The growth of the SAM helicopter market is driven by the increasing demand for military and commercial helicopters. The governments of countries in SAM have been focusing on improving and upgrading helicopter fleet. They are investing in procuring search and rescue helicopters that have additional capabilities in terms of advanced camera, systems, and software. For instance, in 2016, Brazil procured first Airbus C295W for Brazilian Air Force SAR missions. Moreover, in 2018, the country ordered additional Airbus C295 SAR aircraft. Thus, the ongoing upgrade projects in the region have invited a number of manufacturers to offer their products and cater the demand effectively. Leonardo S.p.A is one of the prominent players in the region. With offices and service & maintenance centers in the region, the company has continued to serve its customers even during the pandemic. Brazil, Colombia, Argentina, and Peru are the four countries with decent market prospects for its helicopters.

In case of COVID-19, SAM is highly affected, especially Brazil, followed by Peru, Chile, Colombia, and Ecuador, among others. SAM's governments have taken an array of actions to protect their citizens and contain COVID-19's spread. Brazil is the largest spender in the aerospace industry and is the only modern aircraft manufacturing country in the region. Owing to this, the demand for components and parts is at an all-time high in the country. In addition, the majority of the components are imported from the US, China, and European countries. The slowdown in general aviation and military helicopter production in the country has impaired the supply chain in Brazil. Thus, the outbreak of COVID-19 has had a harsh impact on the SAM Helicopter market, especially in Brazil. Unfortunately, the COVID-19 outbreak has decimated the demand for aircraft (both fixed wing aircraft and helicopters), which reflected significantly lower volumes of orders among the airframe manufacturers, resulting in a lower number of airframe production. The decline in production volumes adversely affected the businesses of various component manufacturers.

Strategic insights for the South America Helicopters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

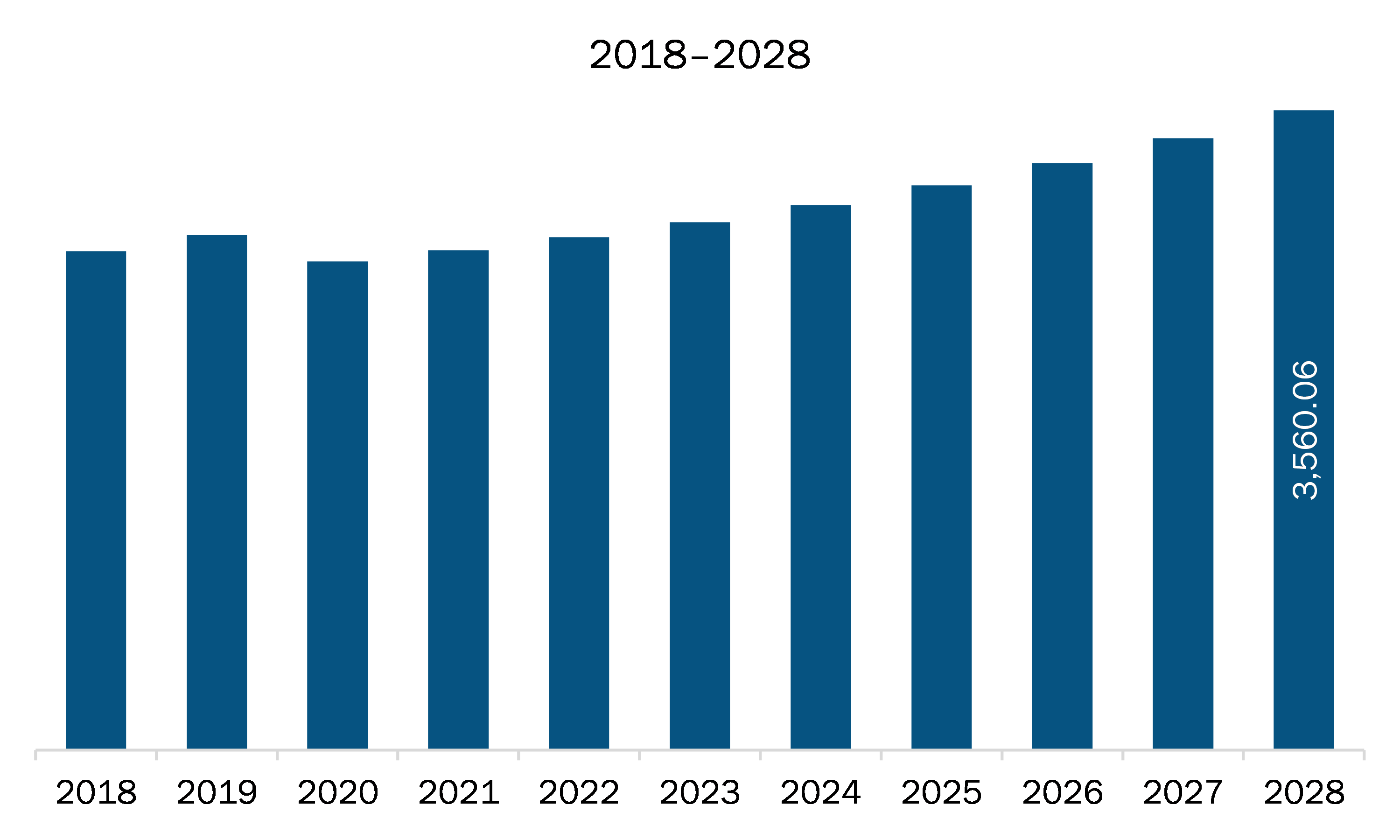

| Market size in 2021 | US$ 2,779.47 Million |

| Market Size by 2028 | US$ 3,560.06 Million |

| Global CAGR (2021 - 2028) | 3.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Helicopters refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM helicopters market is expected to grow from US$ 2,779.47 million in 2021 to US$ 3,560.06 million by 2028; it is estimated to grow at a CAGR of 3.6% from 2021 to 2028. Unmanned helicopters are intended to support both civilian and security missions. They are also capable of delivering cargo to hard-to-reach areas without airfields. One major company across SAM region provides autonomous/unmanned helicopters for various applications including airborne laser scanning (lidar), aerial imagery and photogrammetry, aerial video recording, surveillance and inspection, search & rescue, and aerial scientific measurements, with a remotely piloted aerial system. This heavy lift UAV helicopter provides an exceptional payload capacity of 30 kg for 3 hours and up to 3,000 AMSL (10,000 ft), which can be used for customized solutions and requirements such as digital cameras, video camcorders, laser scanners, infrared, or hyperspectral camera equipment. Apart from the development of unmanned helicopters, there yet another key trend in the SAM market. Original equipment manufacturers (OEMs) are increasingly using parts produced with carbon fiber reinforced plastics composite (CFRP) material. This material is being predominately used because it provides consistent strength to various parts of helicopters providing them higher corrosion resistance and reducing their weight. OEMs that use CFRP material include Airbus S.A.S and Boeing Corporation. Further, OEMs are significantly using artificial intelligence to improve the aircraft production and enhance the safety provision of aircrafts. For instance, Boeing Corporation has developed machine-learning algorithms to design aircraft and automate factory operations. So, the development of unmanned helicopters and use of advanced materials and technology will drive the SAM helicopters market in coming years.

In terms of type, the single rotor segment accounted for the largest share of the SAM helicopters market in 2020. In terms of weight, the light weight segment held a larger market share of the SAM helicopters market in 2020. Further, the commercial & civil segment held a larger share of the SAM helicopters market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the SAM helicopters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Airbus S.A.S.; Bell Textron Inc.; Boeing; Enstrom Helicopter Corp.; Kaman Corporation; Leonardo S.p.A.; Lockheed Martin Corporation; MD Helicopters, Inc.; and Russian Helicopters.

The South America Helicopters Market is valued at US$ 2,779.47 Million in 2021, it is projected to reach US$ 3,560.06 Million by 2028.

As per our report South America Helicopters Market, the market size is valued at US$ 2,779.47 Million in 2021, projecting it to reach US$ 3,560.06 Million by 2028. This translates to a CAGR of approximately 3.6% during the forecast period.

The South America Helicopters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Helicopters Market report:

The South America Helicopters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Helicopters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Helicopters Market value chain can benefit from the information contained in a comprehensive market report.