SAM includes countries such as Brazil, Argentina, and the rest of SAM. SAM is another region contributing to the growth of glass fiber concerning the diversification of the application base. The continuous developments have had a positive impact on Brazil and Argentina's economy that has advanced to a large extent. The increase in population and continuous advancement in the end-use industries such as automotive, construction and others have positively impacted Brazil and Argentina's glass fiber market that has advanced to a large extent. The increase in population and continuous advancement in the end-use industries such as manufacturing, automotive, and others is expected to drive the market growth in the region. The recent structural reforms in SAM has led to a decrease in the interest rates as well as controlled the inflation which has basically made a way for the economy to recover which has increased the investment opportunities in SAM. Due to this reason, industries such as automotive, electronics, manufacturing have seen a rise in investment which has increased the performance level in these industries, and hence, there has been an increase in the demand for glass fiber from these industries. It is considered that with the increasing presence of global and local market players, coupled with increasing research and development activities, the glass fiber market will find immense opportunities in the coming years. The rise in investment in research & development activities, along with technological innovation related to glass fiber, is also fueling the growth of the market.

In case of COVID-19, SAM is highly affected specially Brazil which got the highest number of COVID-19 cases, followed by Argentina, Peru, Chile, and Ecuador, among others. The government of SAM has taken an array of actions to protect their citizens and contain COVID-19’s spread. It is anticipated that SAM will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe, and the United States, which are important trade partners. Containment measures in several countries of SAM will reduce economic activity in the manufacturing and service sectors for at least the next quarter, with a rebound once the epidemic is contained. As a result of this outbreak, the chemical and materials industry across SAM region is one of the major industries experiencing severe disruptions such as supply chain disruptions, technology event cancellations, office shutdowns, and so on.

Strategic insights for the South America Glass Fiber provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

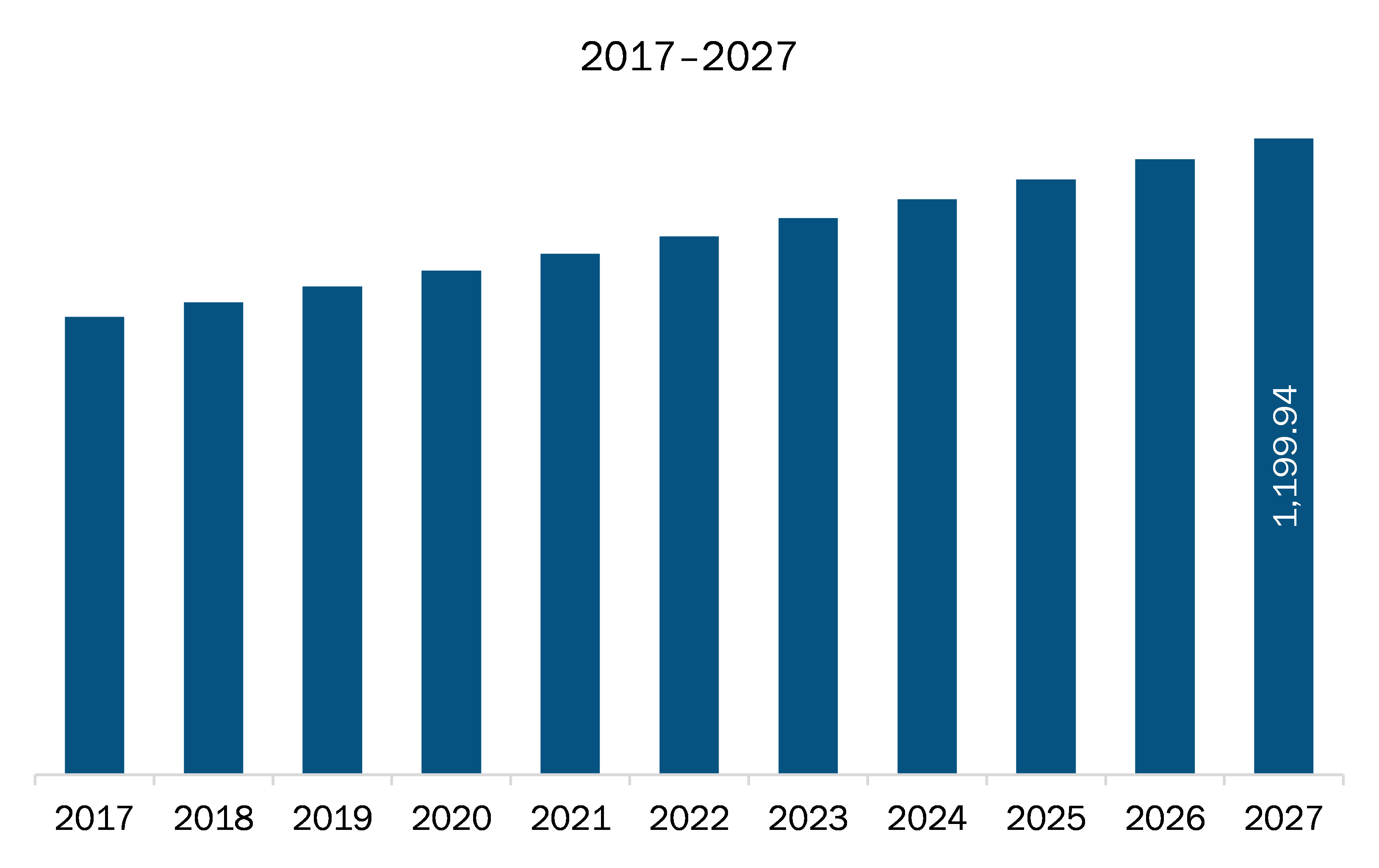

| Market size in 2020 | US$ 950.38 Million |

| Market Size by 2027 | US$ 1,199.94 Million |

| Global CAGR (2020 - 2027) | 3.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

The geographic scope of the South America Glass Fiber refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The SAM glass fiber market is expected to grow from US$ 950.38 million in 2020 to US$ 1,199.94 million by 2027; it is estimated to grow at a CAGR of 3.4% from 2020 to 2027. The escalating demand of fiberglass composites from the automotive industry is expected to surge the market growth. The automotive industry uses number of materials such as iron, aluminum, plastic, steel, and glass to build cars and other vehicles. Fiberglass composite is extensively used as a substitute for aluminum and steel due to its lightweight, high tensile strength, and superior corrosion resistance. All these properties of fiberglass composite are important in automobile manufacturing. Fiberglass composites are utilized in the production of several vehicle parts, especially of sports cars, where weight is crucial. They are mainly used in front and rear bumpers, doors, hoods, and casings. They are also used in the timing belts and V-belts, where glass strings are impregnated with rubber as reinforcement. Fiberglass is also used in vehicle tire reinforcement. Fiberglass reinforced tire provides a greater resistance to damage, better stability, lower reinforcement cost, and a good overall performance in long distance driving. This material is also used in brake pads and clutches, owing to its high abrasion resistance. Fiberglass composites are utilized in the manufacturing of parts for trains and trams. Almost the entire outer body of some modern trains and buses is made of fiberglass composites. They are also used utilized in creation of interior parts. Higher strength-to-weight ratio and great fire resistance properties have made them suitable for high-speed applications. In addition, stringent regulations have been imposed on the automotive industry to reduce carbon dioxide emissions. This has encouraged the industry to introduce fuel-efficient lightweight vehicles to help reduce greenhouse gas emissions. Vehicles built using fiberglass composites deliver higher mileage and enhance fuel efficiency. Thus, the rising demand for lightweight materials, along with government initiatives to reduce the harmful gas emissions and increase fuel efficiency, is expected to drive the SAM glass fiber market in automotive applications.

In terms of fiber type, the E/ECR glass fiber segment accounted for the largest share of the SAM glass fiber market in 2019. In terms of product type, the others segment held a larger market share of the SAM glass fiber market in 2019. In terms of application, the transportation segment held a larger market share of the SAM glass fiber market in 2019. Further, the compression molding segment held a larger share of the SAM glass fiber market based on manufacturing process in 2019.

A few major primary and secondary sources referred to for preparing this report on the SAM glass fiber market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are China Jushi Co., Ltd.; Chongqing Polycomp International Corp. (CPIC); Owens Corning; SAINT GOBAIN S.A.; and Taishan Fiberglass Inc. (CTG)

The South America Glass Fiber Market is valued at US$ 950.38 Million in 2020, it is projected to reach US$ 1,199.94 Million by 2027.

As per our report South America Glass Fiber Market, the market size is valued at US$ 950.38 Million in 2020, projecting it to reach US$ 1,199.94 Million by 2027. This translates to a CAGR of approximately 3.4% during the forecast period.

The South America Glass Fiber Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Glass Fiber Market report:

The South America Glass Fiber Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Glass Fiber Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Glass Fiber Market value chain can benefit from the information contained in a comprehensive market report.