Government Initiatives to Fuel Lighting Contactor Uptake

The governments of countries all over the region are introducing various initiatives.In March 2022, the Global Infrastructure Facility (GIF) collaborated with the Federal Government of Brazil and World Bank Group to launch a ‘Street Lighting Structuring Guide.’ Under this program, the GIF will assist public administrators in structuring street lighting projects for 10 Brazilian municipalities. Such government initiatives will increase the installation of lights and, consequently, the demand for lighting contactors over the forecast period.

Market Overview

SAM lighting contactor market comprises Brazil, Argentina, and the Rest of SAM. Brazil is the region’s fastest-growing country. The country has over 18 million light points and service penetration of around 95% of the residential sector. Under the “Smart Rio Project,” approximately 4, 50,000 street lights will be replaced by LED bulbs in Rio de Janeiro. According to the United Nations Framework Convention on Climate Change (UNFCCC), the City of Buenos Aires, Argentina, ties up with Philips. This deal enables the company to provide its ICT solution, which will help the city remotely monitor and control 72% of the network of streetlights. With this deal, 91,000 streetlights will be replaced by LED lights. In May 2021, Anern, a solar lights producer, provided its all-in-one solar streetlights for South America’s Porsche center parking lot under the “120W all in one Solar Panel Parking Lot Light Project”. Such initiatives and projects increase the installation of lights which will subsequently increase the demand for lighting contactors and drive the lighting contactors market in the region during the forecast period.

Strategic insights for the South America Lighting Contactor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Lighting Contactor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Lighting Contactor Strategic Insights

South America Lighting Contactor Report Scope

Report Attribute

Details

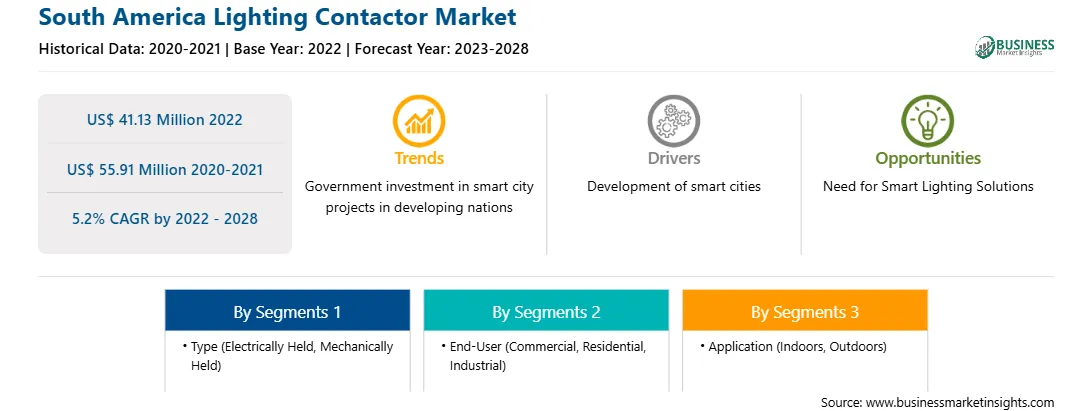

Market size in 2022

US$ 41.13 Million

Market Size by 2028

US$ 55.91 Million

Global CAGR (2022 - 2028)

5.2%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By End-User

By Application

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Lighting Contactor Regional Insights

SAM Lighting Contactor Market Segmentation

The SAM lighting contactor market is segmented into type, end user, application, and country.

ABB Ltd.; Eaton; Hager Group; Hitachi Industrial Equipment Systems Co., Ltd; Ripley Lighting Controls; Rockwell Automation, Inc.; Schneider Electric SE; and Siemens AG are the leading companies operating in the lighting contactor market in the region.

The South America Lighting Contactor Market is valued at US$ 41.13 Million in 2022, it is projected to reach US$ 55.91 Million by 2028.

As per our report South America Lighting Contactor Market, the market size is valued at US$ 41.13 Million in 2022, projecting it to reach US$ 55.91 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The South America Lighting Contactor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Lighting Contactor Market report:

The South America Lighting Contactor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Lighting Contactor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Lighting Contactor Market value chain can benefit from the information contained in a comprehensive market report.