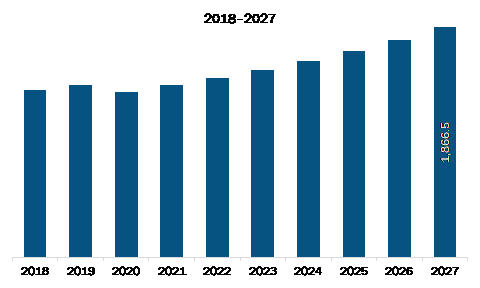

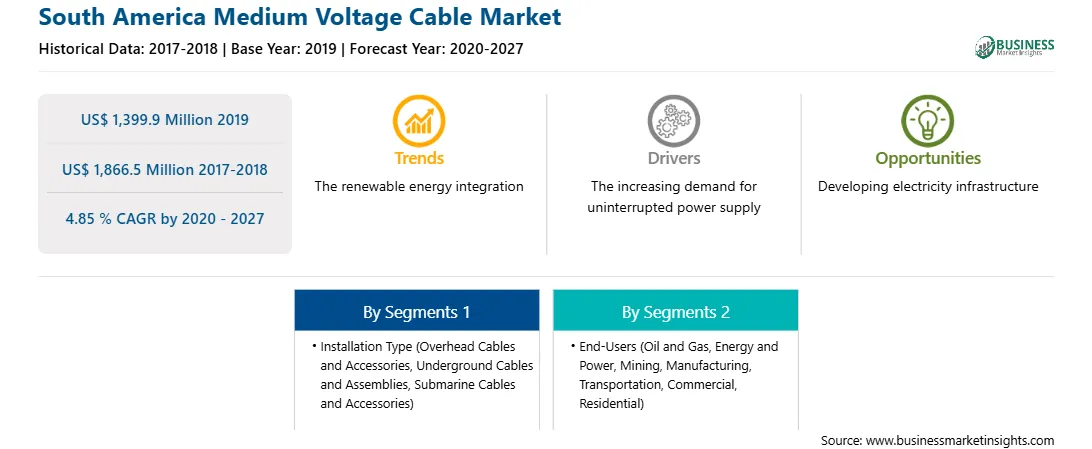

| Market size in 2019 | US$ 1,399.9 Million |

| Market Size by 2027 | US$ 1,866.5 Million |

| Global CAGR (2020 - 2027) | 4.85 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Installation Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Medium Voltage Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM medium voltage cable market is expected to grow from US$ 1,399.9 million in 2019 to US$ 1,866.5 million by 2027; it is estimated to grow at a CAGR of 4.85 % from 2020 to 2027. Detection of new oil & gas reserves is expected to accelerate the SAM medium voltage cable market. The discoveries of new oil & gas reserves have been witnessing exponential growth across SAM region. In 2019, the total recorded discoveries with over million barrels of oil, with offshore countries leading the new oil & gas deposits. In September 2020, one of the largest energy company in SAM, Equinor announced the discovery of new oil & gas fields. The company also announced the discovery of two oil fields. Furthermore, another company, in October 2020, Total and its partners announced to evaluate several development options for commercializing a new gas and condensate discovery. Such discoveries of new offshore oil & gas reserves are expected to boost the construction of new plants and electricity requirements for new offshore plants, thereby boosting the SAM medium voltage cable market.

In terms of installation type, the overhead cables and accessories segment accounted for the largest share of the SAM medium voltage cable market in 2019. In terms of end-users, the energy and power segment held a larger market share of the SAM medium voltage cable market in 2019.

A few major primary and secondary sources referred to for preparing this report on the SAM medium voltage cable market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Alpha Wire; Furukawa Electric Co. Ltd.; General Cable Technologies Corporation; LEONI AG; LS Cable & System Ltd.; Nexans; Sumitomo Electric Industries, Ltd.

The South America Medium Voltage Cable Market is valued at US$ 1,399.9 Million in 2019, it is projected to reach US$ 1,866.5 Million by 2027.

As per our report South America Medium Voltage Cable Market, the market size is valued at US$ 1,399.9 Million in 2019, projecting it to reach US$ 1,866.5 Million by 2027. This translates to a CAGR of approximately 4.85 % during the forecast period.

The South America Medium Voltage Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Medium Voltage Cable Market report:

The South America Medium Voltage Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Medium Voltage Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Medium Voltage Cable Market value chain can benefit from the information contained in a comprehensive market report.