IR spectroscopy market in South America is segmented into Brazil and Argentina. Despite many economic challenges, favorable government initiatives would propel the growth of the region’s economy during the forecast period. The region has the highest urbanization rate worldwide owing to the government initiatives that support the industrial growth. With the growth in industrial sector, the scope of integrating advanced technologies for sampling testing is expected to increase. Brazil, Argentina, and Chile are among the countries witnessing the growth in the healthcare sector with the adoption of advanced healthcare solutions for analyzing the samples. Thus, the use of advanced technology to provide diagnostic and disease detecting services is anticipated to propel the adoption of spectroscopes. Additionally, it is estimated that by 2025, nearly 75% of the region’s population would subscribe to mobile services; therefore, the growing mobile penetration would present South America an opportunity for various IR spectroscopes. In addition to rising use of smartphones, the advent of mobile-based IR spectroscopes systems will contribute toward the market growth. Moreover, Plataforma Saúde, a Brazilian organization, is planning to capitalize smartphone technology to give access to healthcare with respect to medical examinations for identifying chronic lifestyle diseases such as hypertension, heart ailments, and diabetes of any individuals.

According to latest situation report from the World Health Organization (WHO), Brazil, Argentina, Colombia, and Peru are some of the worst affected countries due to COVID-19 outbreak. The COVID-19 crisis is affecting the industries worldwide and the global economy is anticipated to take a worst hit in 2020 and likely in 2021. The outbreak has created significant disruptions in primary industries such as food & beverage, medical, energy & power, electronics & semiconductor, petroleum, and chemicals. A sharp decline in the growth of mentioned industrial activities is impacting the growth of the South America IR spectroscopy market as they are the major supply and demand sources for IR spectroscopy products and solutions. The factory shutdowns, travel bans, trade bans, and border lockdowns to combat and contain the outbreak have impacted manufacturing, supply, and sales of various electronic components that are required for the manufacturing of IR spectroscopy.

Strategic insights for the South America IR Spectroscopy provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

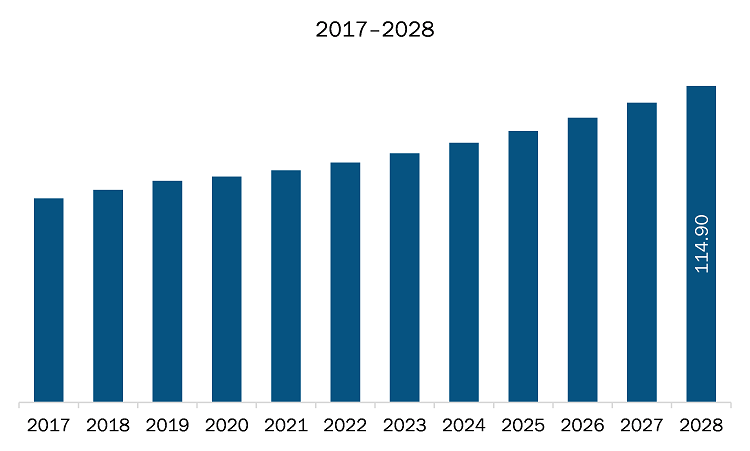

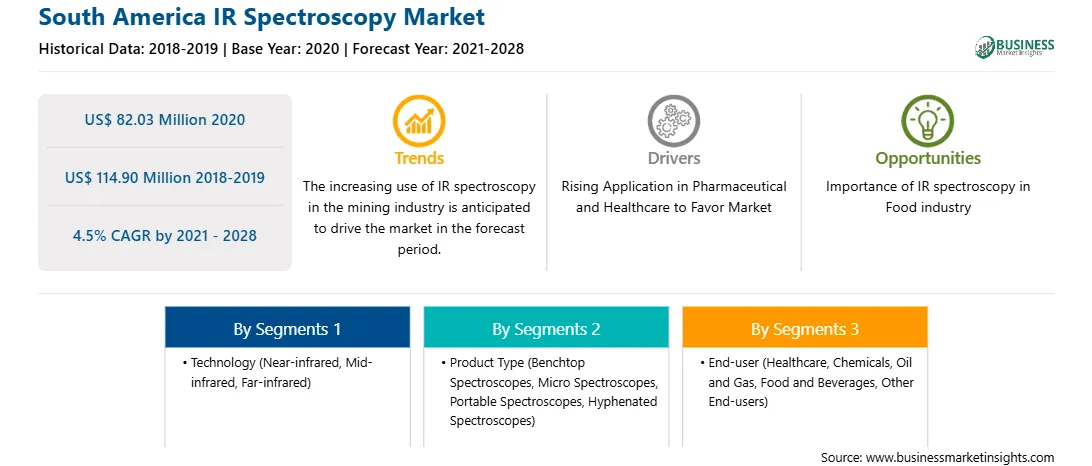

| Market size in 2020 | US$ 82.03 Million |

| Market Size by 2028 | US$ 114.90 Million |

| Global CAGR (2021 - 2028) | 4.5% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America IR Spectroscopy refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The IR spectroscopy market in South America is expected to grow expected to reach US$ 114.90 million by 2028 from US$ 82.03 million in 2020. The market is estimated to grow at a CAGR of 4.5% from 2021 to 2028. Portable spectrometers or handheld spectrometers enable the researchers to analyze varied samples on the go. Identification of raw materials, field analysis of samples, and forensic analysis, are among the applications of portable spectroscopes. Moreover, portable spectroscopes provide analysis capabilities similar to benchtop models. Compatibility for specific applications, software and interface, spectral range, integration to mobile or computer, and accuracy are among the notable factors to be considered while buying portable spectrometer. Metrohm Instant Raman Analyzers (Mira P), ASD QualitySpec Trek Portable Spectrometer (Malvern Panalytical), RapID Portable Raman Raw Material ID Verification (Agilent Technologies), and TerraSpec Halo Portable Mineral Analyzer, (Malvern Panalytical) are some of the portable spectroscopes along with the name of their providers. In the last few years, the IR spectroscopy has witnessed the arrival of handheld/portable laser-induced breakdown spectroscopy (LIBS) and smartphone spectroscopy concentrating on medical diagnostics for low-resource areas. The emergence and capabilities of portable instruments have increased drastically in the last 20 years, along with becoming compact and lighter. Pertaining to the factors such as developments in computing power, consumer electronics, constant R&D, and manufacturing advancement for the production of instruments are contributing toward the adoption of portable spectroscopy.

In terms of technology, the mid-infrared segment accounted for the largest share of the South America IR spectroscopy market in 2020. In terms of product type, the benchtop spectroscopes segment held a larger market share of the South America IR spectroscopy market in 2020. Further, the healthcare segment held a larger share of the South America IR spectroscopy market based on end-user in 2020.

A few major primary and secondary sources referred to for preparing this report on South America IR spectroscopy market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Agilent Technologies, Inc.; Bruker Corporation; Carl Zeiss AG; Hitachi, Ltd.; Horiba, Ltd.; JASCO; International Co., Ltd.; Lumex Instruments; PerkinElmer, Inc.; Shimadzu Corporation; and Thermo Fisher Scientific Inc. among others.

The List of Companies - South America IR Spectroscopy Market

The South America IR Spectroscopy Market is valued at US$ 82.03 Million in 2020, it is projected to reach US$ 114.90 Million by 2028.

As per our report South America IR Spectroscopy Market, the market size is valued at US$ 82.03 Million in 2020, projecting it to reach US$ 114.90 Million by 2028. This translates to a CAGR of approximately 4.5% during the forecast period.

The South America IR Spectroscopy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America IR Spectroscopy Market report:

The South America IR Spectroscopy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America IR Spectroscopy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America IR Spectroscopy Market value chain can benefit from the information contained in a comprehensive market report.