Horticulture lighting is an artificial light used to facilitate photosynthesis. This process is beneficial in areas where adequate sunlight is absent. Horticulture lighting also enhances the growth of plants by illuminating them with artificial light. Horticulture's LED lighting technology is gaining traction in the market due to its numerous advantages, such as low power consumption and existing technologies, which enable lower energy costs. Horticultural lighting is used in urban agriculture, multi-layer cultivation, supplemental lighting, and daylight-free cultivation. Due to increasing awareness of sustainable farming, researchers, governments, and organizations have taken initiatives to improve horticulture with efficient and adequate lighting. Increase in demand for advanced lighting-related technologies is expected to boost the growth of the SAM horticulture lighting market. Toshiba and Panasonic have started to support the farmers by providing financial and technical support to establish vertical farms. Such developments in vertical agriculture are boosting the growth of the SAM horticulture lighting market. Various governments are emphasizing on the use of LED lighting technology. Thus, the government initiatives on rise is expected to create a significant demand for horticulture lighting in the coming years, which is further anticipated to drive the SAM horticulture lighting market. Again the ongoing COVID-19 pandemic is having severe impact over the SAM region. Brazil has the highest number of COVID-19 confirmed cases, followed by other countries such as Ecuador, Peru, Chile, and Argentina. The governments of various countries in SAM are taking several initiatives to protect people and to control COVID-19’s spread in the region through lockdowns, trade bans, and travel restrictions. These measures are expected to have a direct impact on the region’s economic growth as the region will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to major trading partners such as China, Europe, and North America. At present, the total number of cases in Brazil accounted for 3,627,217 out of which 115,451 total deaths are recorded. The sharp decline in the sales of various horticulture lightning products in the region due to lockdown measures is expected to directly impact the growth of the horticulture lightning market in this region. The sharp decline in business activities and product sales are expected to directly affect the growth rate of the horticulture lightning market in SAM region for the next three to four quarters.

Strategic insights for the South America Horticulture Lighting provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

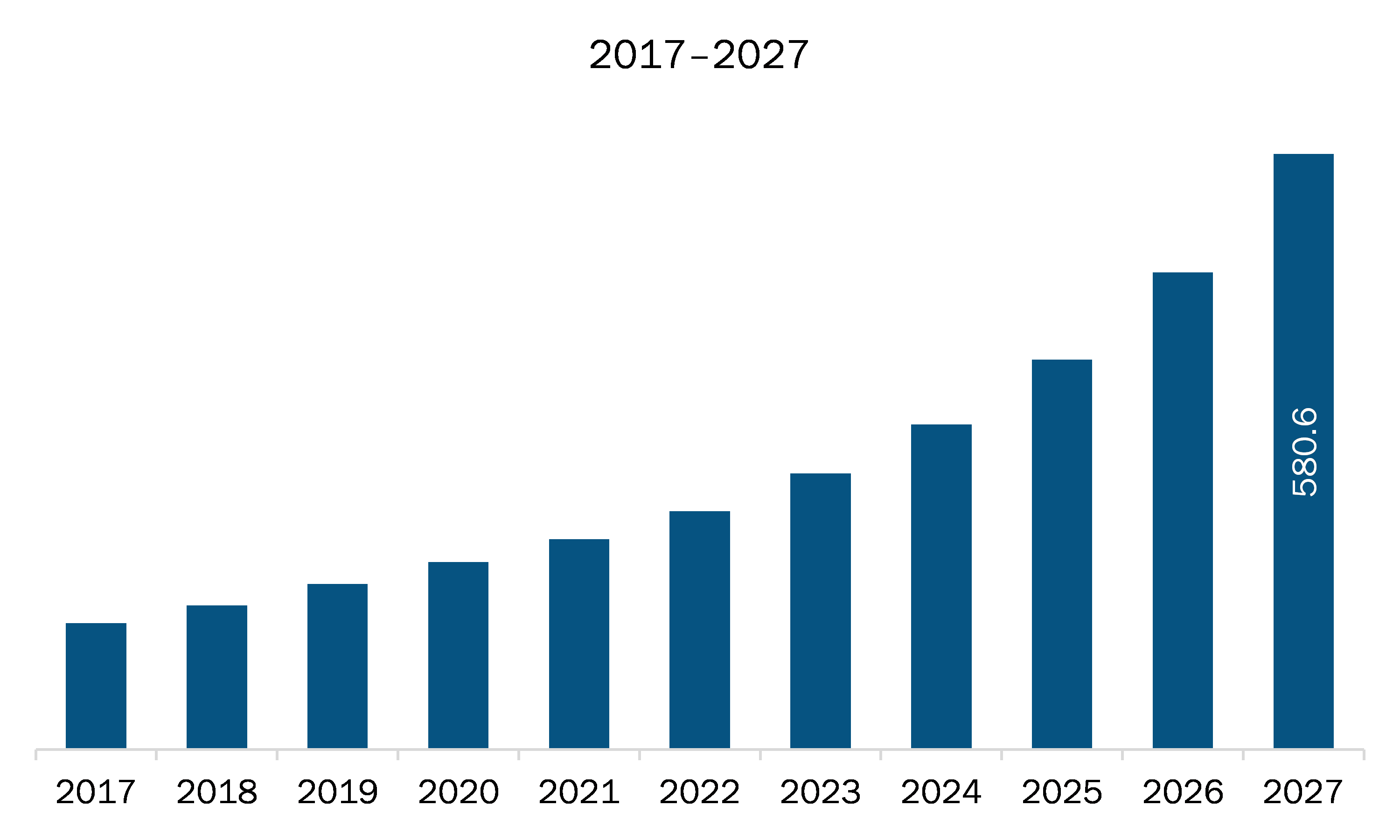

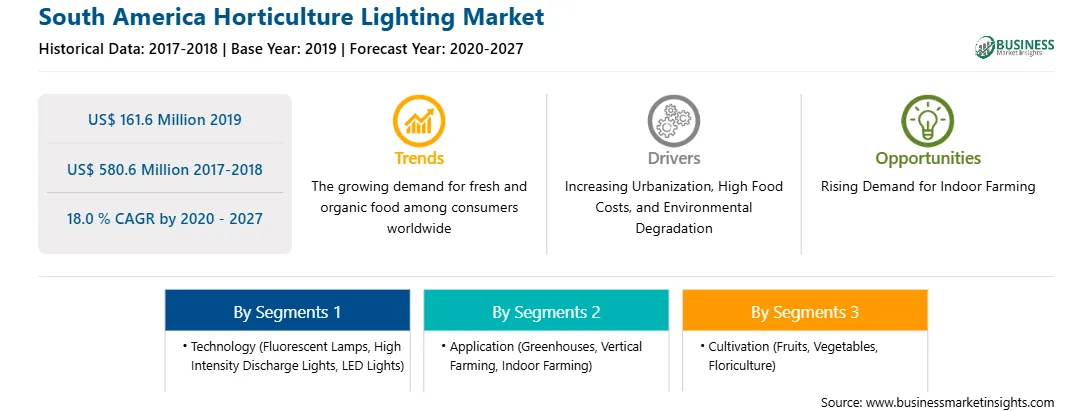

| Market size in 2019 | US$ 161.6 Million |

| Market Size by 2027 | US$ 580.6 Million |

| Global CAGR (2020 - 2027) | 18.0 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Horticulture Lighting refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The horticulture lighting market in SAM is expected to grow from US$ 161.6 million in 2019 to US$ 580.6 million by 2027; it is estimated to grow at a CAGR of 18.0 % from 2020 to 2027. Vertical farming is getting attention and is expected to drive the horticulture lighting market in SAM. Increase in population throughout SAM creates a huge demand for food, which cannot be fulfilled only through conventional or outdoor farming. In order to meet the increasing food demand, various countries are designing and implementing vertical farms, which includes cultivating plants on vertically inclined surfaces. Vertical farming produces crops by incorporating several technologies, such as robotics, internet of things, big data analytics, and Artificial Intelligence (AI); thus, it produces healthy crops without any agronomic constraint. The environmental degradation caused by traditional farming methods allows various countries to opt for vertical farming. It ensures pollution degradation and leads to growing food production and mitigates resources. It produces crops by artificially stacking plants vertically above each other, which may reduce the issues of malnutrition and contaminated food in the coming years. Several vertical farming businesses in SAM are growing across the urban parts of several countries with limited agricultural land. Vertical farming offers numerous opportunities for growers to sustainably produce crops by diminishing the use of water, reducing fertilizers, maintaining healthy ecosystems, and safeguarding crops from weather-related disasters. All these factors are collectively responsible for bolstering the growth of the SAM horticulture lighting market.

In terms of technology, the LED lights segment accounted for the largest share of the SAM horticulture lighting market in 2019. In terms of application, the greenhouses segment held a larger market share of the SAM horticulture lighting market in 2019. Further, the fruits & vegetables segment held a larger share of the market based on cultivation in 2019.

A few major primary and secondary sources referred to for preparing this report on the horticulture lighting market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are General Electric Company; Hubbell, Inc.; Lumileds Holding B.V.; OSRAM Licht AG; Signify N.V.

The List of Companies - South America Horticulture Lighting Market

The South America Horticulture Lighting Market is valued at US$ 161.6 Million in 2019, it is projected to reach US$ 580.6 Million by 2027.

As per our report South America Horticulture Lighting Market, the market size is valued at US$ 161.6 Million in 2019, projecting it to reach US$ 580.6 Million by 2027. This translates to a CAGR of approximately 18.0 % during the forecast period.

The South America Horticulture Lighting Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Horticulture Lighting Market report:

The South America Horticulture Lighting Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Horticulture Lighting Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Horticulture Lighting Market value chain can benefit from the information contained in a comprehensive market report.