SAM include Argentina, Brazil, and the rest of SAM. The market for medical affairs outsourcing in the region is expected to have growth opportunities in both countries. The government funding for the introduction of new Medical Affairs Outsourcing, rising investments in the healthcare sector, Cost efficiency and high level of quality offered by the CROs are projected to drive the medical affairs outsourcing market in Brazil and Argentina. Brazil is the fifth largest country in the world, both by area and by population. The rising spending in the healthcare sector and the pharmaceutical and medical device firms are outsourcing their medical affairs services in order to diverge their business activities and manage product life cycles, and rising demand for clinical trials and its outsourcing services are driving the growth of the medical affairs outsourcing Market in Brazil. Argentina is located in the far of southeast South America. Argentina was not well known as a CRO outsourcing destination until just a few years ago, but the combination of a reasonably good health care infrastructure (importantly including national clinical trial standards that are compatible with international norms) and relative ease of patient recruitment has led to rapid growth in the Argentine CRO industry since 2008. A number of multinational CROs such as Activa, Blanchard &Asociados, Charles River Laboratories, Covance Inc., EGCP, Klixar, LatinClin, and Quintiles already have operations in Argentina (including many recent mergers and acquisitions of local CROs). These companies focus on providing clinical trial services ranging from regulatory consultation to project management and data analysis. Healthcare in Argentina is widely considered to be the highest quality in all Latin American countries. This is likely to provide a conductive scenario for the growth of the medical affairs outsourcing market in the country.

On February 26, 2020, the first case of COVID-19 was detected in Brazil's São Paulo. Since then, the governments in this region have taken various steps to protect their people and reduce the spread of COVID-19. By July 26, Latin America was the region with the highest number of reported cases worldwide, accounting for more than a quarter of the world's cases. South America registered 16,810,346 cases as of February 12, 2021. On June 11, the Government of Sao Paulo, Brazil's Instituto Butantan, signed an agreement with the Chinese laboratory Sinovac Biotech to develop an experimental vaccine against COVID-19. On December 10, President Alberto Fernández launched a national vaccination initiative to distribute 60 million doses in the first six months of 2021. Older people, health care staff, and military personnel will be among the first to obtain immunization. The President also announced an initial procurement of 600,000 Russian Sputnik V vaccine doses to vaccinate 300,000 Argentinians.

Outsourcing is very local in Latin America. Latin America has always been known for its legal and regulatory knowledge, language skills, and compatible time zone with America. Latin America is not caught up with inflation regarding total cost, which promotes a powerful value proposition of providing cost-effective services. When it comes to Spanish and Portuguese language skills, Latin America is probably the only region globally that offers the combination of language skills at scale plus cost savings. This works in favor of US markets due to the huge Spanish population present in the US. Global companies are gaining several regional and business opportunities, especially in large countries such as Brazil and Argentina, where the domestic market is also large (nearly 60–70%). With established regional markets and promises of lower costs, Latin America is considered the fastest-growing destination for offshore services in the healthcare industry.

Strategic insights for the South America Medical Affairs Outsourcing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 78.83 Million |

| Market Size by 2027 | US$ 157.45 Million |

| Global CAGR (2020 - 2027) | 10.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Services

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Medical Affairs Outsourcing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

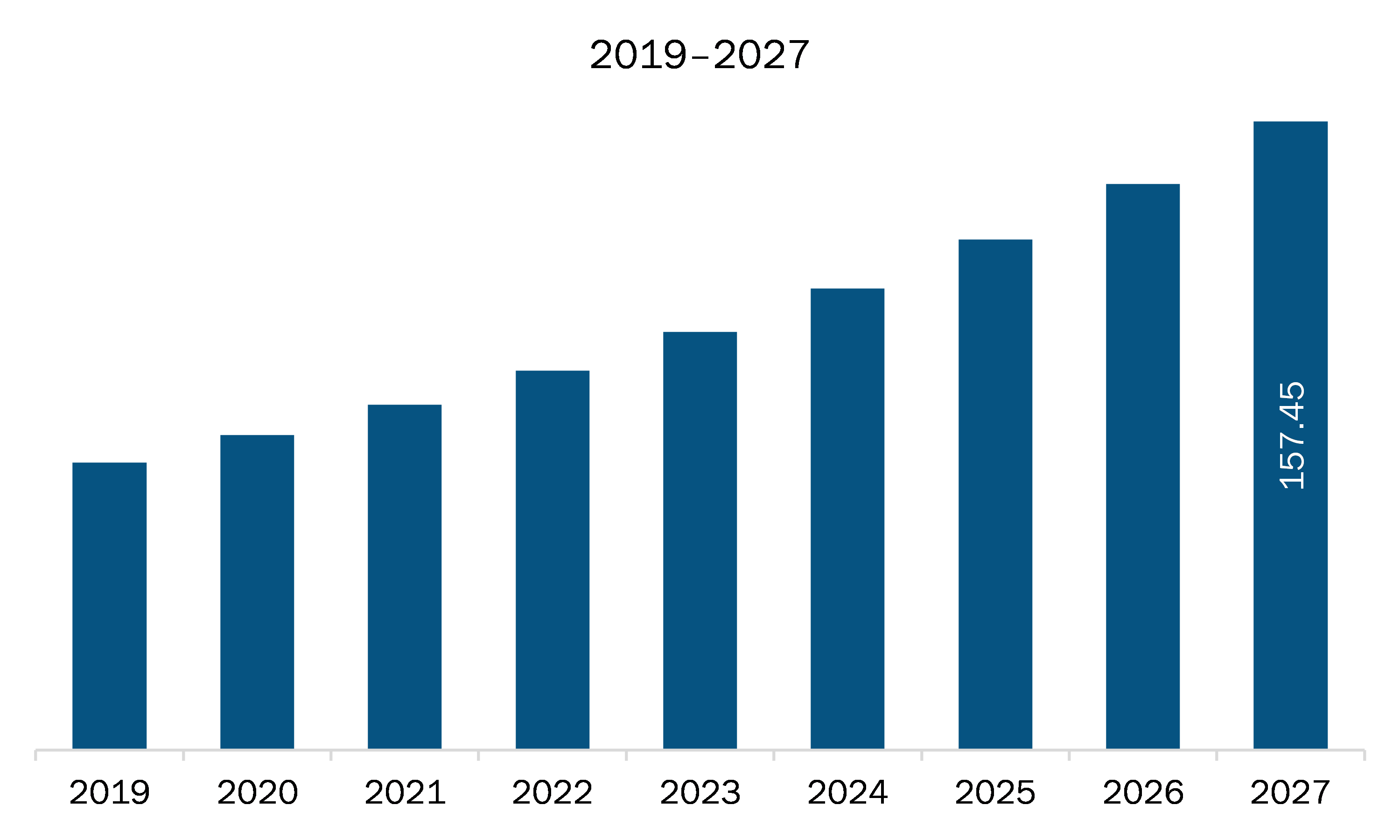

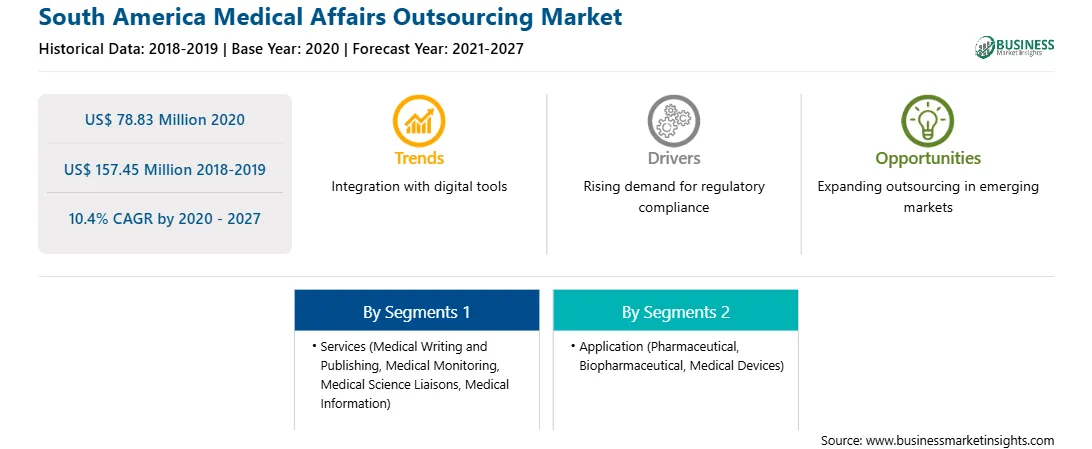

The medical affairs outsourcing market in SAM is expected to grow from US$ 78.83 million in 2020 to US$ 157.45 million by 2027; it is estimated to grow at a CAGR of 10.4% from 2020 to 2027. Some of the prominent countries contributing to the growth of male infertility market include Chile, Colombia, Peru, and Bolivia. Escalating research and developments undertakings, coupled with growing spending in the healthcare sector, and Changes in reimbursement scenario and pricing pressure are the factors responsible for the growth of the market. pharmaceutical companies as well as medical device companies are increasing adopting the outsourcing trend in order to reduce expenses. Outsourcing clinical trial services make the tedious process easier, faster, and cheaper thereby increasing the manufacturing processes as well as allowing medical device and pharmaceutical companies to divert their focus on revenue generating areas such as distribution, sales and marketing. Additionally, increasing pressure on the pharmaceutical and medical device giants to improve the return of their investments is further encouraging the outsourcing activities is likely to propel the growth of medical affairs outsourcing market during the forecast years.

SAM medical affairs outsourcing market is segmented into services, application, and country. The SAM medical affairs outsourcing market, by services, is segmented into medical writing and publishing, medical monitoring, medical science liaisons (MSLs), medical information, and others. The medical writing and publishing segment held the largest share of the market in 2019. Based on application, the SAM medical affairs outsourcing market is segmented into pharmaceutical, biopharmaceutical, and medical devices. The medical devices market is further segmented into therapeutic medical devices, and diagnostic medical devices. The pharmaceutical segment held the largest share of the market in 2019. Based on country, the SAM medical affairs outsourcing market is segmented into Brazil, Argentina, and rest of SAM. Brazil held the largest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the medical affairs outsourcing market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ICON PLC, IQVIA Inc, PAREXEL INTERNATIONAL CORPORATION, PPD Inc,

The South America Medical Affairs Outsourcing Market is valued at US$ 78.83 Million in 2020, it is projected to reach US$ 157.45 Million by 2027.

As per our report South America Medical Affairs Outsourcing Market, the market size is valued at US$ 78.83 Million in 2020, projecting it to reach US$ 157.45 Million by 2027. This translates to a CAGR of approximately 10.4% during the forecast period.

The South America Medical Affairs Outsourcing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Medical Affairs Outsourcing Market report:

The South America Medical Affairs Outsourcing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Medical Affairs Outsourcing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Medical Affairs Outsourcing Market value chain can benefit from the information contained in a comprehensive market report.