Geographically, the instrument calibrator market in SAM is segmented into Brazil and Argentina. Despite many economic challenges, favorable government initiatives would propel the growth of the region’s economy during the forecast period. The region has the highest urbanization rate globally owing to the government initiatives that support the industrial growth. With the growth in industrial sector, the scope of integrating advanced technologies for sampling testing is expected to increase. Brazil, Argentina, and Chile are among the countries witnessing the growth in the healthcare sector with the adoption of advanced healthcare solutions for analyzing the samples. The recent technological developments have had a direct impact on the economy of Brazil that has advanced to a large extent. The cost savings advantage and higher work efficiencies achieved are cited as the major attracting points for manufacturing companies to establish bases in SAM. Latin American economy is facing a lot instability in the current times and poses a challenge to the developing economies.

SAM is witnessing a growing number of COVID-19 cases; the increasing number of cases in Brazil, Peru, Chile, Ecuador, and Venezuela is likely to have negative impact on the market. With the outbreak of second wave COVID-19, there has been an increasing number of cases in the SAM countries. According to the International Council of Nurses, the number of deaths of health professionals in Brazil are above other countries due to high transmission of the virus. As Brazil has many populated regions with small houses with 6-7 people per house, the virus spreads like wildfire. Currently, the countries in this region are rapidly increasing its clinical programs to fight against the novel corona virus. In this scenario, the COVID-19 epidemic has once again highlighted Brazil's need to reduce its dependence on foreign active pharmaceutical ingredients (APIs). Brazil imports 95 percent of the raw ingredients it needs to make medications, and with rising freight costs and the value of the dollar, the Brazilian pharmaceutical industry is beginning to feel the impact on production costs. The first scenario has two transmission pathways across the economic system a negative shock to labour supply as a result of the pandemic's high rates of sickness and mortality, and a temporary closure of non-essential economic activities. Furthermore, by assuming 3 and 6 months of shutdown in both scenarios, a sensitive analysis of the shutdown's temporality is considered. The results show a 3.78 percent loss in national GDP growth rate in Scenario 1 and a 0.48 percent reduction in Scenario 2 in 2020, with three months of shutdown. In Scenarios 1 and 2, the reduction would be greater with 6 months, at 10.90 percent and 7.64 percent, respectively. These factors are likely to have negative impact on the market growth.

Strategic insights for the South America Instrument Calibrator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

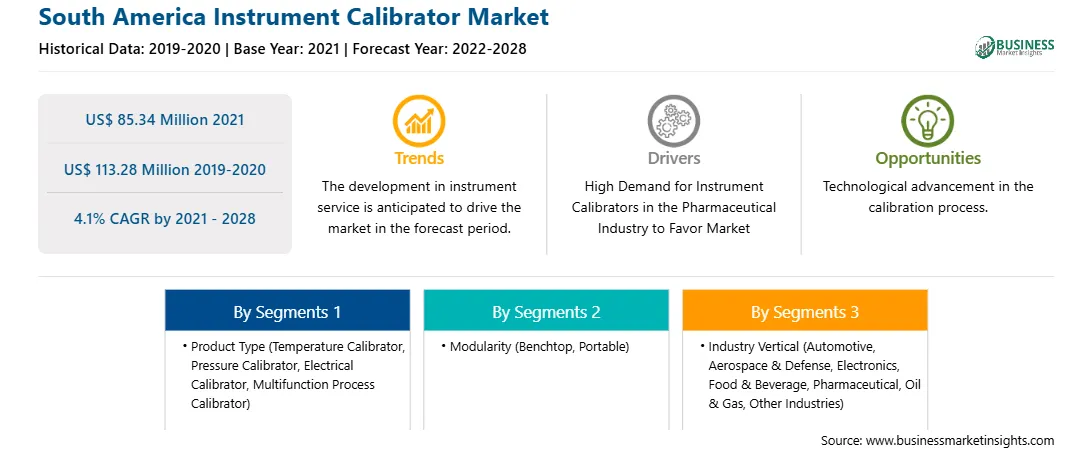

| Market size in 2021 | US$ 85.34 Million |

| Market Size by 2028 | US$ 113.28 Million |

| Global CAGR (2021 - 2028) | 4.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Instrument Calibrator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The instrument calibrator market in SAM is expected to grow from US$ 85.34 million in 2021 to US$ 113.28 million by 2028; it is estimated to grow at a CAGR of 4.1% from 2021 to 2028. Pharmaceutical companies need a complete calibration solution that meets with industry regulations while increasing efficiency and improving data integrity and quality standards. Temperature, pressure, and electrical calibrators are required for the frequent calibration of various pharmaceutical equipment, such as medical testing instruments, weather stations, thermistors, and furnaces. Thus, the pharmaceuticals industry is contributing to the instrument calibrators market growth.

SAM instrument calibrator market is segmented into product type, modularity, industry vertical and country. Based on product type, the SAM instrument calibrator market is segmented into temperature calibrator, pressure calibrator, electrical calibrator, and multifunction process calibrator. Pressure calibrator segment held the largest market share in 2020. The modularity segment is classified into benchtop, and portable. Portable segment held the largest market share in 2020. Based on industry vertical, the SAM instrument calibrator market is categorized into automotive, aerospace and defense, electronics, food, and beverage, pharmaceutical, oil and gas, and others. Oil and gas segment held the largest market share in 2020. Based on country, the SAM instrument calibrator market is segmented into Brazil, Argentina, and rest of SAM. Brazil held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the instrument calibrator market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Additel; AMETEK Inc.; Baker Hughes Company; Beamex Oy Ab; Calmet; Fluke Corporation; Spectris; WIKA Alexander Wiegand SE & Co. KG; and Yokogawa Electric Corporation.

The South America Instrument Calibrator Market is valued at US$ 85.34 Million in 2021, it is projected to reach US$ 113.28 Million by 2028.

As per our report South America Instrument Calibrator Market, the market size is valued at US$ 85.34 Million in 2021, projecting it to reach US$ 113.28 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The South America Instrument Calibrator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Instrument Calibrator Market report:

The South America Instrument Calibrator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Instrument Calibrator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Instrument Calibrator Market value chain can benefit from the information contained in a comprehensive market report.