The South American economy that includes more than 10 countries, is extremely diverse. Brazil, Argentina, and Chile are among the major contributors to the economy of this region. Compared to the Caribbean and other eastern countries in the region, the western countries in the region are more advanced. As a result, the western part of SAM experiences more innovations and advancements, especially in automation technologies. Over the next decade, Brazil is expected to be the epicenter of new liquefied natural gas (LNG) demand in Latin America. In Brazil, gas remains the transition fuel as it provides for the greatest penetration of wind and solar energy. In Brazil, natural gas power is mostly utilized as a backup for hydropower, and the benefit of LNG over other supply choices is its flexibility. Further, Argentina and Chile, having developed four regasification facilities in the first decade of the century, will experience a growing demand for LNG imports as well as an optimization of existing infrastructure. With the rising demand for LNG in the region, storage tank manufacturers will have a unique chance to design long-lasting tanks for importing gas from other nations.

Brazil has the third highest number of COVID-19 cases in the SAM, countries including Colombia, Ecuador, Chile, Peru, and Argentina, among others are also witnessing the adverse impacts of the pandemic across various industries. The COVID-19 pandemic has led to the closure of all economic activities across the region, to combat the spread of the virus. The country also witnessed a major decline in its oil & gas related activities following the huge decline in gas prices and subsequent limited manufacturing activities like other global market players. Thus, the country also registered a sharp decline in the demand for LNG storage tanks owing to the outbreak of COVID-19 across the Latin American region and subsequent lower business activities in the oil & gas sector. Moreover, shutdown of business activities, lockdowns, and trade bans has negatively impacted the LNG storage tanks market in the region.

Strategic insights for the South America LNG storage tank provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

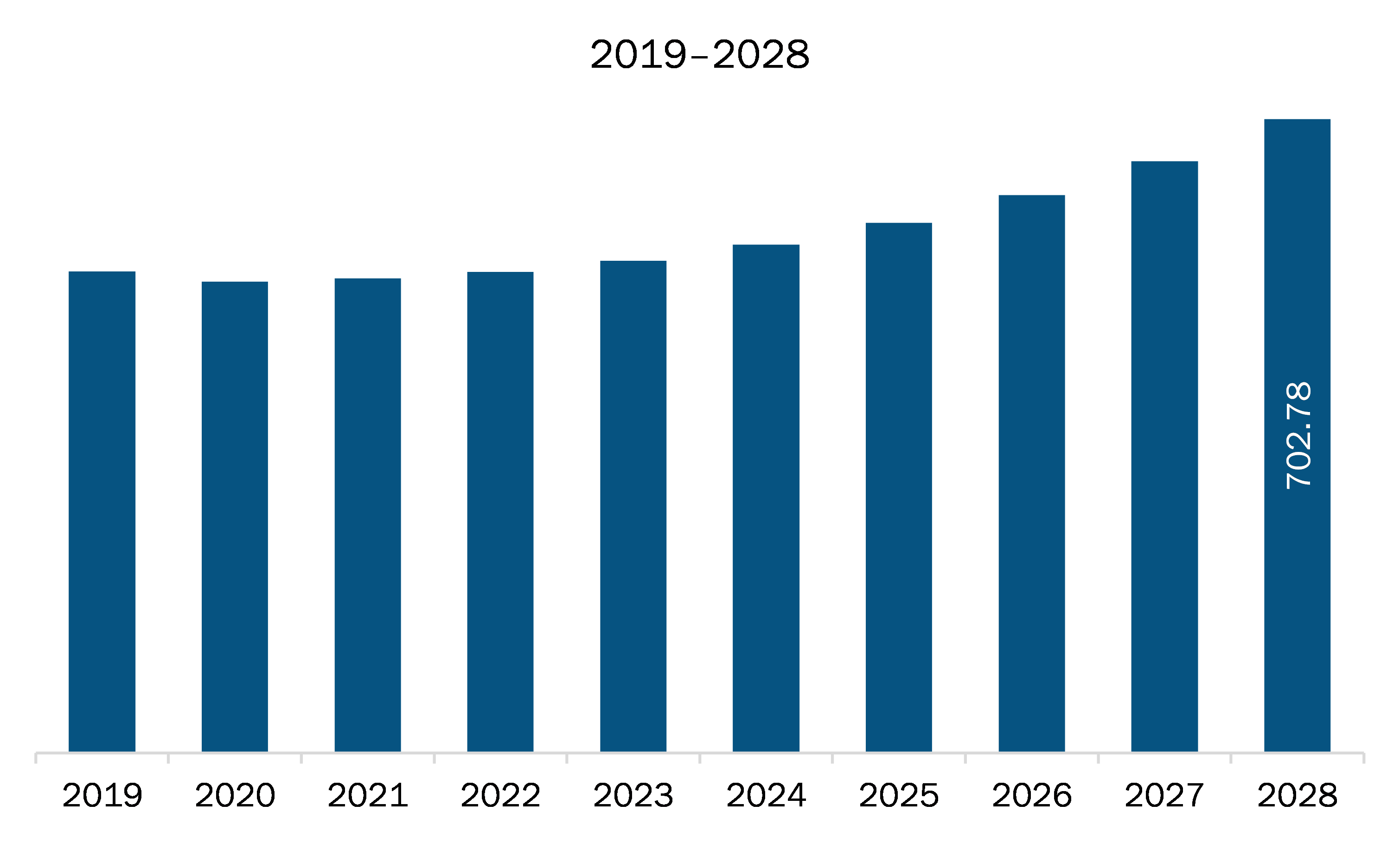

| Market size in 2021 | US$ 526.18 Million |

| Market Size by 2028 | US$ 702.78 Million |

| Global CAGR (2021 - 2028) | 4.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Configuration

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America LNG storage tank refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The LNG storage tank market in SAM is expected to grow from US$ 526.18 million in 2021 to US$ 702.78 million by 2028; it is estimated to grow at a CAGR of 4.2% from 2021 to 2028. The accentuating liquefied natural gas (LNG) trade across the SAM and rising number of floating storage and regasification units are anticipated to boost the LNG storage tanks market. Moreover, rising infrastructure development across different economies such as Brazil creates enormous opportunities for marine transport to grow during the forecast period. Further, the rapid population growth is one of the driving factors supporting the increase in demand for LNG as a fuel, thus propelling the LNG carrier's demand for transportation. In addition, several governments of the countries are proposing different regulations for reducing emissions; therefore, the adoption of LNG is expected to rise prominently.

The SAM LNG storage tank market is segmented on the bases of configuration, type, material, and country. Based on configuration the SAM LNG storage tank market is segmented into self-supporting tank and non-self-supporting tank. The self-supporting tank segment is the most used configuration in the LNG storage tanks market in 2020. Based on type, the market is segmented into LNG carrier, and LNG fuelled vessel. LNG carrier segment held the largest market share in 2020. Similarly, based on materials, the market is segmented into stainless steel, aluminum alloy, 9% nickel steel, invar alloy, C-MN steel, others. Stainless steel segment held the largest market share in 2020. Based on country the SAM LNG storage tank market is segmented Into Brazil and rest of SAM.

A few major primary and secondary sources referred to for preparing this report on the LNG storage tank market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Air Water Inc.; Chart Industries, Inc.; Cryolor; IHI Corporation; ISISAN AS; Linde Plc; McDermott International, Inc and Wartsila Corporation.

The South America LNG storage tank Market is valued at US$ 526.18 Million in 2021, it is projected to reach US$ 702.78 Million by 2028.

As per our report South America LNG storage tank Market, the market size is valued at US$ 526.18 Million in 2021, projecting it to reach US$ 702.78 Million by 2028. This translates to a CAGR of approximately 4.2% during the forecast period.

The South America LNG storage tank Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America LNG storage tank Market report:

The South America LNG storage tank Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America LNG storage tank Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America LNG storage tank Market value chain can benefit from the information contained in a comprehensive market report.