The SAM includes Brazil, Argentina, and the Rest of SAM. The Rest of SAM includes Peru, Ecuador, Uruguay, and Venezuela. The region is characterized by a mixed growth scenario, with a few countries having complex macroeconomic and political environments. However, despite several challenges, positive government-led initiatives to boost marine and oil & gas industries are expected to support the growth of the hydrographic survey market in this region in the future. The growing focus on oil & gas activities in SAM is likely to propel the demand for hydrographic surveys. For instance, according to the IEA, expenditure on upstream activities in the region is set to rise due to the high investment by Brazil, Argentina, and Colombia. Petrobras, a Brazil-based state-held oil firm, plans to invest US$ 75.7 billion over the next five years to boost oil production. The robust marine industry has contributed significantly to the notable number of marine vessels. Though the industry is heavily fragmented, a significant number of small players have facilitated the development of port infrastructure and technological adoption for their seamless operation across prominent ports throughout the SAM countries. Thus, high emphasis on the marine industry would also compel the demand for hydrographic survey software and services in the near future.

Furthermore, in case of COVID-19, Brazil has the highest number of confirmed cases, followed by other countries such as Colombia, Argentina, Peru, and Chile. The governments of various countries in SAM are taking several initiatives to protect people and to contain COVID-19’s spread in the region through lockdowns, trade bans, and travel restrictions. These measures are expected to directly impact the region’s economic growth as the region will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to major trading partners such as China, Europe, and North America. The total number of cases in Brazil accounted for 9,497,795, out of which 231,012 total deaths are recorded. The shutdown of businesses and halt in ongoing offshore projects due to lockdown measures has directly affected the growth of the hydrographic survey market in this region. The sharp decline in business activities and product sales are also affected the growth rate of the hydrographic survey in this region in 2020 and most likely to affect till Mid-2021.

Strategic insights for the South America Hydrographic Survey provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 9.21 Million |

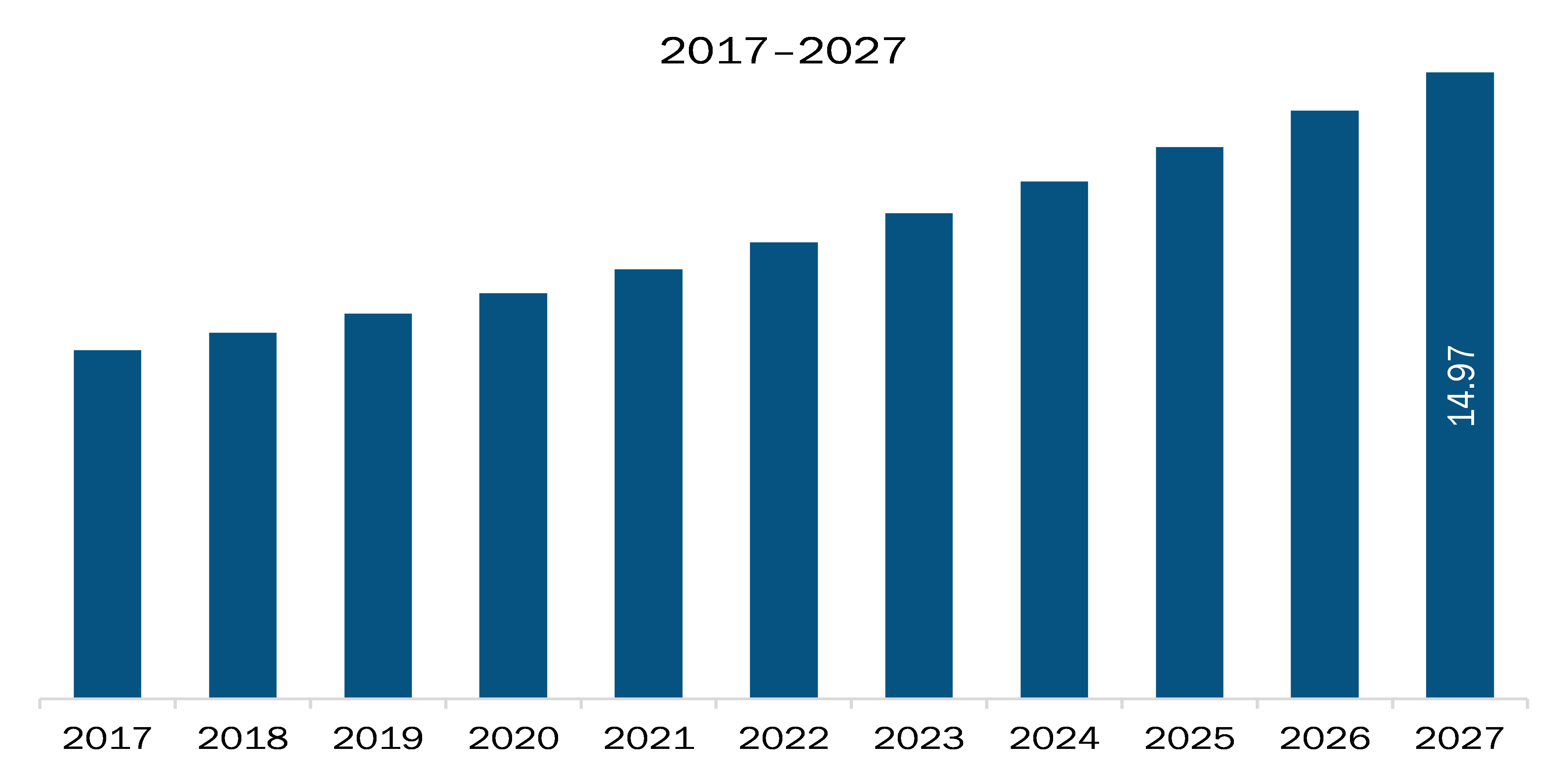

| Market Size by 2027 | US$ 14.97 Million |

| Global CAGR (2020 - 2027) | 6.4 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Hydrographic Survey refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM hydrographic survey market is expected to grow from US$ 9.21 million in 2019 to US$ 14.97 million by 2027; it is estimated to grow at a CAGR of 6.4 % from 2020 to 2027. Collaborating advanced technologies with hydrographic survey software and services will accelerate the SAM hydrographic survey market. Hydrographers play a key role in identifying the ocean environment and the production of nautical charts for navigation safety. In addition to the primary role of hydrography, the end users are increasingly seeking real-time data for the sustainable management of marine resources and protection of coastal infrastructure. They need hydrographic data to manage the challenges related to climate change and urbanization in coastal communities. Thus, hydrographic surveying and the roles of experts in this field are in experiencing a paradigm shift, and rise in the adoption of disruptive technologies, solutions, and techniques is likely to boost survey capacity and productivity, simultaneously mitigating the risks and costs involved. The integration of advanced technologies such as artificial intelligence (AI), virtual reality (VR), and automated data collection is emerging as the next step in the further development of the hydrographic survey industry. AI, machine learning (ML), and forward-looking sonar (FLS) transform hydrographic data collection, processing, analysis, and presentation. The technology integration would enable the close-to-real-time transmission of hydrographic data to cloud in the coming years. Moreover, several methods of processing data using complex algorithms and AI are in the developing phase. The introduction of AI and ML capabilities would allow enterprises to shift from being product-centric to data-centric, which would enable enterprises to expand their product and service portfolios, thereby allowing them to ensure greater client satisfaction. Advanced technologies are swiftly gaining prominence in the marine, and oil & gas sectors, and the rising use of hydrographic survey software integrated with advanced technologies is emerging as a prominent trend in the SAM market.

In terms of component, the software segment accounted for the largest share of the SAM hydrographic survey market in 2019. In terms of end user, the oil & gas segment held a larger market share of the SAM hydrographic survey market in 2019.

A few major primary and secondary sources referred to for preparing this report on the SAM hydrographic survey market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Esri, HYPACK / Xylem Inc., OceanWise Limited, Quality Positioning Services B.V. (QPS), Teledyne Marine (Teledyne Technologies Incorporated).

The South America Hydrographic Survey Market is valued at US$ 9.21 Million in 2019, it is projected to reach US$ 14.97 Million by 2027.

As per our report South America Hydrographic Survey Market, the market size is valued at US$ 9.21 Million in 2019, projecting it to reach US$ 14.97 Million by 2027. This translates to a CAGR of approximately 6.4 % during the forecast period.

The South America Hydrographic Survey Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Hydrographic Survey Market report:

The South America Hydrographic Survey Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Hydrographic Survey Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Hydrographic Survey Market value chain can benefit from the information contained in a comprehensive market report.